Although many forecasts for the price of XRP in 2025 are optimistic, some onchain-data show a different picture. A look at September can help XRP investors better manage risks.

An analysis of data from sources such as Cryptoquant, Defillama and Google Trends, revealed three main problems.

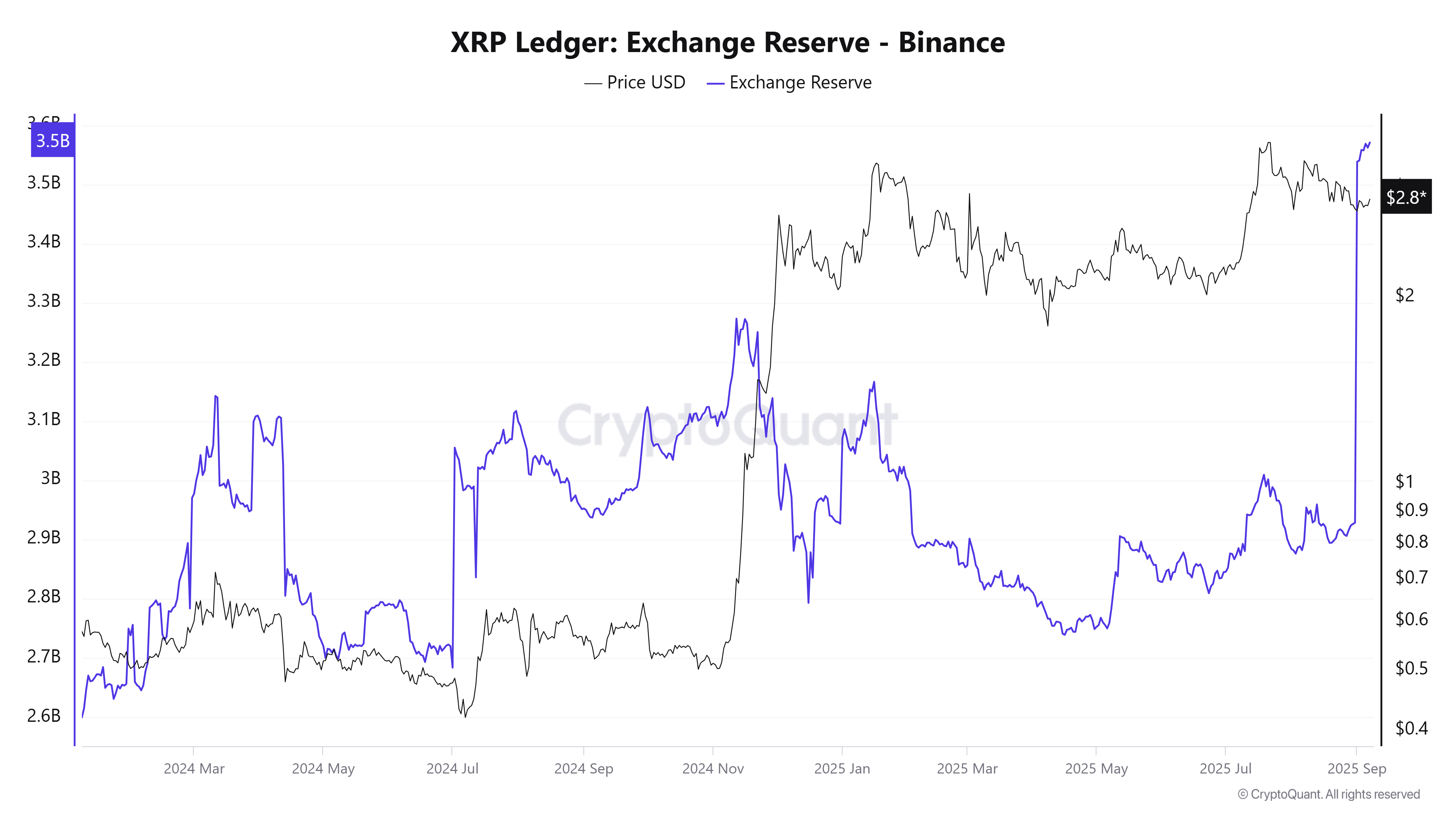

XRP reserves on Binance reached a record in September

The first and most noticeable signal is the mass tributary of the XRP on Binance. According to Cryptoquant, on August 31, Binance was about 2.9 billion XRP. By the seventh of September, this figure increased to a record level of 3.57 billion.

This means that from the beginning of September, about 670 million XRP has been transferred to Binance. The tributaries began after the price of XRP fell by more than 25% of the July peak.

Typically, a significant influx of exchanges tokens indicates that investors can prepare for sale to fix profit or reduce losses.

XRPL ecosystem weakened in September

Another alarming signal is a decrease in the total value of blocked assets (TVL) on the XRP Ledger (XRPL), which indicates the withdrawal of capital from the ecosystem. According to Defillama, the indicator has fallen from $ 120 million to $ 98 million over the past two months.

The volume of trading on DEX on XRPL also decreased in September, reaching only $ 2.3 million per day – this is the lowest in April. It means 90% fall compared to the middle of July.

Even at the peak, the total value of the blocked assets of XRPL remained small compared to billions of dollars blocked in other Defi protocols. The data show that XRPL loses its position in the field of Defi, which leads to a decrease in trade activity.

Google Trends show a decrease in interest in XRP

The third sign is a sharp decrease in the interest of the community measured using Google Trends. Over the past two months, an interest index in XRP has fallen from a maximum of 100 to all to all 19. The keyword “XRP ETF” has fallen sharply in popularity, decreasing from 100 to 9 points over the past month.

A decrease in interest threatens to reduce the amount of bidding, making XRP more subject to sharp price fluctuations due to the actions of large players or macroeconomic factors, such as the percentage rates of the Fed.

Technical analysts see the situation differently

In the meantime, technical analysts do not lose optimism. They claim that XRP escaped from a descending triangle last weekend, which can mean the beginning of a new rally. Some note that the XRP has been holding in the range of $ 2.7– $ 2.8 for several months, which indicates a strong accumulation. This can lead to a breakthrough by the end of the year.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.