This is what you need to know about the markets today, Wednesday, September 14:

A butchery! It’s not often you see a sell-off of this magnitude on the back of a single economic figure. The market clearly had a favorable outcome in mind and was psychologically positioned that way. In my news yesterday, I also thought that inflation would take time to prove its strength and believed that the currency would not fall for another two or three publications.

I said the risk-reward trade was lower, so at least that’s some consolation, even if I didn’t take my own advice. By now, many of you will have seen the exciting statistic that all Nasdaq 100 stocks ended lower on Tuesday. It’s a pretty rare event, but so was the price action. Drops of more than 5% are not that common, and such a big move has taken us to levels we haven’t seen in some time. Last Thursday, to be exact.

Yes that’s how it is. Despite all the panic and buzz, we are just back to where we were four trading days ago! I said we’d see some wild swings, and sometimes it’s hard to see the forest from the trees. Now is the time to reassess a bit before the big money rolls in and hits us some more. Bonds are already moving, and the equity risk premium doesn’t seem right, so we’ll have to go lower. The P/E ratios also seem too high, so both P and E will have to go down. But beware: nothing goes down in a straight line.

After the CPI, the dollar soared, and today it has stopped a bit because the BoJ has revised rates. This means that they are trying to warn about a possible intervention to weaken the yen. However, it probably won’t work and is just saber rattling. The Dollar Index is weaker at 109.44. Oil is confused as talk of recharging the $80 oil stock gives it some support. Oil is at $87. Bitcoin is also a highly durable asset, which is why it crashed after the IPC to $20,200. Gold is at $1,704.

European markets down: Eurostoxx flat, FTSE -0.3%, and Dax -1%.

The american futures also up: SP500 +0.3% Nasdaq +0.8% and Dow +0.4%.

Wall Street Top News (QQQ) (SPY)

Higher-than-expected US CPI sends markets down.

Fed funds futures now see a 33% chance of a 100 basis point rate hike next week.

GOAL: Fines in South Korea for privacy laws.

Alphabet (GOOGL): Same as above. In addition, the EU orders you to pay for the Android domain.

Manzana (AAPL) will use Taiwan Semiconductor (TSMC) chips for iPhones and Macbooks next year – Nikkei.

The shareholders ofTwitter (TWTR) say yes to the acquisition of Elon Musk.

Johnson & Johnson (JNJ) plans a $5 billion buyback as it reaffirms its prospects.

Starbucks (SBUX) up 1% on its three-year growth forecasts.

Palo Alto Networks (PANW): Stock split 3 for 1.

The CEO of Modern (MRNA) claims it can supply vaccines to China.

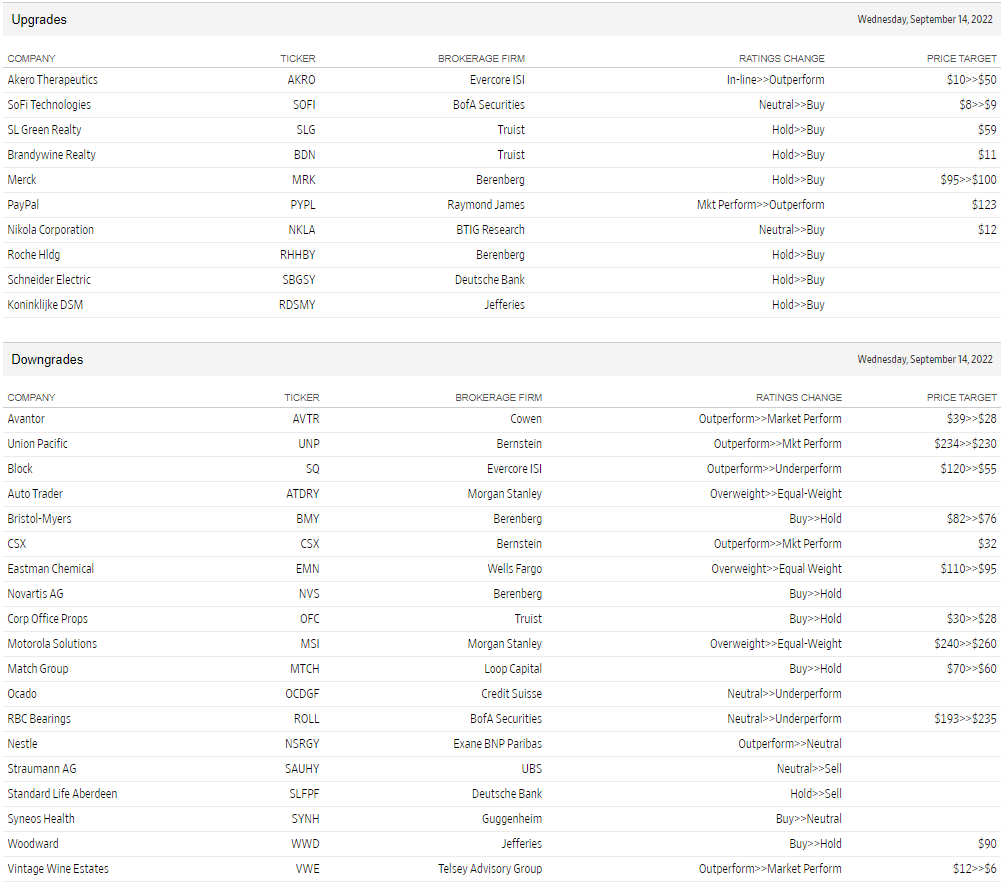

Ups and downs

Source: WSJ.com

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.