This is what you need to know to trade today Tuesday January 10:

Equities had an ugly close on Monday as intraday gains gave back. The Dow and S&P 500 closed in the red, while the NASDAQ held only some gains. Technology stocks rebounded, with Tesla (TSLA) being the biggest standout after some positive news on wait times in China. However, the allure of $100 is still close, so let’s see if the bears have the stomach for it. Equities are quieter on Tuesday as most markets now focus on the US CPI release on Thursday. So far, optimism remains the central theme of the first week of the year, and Goldman Sachs added to that by withdrawing its recession prediction for Europe and forecasting 0.6% growth for the year instead. Bond yields in Europe remain supportive against those in the US, which is helping the Euro to hold up against the Dollar, in anticipation of a lower CPI on Thursday.

The DXT Dollar Index rose slightly to 103.20, gold was steady at $1,872 and oil rose to $74.91.

European markets are trading mixed:

- FTSE:+0.2%

- Dax: -0.4%

- Eurostoxx: flat.

US futures down:

- S&P 500: -0.5%

- Dow Jones: -0.5%

- nasdaq: -0.7%.

Featured Wall Street News

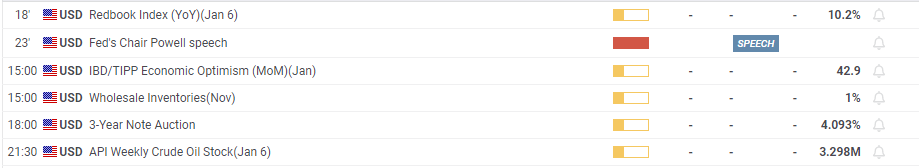

Powell will speak at the Riksbank conference call at 14:00 GMT.

Crocs (CROX) raise your prospects.

Coinbase (COIN) will cut 950 jobs.

sales of Shake Shack (SHAK) do not reach the estimates.

Bed Bath & Beyond (BBBY) loses on the top and bottom lines.

Reuters news

Apple (AAPL) will replace Broadcom’s key chip with its own design – Bloomberg News.

Jefferies Financial Group Inc (JEF): The investment bank reported a 52.5% decline in fourth-quarter profit on Monday, hurt by lower underwriting fees and volatile markets that dented revenue from its trading desks.

Alibaba Group Holding Ltd (BABA): The Chinese e-commerce giant has signed a cooperation agreement with the Hangzhou government.

Amazon.com Inc (AMZN): The company has said it plans to close three UK stores in a move that will affect 1,200 jobs, PA Media reported.

Coca Cola Inc (KO) and PepsiCo Inc (PEP): Beverage giants Coca-Cola and PepsiCo are the subject of a preliminary investigation by the US Federal Trade Commission (FTC) into possible price discrimination in the soft drink market, Politico reported Monday, citing sources.

Pfizer Inc (PFE): The company is not in talks with Chinese authorities to license a generic version of its Paxlovid COVID-19 treatment for use there, but is in talks over a price for the brand-name product, Chief Executive Albert Bourla said.

Southwest Airlines Co (LUV): The company said on Monday that it made leadership changes in several departments in an attempt to strengthen operations amid a recent technological collapse that forced the airline to cancel more than 16,700 flights.

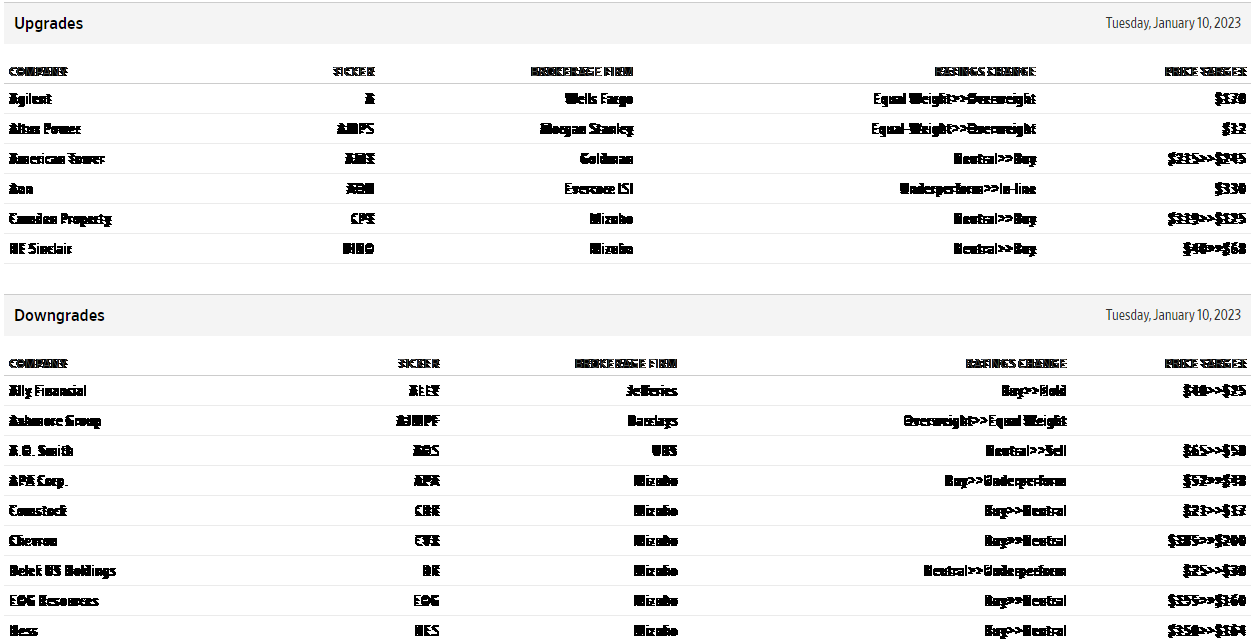

upgrades and downgrades

Source: WSJ.com

Economic data

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.