After reaching March 10, a minimum of $ 78,620, Bitcoin (BTC) began to recover and now moves upwardly but confidently.

Over the past week, Bitcoin has risen in price by 1.2%. Oachin-data indicate a new wave of BTC accumulation among large investors known as whales.

The demand of the whales on BTC is growing, investors are bought on decline

In the new report, an anonymous analyst Cryptoquant Onchained noted the appearance of a new wave of bitcoin kits. These large investors own at least 1,000 BTC and purchased them on average less than six months ago.

When new whales show interest, this indicates the revival of confidence in the long -term asset potential. The recent fall in Bitcoin to many years of minimums spurred the battery trend. It became a great opportunity for whales to “buy on a decline” and sell at a higher price.

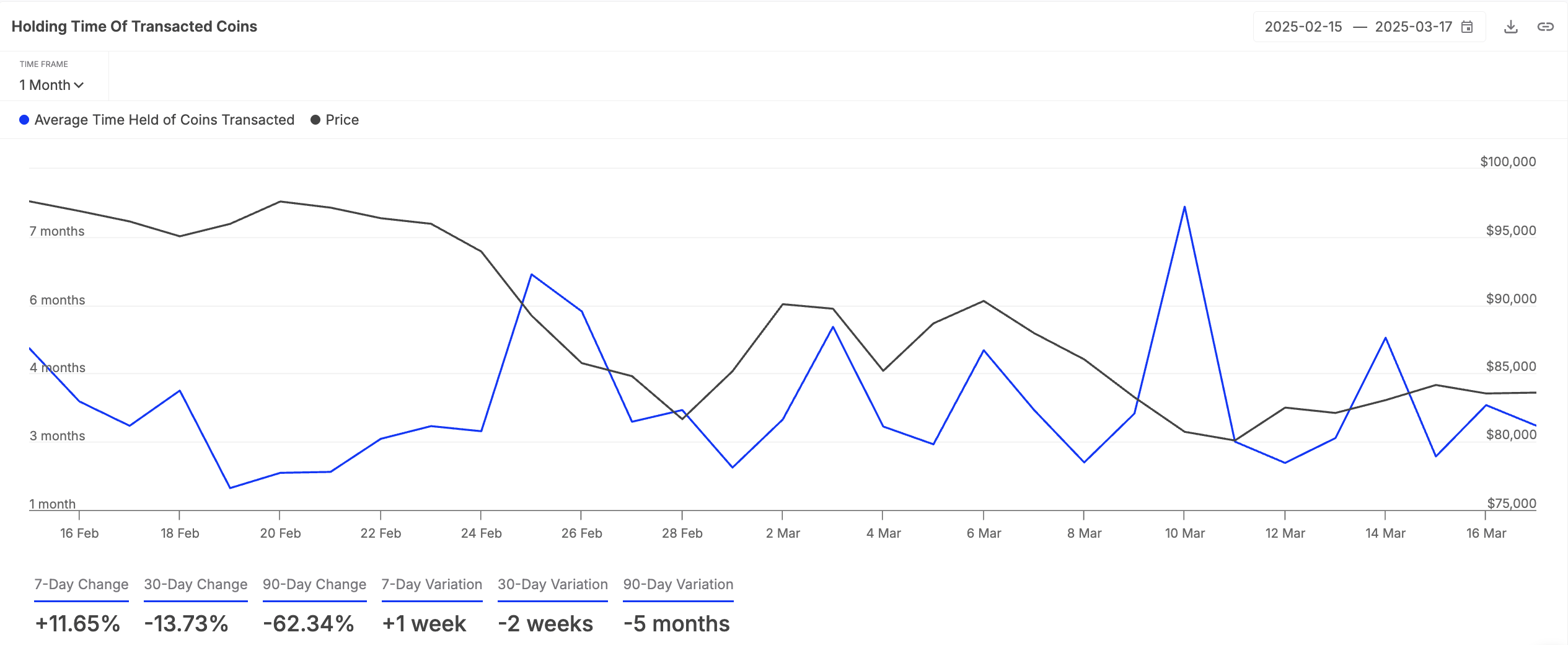

Over the past week, the time of ownership of coins has increased, indicating the gradual return of optimism to the market. According to IntoTheblock, this indicator has grown by 12% over the past seven days.

Storage time shows how long investors keep their tokens before selling or moving. It is increased that investors are confident in the future of the BTC and prefer to hold coins, and not sell them. This can reduce the pressure of sales, as the supply volume is reduced, which can lead to price growth.

Bitcoin at a crossroads: $ 89,000 or $ 77,000

The Elder-Ray index for Bitcoin continues to show red bars, but their dimensions are gradually decreasing in recent days. The indicator compares the pressure of purchases and sales to identify price trends.

A decrease in the height of the bars indicates a weakening of pressure from the sellers. This may mean that they lose strength, and buyers begin to activate. Preservation of this trend can slow down the BTC fall, and its price can be restored to $ 89,434.

If sales pressure intensifies, bitcoin can fall to $ 77 114.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.