Homeowners rushed to take advantage of the sharp drop in interest rates last week.

Refinance demand pushed mortgage application volume up 5% for the week to the highest level since 2013, according to the Mortgage Bankers Association’s seasonally adjusted index. Purchase demand, however, dropped.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.71% from 3.81%, with points remaining unchanged at 0.28 (including the origination fee) for loans with a 20% down payment. That is the lowest level since October 2016. The rate was 98 basis points higher one year ago.

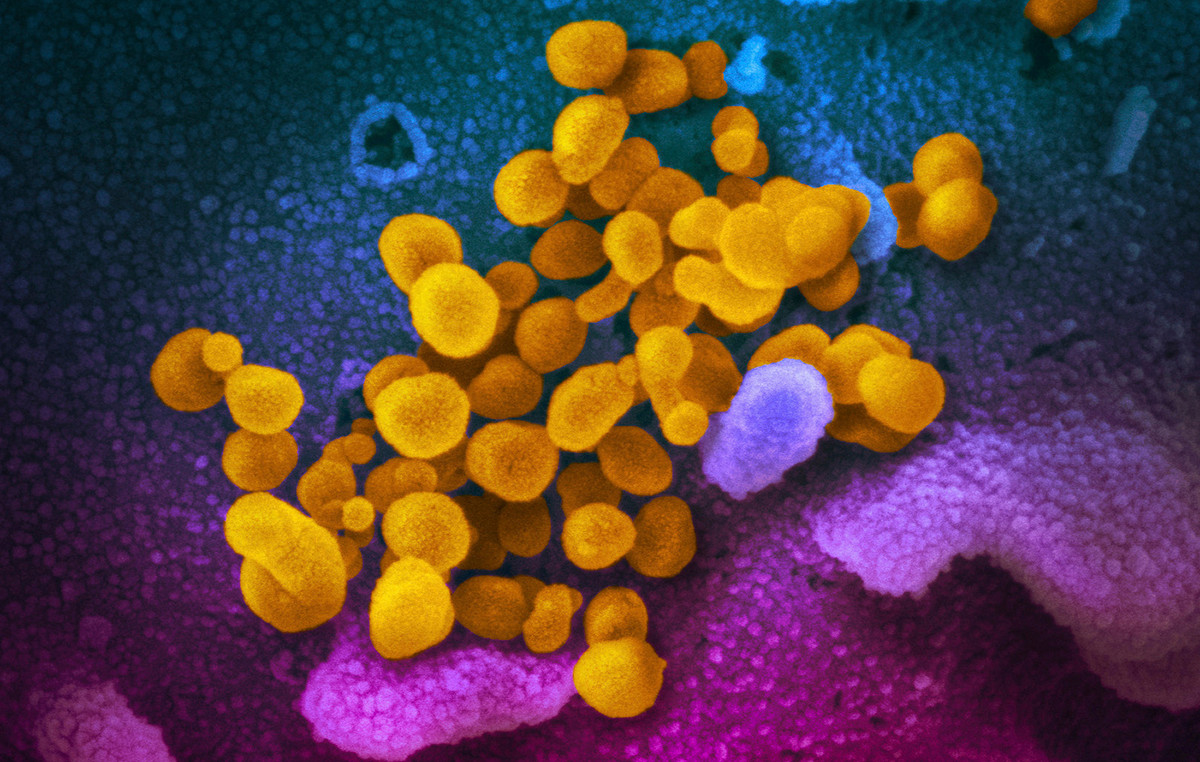

“The 10-year Treasury yield fell around 20 basis points over the course of last week, driven mainly by growing concerns over a likely slowdown in Chinese economic growth from the spread of the coronavirus. This drove mortgage rates lower, with the 30-year fixed rate decreasing for the fifth time in six weeks,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

Refinance applications, which are most sensitive to weekly rate moves, jumped 15% for the week and were 183% higher than a year ago. Demand hit the highest level since June 2013. The average loan amount also spiked, as homeowners with jumbo loans have more to gain from weekly rate declines. The refinance share of mortgage activity increased to 64.5% of total applications from 60.4% the previous week.

Mortgage applications to purchase a home decreased 10% from one week earlier, but were 11% higher annually. Today’s buyers are facing a tight and increasingly pricey housing market. The supply of homes for sale fell to a record low at the end of last year, and price gains, which had been easing a bit, have reaccelerated again.

“Prospective buyers weren’t as responsive to the decline in mortgage rates — likely because of suppressed supply levels,” Kan said. “Purchase applications took a step back, but still remained 7.7% higher than a year ago.”

Mortgage rates have been falling on fears over the coronavirus hitting financial markets. Rates, however, finally turned slightly higher Tuesday, as the stock market bounced higher.

“The bigger issue is merely the risk that today [Tuesday] marks some sort of turning point in the bigger picture,” said Matthew Graham, chief operating officer of Mortgage News Daily. “It’s too soon to know if that’s what this is, but it’s definitely the first obvious candidate since the coronavirus rate-drop began.”

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.