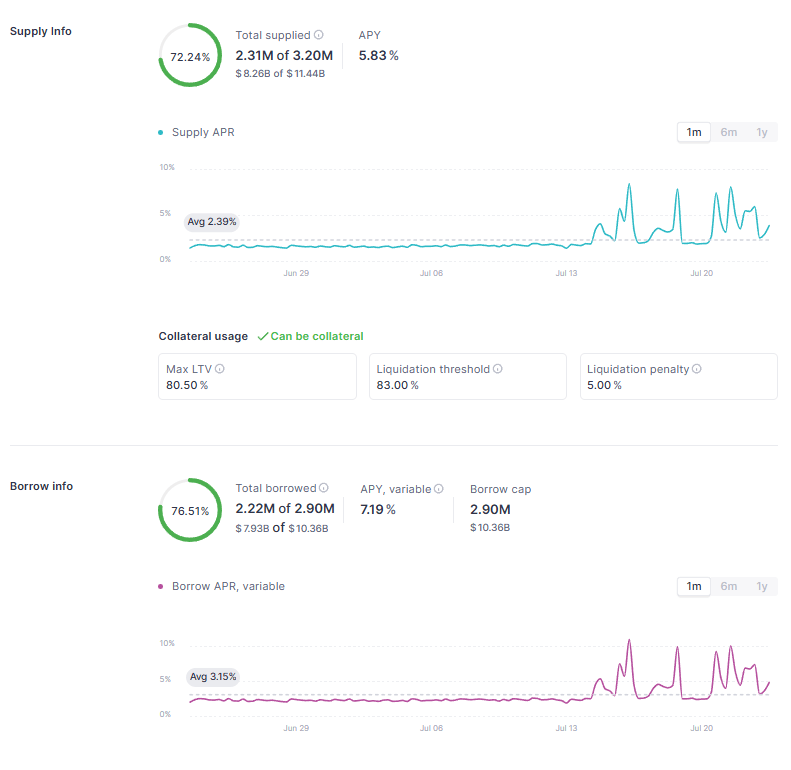

Over the past week, whales withdrawn significant volumes of Ethereum from the AAVE lending protocol, causing an increase in financing rates and a sharp closure of some positions.

On some days, APY in positions in Weth exceeded 10%. In this case, liquidity suppliers were winning, but users occupying assets are vice versa.

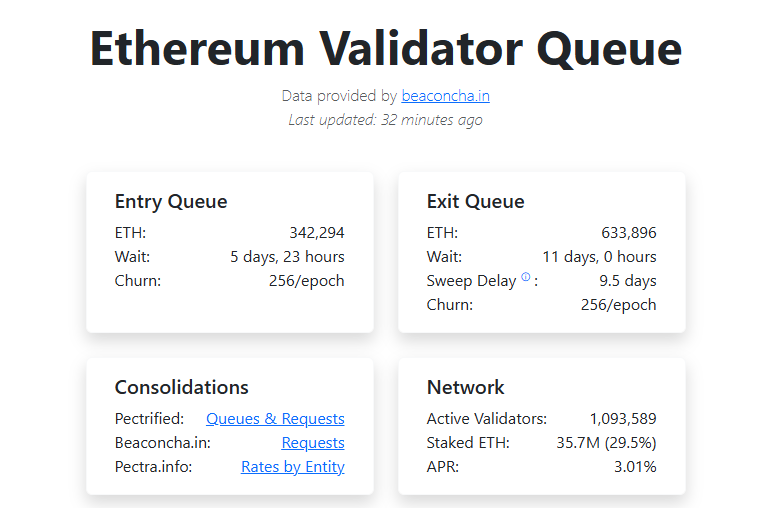

Suddenly, traders who were engaged in luping, a strategy for making a profit from steiking Ethereum, began to lose money by repeatedly making deposits and borrowings. They massively closed their positions, as a result of which the providers of liquid stakeing had to refuse to block coins.

As a result, a huge queue for conclusion was formed. As of July 23, 633,896 ETH awaits the removal – a record indicator in history.

Thus, a temporary liquidity deficiency has formed.

Now AAVE financing rates have returned to normal, but the situation has demonstrated the degree of influence of large players.

Who displayed assets?

In an interview with Dlnews, AAVE Roller Contributor said that he considers the founder of Tron Justin San as the main withdrawing funds from the Chita protocol. According to his observations, the businessman regularly transfers and withdraw large amounts.

According to Dashboard ARKHAM, in recent days, the wallets belonging to the dignity brought out about $ 650 million in Ethereum. His addresses are still stored by Steth worth $ 390 million.

The addresses associated with the HTX cryptocurrencies also moved the coin from the protocol in the amount of approximately $ 450 million.

In addition, the London investment company Abraxas Capital Management has taken cryptocurrency for more than $ 100 million over the past week.

Recall that against the background of market growth in Bitcoin and Ethereum networks, a surge in the activity of whales began. Large investors have moved coins to billions of dollars.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.