This is what you need to know to trade today Tuesday January 17:

Traders return today after a long weekend in the US, with initial signs pointing to a subdued start to the week. Overnight, China data was positivebut commodities failed to provide a positive boost. Europe added to the bullish sentiment with a strong ZEW from Germany, but again the market shrugged and ignored it. With a big profit season just around the corner, it may not come as a surprise. This week we have the end of the investment banks with Morgan Stanley (MS) and Goldman (GS). Next, the regional and commercial banks. Netflix (NFLX) opens tech season on Thursday.

The dollar weakens slightly at 102.16 for the DXY dollar index awaiting the Bank of Japan. Gold is also down to $1,912, and oil has broken above $80, sitting at $80.47, perhaps as a late reaction to good data from the ZEW and China.

European markets are mixedwith the FTSE, CAC, DAX and Eurostoxx more or less flat.

US futures all down -0.2%.

Wall Street News

The German ZEW it is much better than expected.

The GDP, retail sales and unemployment in China forecasts improve.

Morgan Stanley (MS): EPS online, beat in revenue.

Goldman Sachs (GS): large losses in profits and revenue.

Reuters News

Activision Blizzard Inc (ATVI) and Microsoft Corp (MSFT): Microsoft is likely to receive an antitrust warning from the EU over its $69 billion offer for “Call of Duty” maker Activision Blizzard, people familiar with the matter said, potentially posing another challenge to completing the deal.

AbbVie Inc and Eli Lilly and Co (ABBV): Pharmaceutical companies have withdrawn from Britain’s voluntary drug price agreement, an industry body said on Monday.

Alibaba Group Holding Ltd (BABA): Billionaire investor Ryan Cohen has built a stake in Chinese group Alibaba worth hundreds of millions of dollars and is pushing the e-commerce giant to increase and speed up share buybacks, people familiar with the matter said on Monday.

Credit Suisse Group AG (CS) & UBS Group AG: UBS has no interest in buying fellow Swiss Credit Suisse, bank chairman Colm Kelleher said in an interview published on Saturday.

Manchester United PLC (MANU): The company presented a glitzy showcase in Davos this week, but insisted its show was to entertain clients and partners rather than attract buyers for the English soccer club.

Pfizer Inc (PFE): Chinese authorities have acknowledged that supplies of Paxlovid remain insufficient to meet demand, even as Pfizer CEO Albert Bourla said last week that thousands of courses of the treatment have been shipped to the country in the past year and in the past couple of years. Millions more were shipped weeks.

Rio Tinto PLC (RIO): The miner said China’s reopening of COVID-19 restrictions will increase near-term risks to labor and supply chain shortages, while also signaling a strong start to ore shipments from iron by 2023.

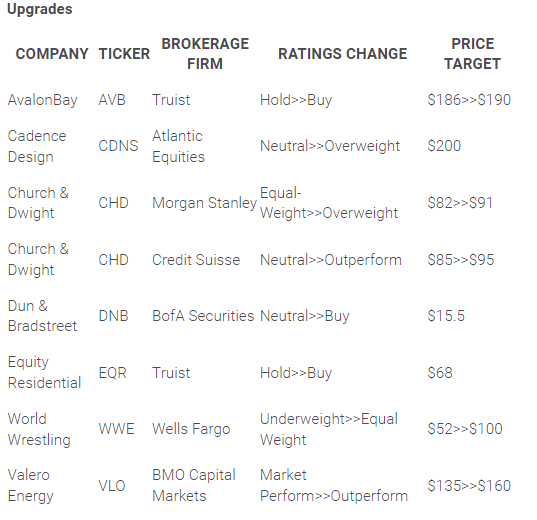

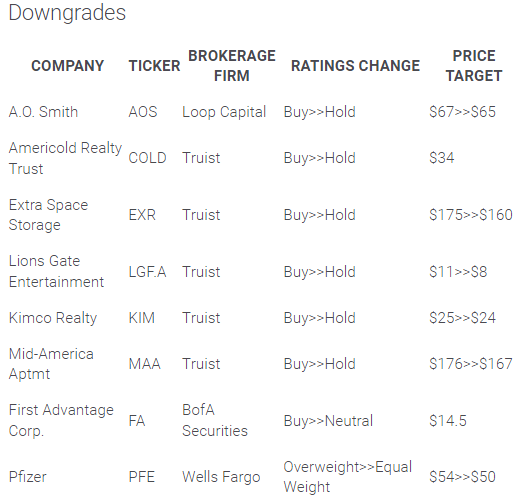

upgrades and downgrades

Source: WSJ.com

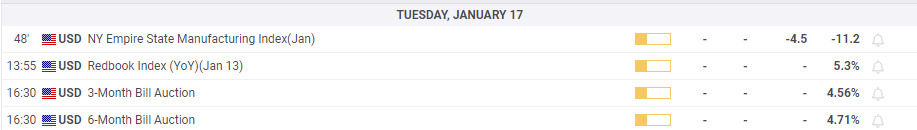

Economic data

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.