Bitcoin has recently reached a new historical maximum at $ 124,474, but over the past 24 hours its price has fallen by 3.5%. This fall is associated with the actions of whales.

We figure out what is happening in the Bitcoin market (BTC) and what to expect from the price of cryptocurrency.

Bitcoin whales benefit

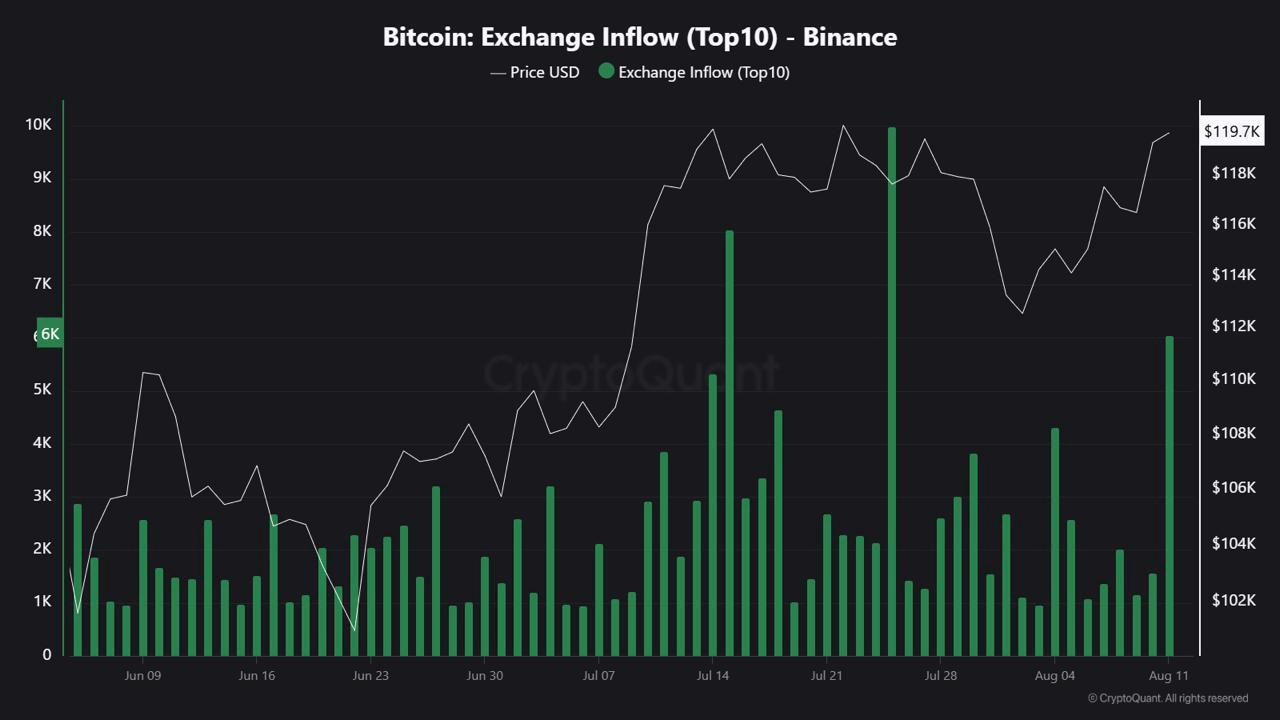

Over the past 24 hours, Bitcoin deposits have significantly increased on Binance: 6,060 BTC have arrived at the exchange, which is about $ 722 million. According to Cryptoquant, this growth is mainly related to whales.

Analyst JA Maartunn from Cryptoquant notes that recent economic reports, such as data on applications for unemployment benefits in the United States, producer prices (PPI) and retail sales, affect whale behavior.

An increase in Bitcoin balance on Binance shows that whales actively operate against the background of indefinite economic data. This behavior usually negatively affects the price, since large transactions often signal the change of moods.

Changing the pure position of the Hodler is an important indicator showing the behavior of long -term holders (LTH). Now this indicator comes out of the bear area, which indicates a decrease in sales pressure.

This behavior of the Hodler is a good sign showing that large Bitcoin holders remain faithful to their positions. Despite the recent historical maximum and subsequent fall, LTH continues to keep their assets, which can stabilize the market and support its restoration. This resistance to sales can help return to higher prices – for example, to $ 122,000.

The price of BTC is held

At the time of writing this material, the BTC is traded at $ 119 186 after a fall below $ 120,000. The price decreased with a recent maximum of $ 124,474, showing some volatility. Despite this, Bitcoin holds support above $ 119,000, which can mean short -term correction.

Given the mixed mood in the market, bitcoin can recover above $ 120,000 as a reliable level of support. If the bulls keep this level, the coin will receive a chance to return to $ 122,000.

If the sales pressure intensifies, the price of bitcoin risks breaking up support at $ 117,261. A deeper drop can reduce the price to $ 115,000 or lower, which will cancel the bull forecast and indicate further market weakness.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.