This is what you need to know to trade today Wednesday January 11:

Risk markets remain firm, with a positive Asian session and leading to modest gains again in Europe on Wednesday. Surprising Australian retail sales and inflation data were ignored despite prospects for more restrictive measures. Oil also escaped a surprise build in crude inventories, but with US CPI on Thursday, moves are limited as position taking is kept to a minimum. Risk appetite started with falling bond yields around the world, so tomorrow’s CPI should confirm that. Bond yields fell again yesterday and are down this morning in Germany, which is helping stocks and other risky assets maintain gains. This has kept the dollar under pressure, as it stands at 103.30 on the DY dollar index. Oil rose to $76.70 and gold held steady at $1,880.

European markets:

- Eurostoxx: +0.7%

- FTSE: +0.7%

- Dax: +1%

Futures in the United States:

- Dow Jones, Nasdaq and S&P 500: +0.4%

Wall Street News

Airlines (LUV) (DAL) (AAL) (UAL): The FAA is reporting a nationwide issue that’s paralyzing all sorties, though it’s already back on track.

Tesla (TSLA) is preparing to expand its giga-factory in Texas.

Reuters news

Apple Inc (AAPL): The company is planning to start using its own custom screens on its mobile devices starting in 2024 in an attempt to bring more components in-house, Bloomberg News reported Tuesday, citing people with knowledge of the matter.

BlackRock Inc (BLK): The company’s iShares ETFs netted more than Vanguard’s ETFs last year, according to estimates by industry tracker Morningstar.

Credit Suisse Group AG (CS): The company is considering a 50% cut to its global bonus pool for 2022, Bloomberg News reported on Wednesday.

Goldman Sachs Group Inc (GS): Goldman Sachs employees brace to find out if they will keep their jobs as the US investment bank launches a sweeping cost-cutting campaign that could cut its global workforce of 49,000 by thousands.

Merck & Co Inc (MRK): The company said it would take legal action against some pharmaceutical companies after warning that some manufacturers were supplying COVID-19 drugs to some provinces and cities saying the drugs were authorized by Merck.

Wells Fargo & Co (WFC): The company will scale back its mortgage lending business by reducing its mortgage servicing portfolio and exiting the correspondent lending business, the company said.

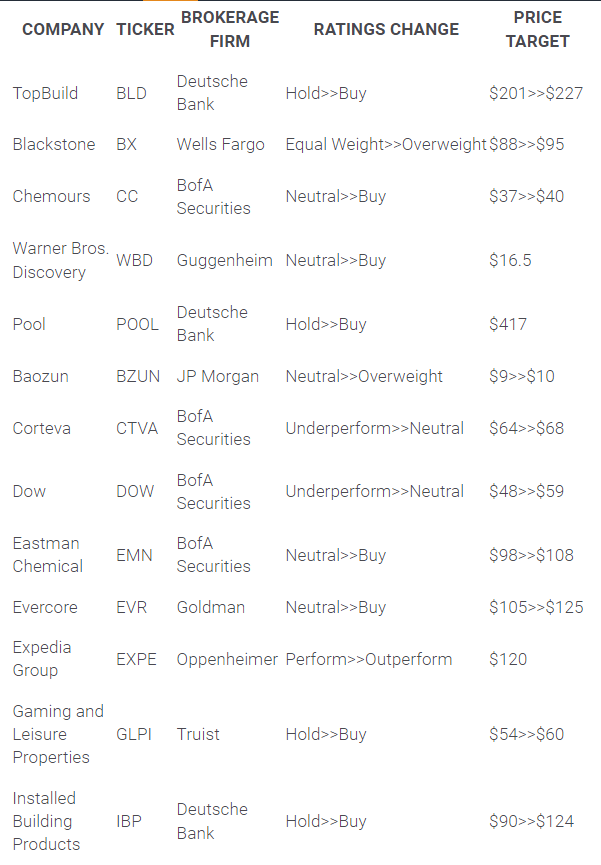

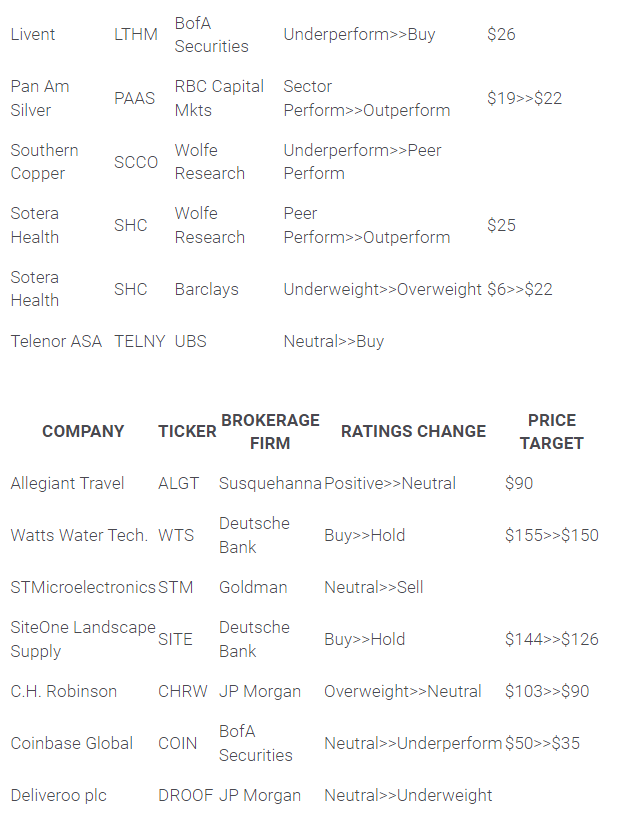

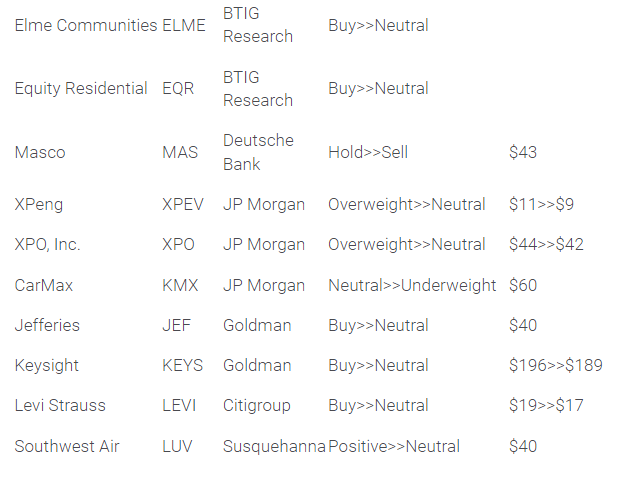

upgrades and downgrades

Source: WSJ.com

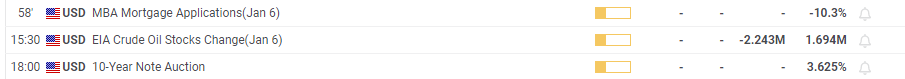

Economic data

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.