Investors drew attention to the World Liberty Finance after the start of trading in the WLFI tokene and the reached flagship stabelcoin USD1 of the volume of $ 2.64 billion in six months

With an increase in popularity, they discuss which altcoins can benefit. Analysts believe that it can be BNB Coin, ChainLink (Link) and Bonk (Bonk).

Why can BNB, Link and Bonk benefit from WLFI acceptance

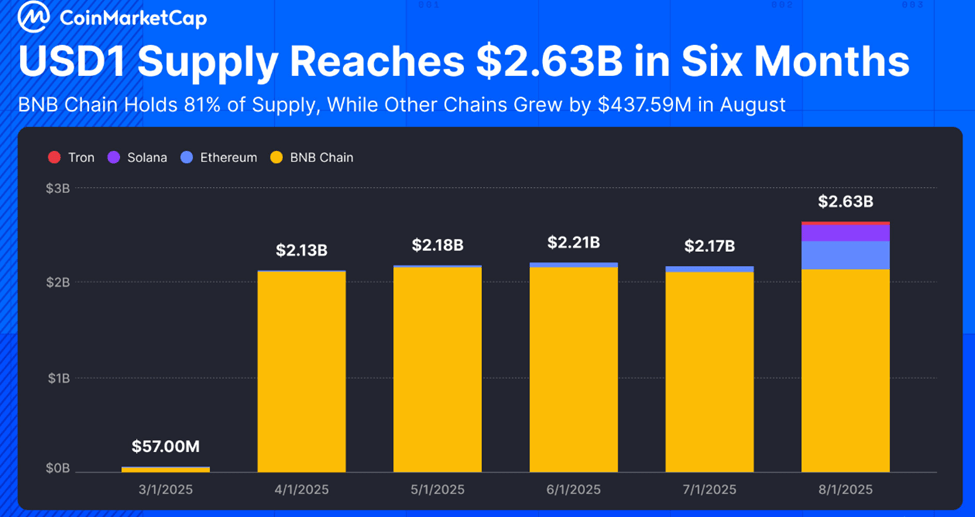

BNB Chain has become a key platform for the USD1 expansion. According to CoinmarketCap, 81% of the USD1 sentence is on BNB Chain, which makes it a leading network for WLFI stablecoin. Although the USD1 Stablecoin proposal on other networks in August increased by $ 437.59 million, the BNB Chain remains a leader.

This concentration emphasizes the importance of BNB in the WLFI ecosystem. With an increase in USD1, the demand for blockchain space and liquidity on the BNB Chain will probably increase. For BNB holders, the network effect can lead to steady utility and growth of transactions, which will positively affect the BNB price.

Chainlink (Link) has become an important player due to its protocol of inter -foundation compatibility (CCIP), which serves as a key element for WLFI operations.

ZA REINS from the ChainLink community said that CCIP processed more than $ 130 million intercourse transfers in one day. Of these, $ 106 million, or 81.5%, are associated with WLFI translations.

WLFI also uses the CROSS-Chain token (CCT) standard from Chainlink, making Link oracles and compatibility services important for its growth strategy.

With more than 80% of the CCIP volume associated with WLFI, the partnership displays Link to the center of the developing multicopular ecosystem.

The growth of WLFI activity can strengthen the Link position in the market.

Another promising altcoin is Bonk (Bonk), leading Memcoin on Solana. WLFI recently chose Bonk.fun for launching USD1 on SOLANA, which has become an important event for both ecosystems.

Analysts, such as UnipCS, believe that this agreement can significantly increase liquidity in the Bonk ecosystem. They note that the USD1 led to $ 30 billion trading volume on BNB Chain in just the first month.

If WLFI repeats its success on SOLANA, BONK and its ecosystem can attract significant flows of liquidity and attention.

Short -term difficulties and long -term opportunities for the WLFI ecosystem

Despite optimistic forecasts, the WLFI ecosystem is faced with short -term difficulties. CoinmarketCap data show that the market capitalization of the ecosystem fell by 4.28% to $ 11.47 billion, and the volume of bidding decreased by almost 60%.

Analysts suggest that the early exits can affect the price dynamics of WLFI, but the situation may change with the launch of new partnerships such as Bonk.Fun. BNB, Link and Bonk stand out as leading altcoins that can benefit from the growing influence of WLFI.

These projects are able to lead a new wave of liquidity, interactiveness and growth associated with stablecoins on cryptocurrences. However, it depends on the rapid adoption of WLFI.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.