This week, Bitcoin survived significant fluctuations in prices, reaching $ 122,000 during the day, and then rolling quickly. At the time of writing, the BTC is traded at $ 119 117.

We figure out what is happening in the Bitcoin market (BTC) and what to expect from the price of cryptocurrency.

Bitcoin investors become more optimistic

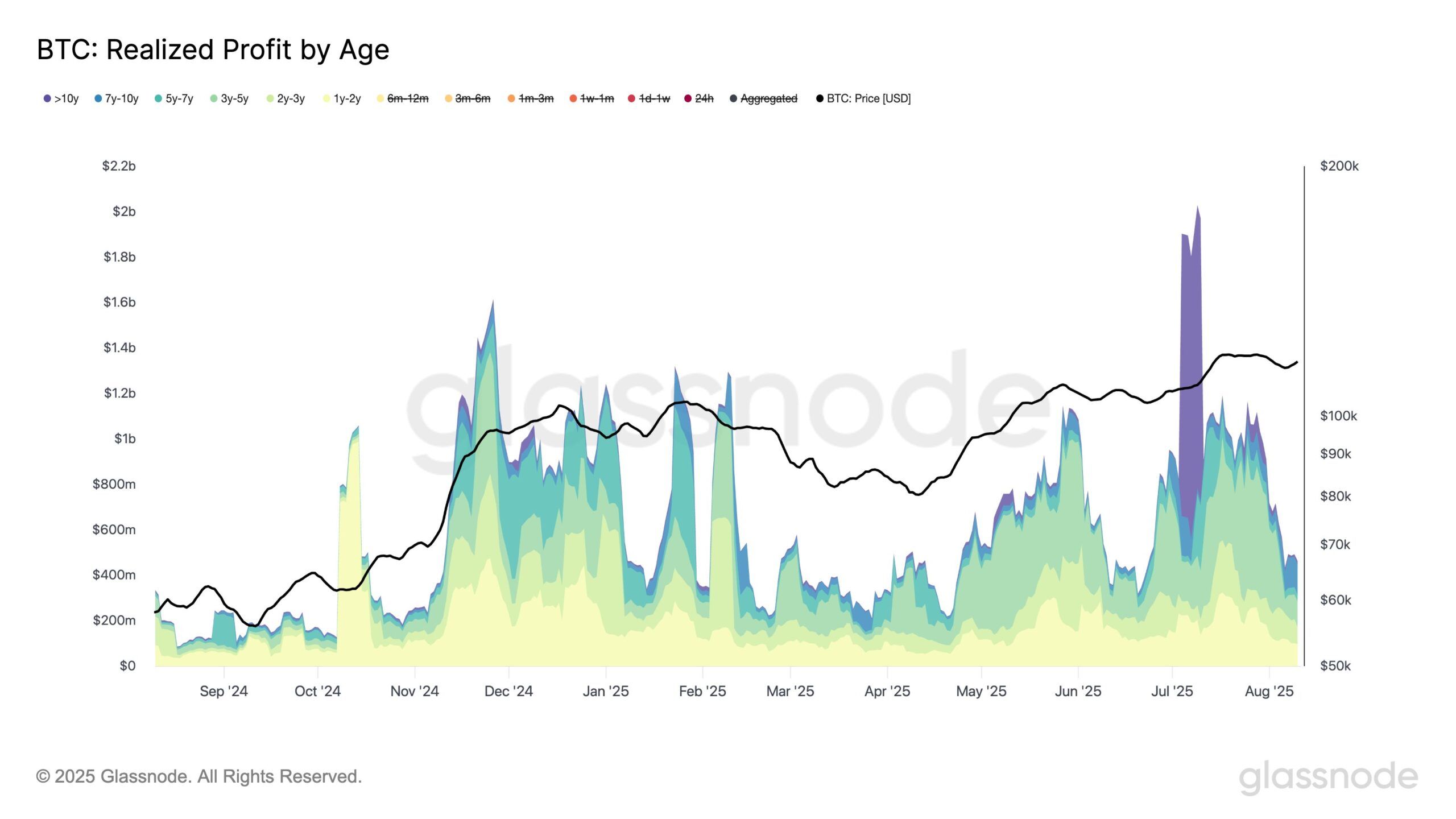

In August, long-term Bitcoin holders significantly slowed down the sale of their assets (7-day simple sliding medium or SMA). After July, which became one of the largest periods of fixation of profit in the history of Bitcoin, the trend of daily profit above $ 1 billion began to decline.

A decrease in sales activity among long -term holders contributes to a positive forecast for bitcoin. As the market stabilizes, investors are more and more confident in the long -term cryptocurrency potential.

Bitcoin attracts more and more attention: over the past ten days, the number of new addresses has increased by 15%. The number of active addresses reached 367 349 – a maximum in nine months.

This growth shows that bitcoin is becoming more popular among new investors, strengthening the common market mood. Bitcoin prices can greatly depend on the upcoming CPI USA report. Typically, a higher CPI leads to an increase in interest rates, making BTC and other crypto acts attractive, as they protect against inflation. However, this time the situation has changed.

CPI effect on BTC price

At the time of writing this material, the BTC is traded at $ 119,117, after over the past 48 hours its price has exceeded $ 122,000, reaching a monthly maximum. However, shortly after, Bitcoin fell sharply to the current price.

Now bitcoin is faced with resistance only below $ 120,000. This has become a serious barrier in recent price dynamics, not allowing cryptocurrency to move higher.

If the upcoming report on the consumer price index (CPI) in the USA will show inflation above the expected 2.8% per year, the price of bitcoin may remain under the level of resistance. This is due to the fact that the correlation of the pieron between the BTC and the US shares is 0.76. In April and May, Bitcoin moved to unison with stock markets, and a low CPI led to an increase in BTC price.

Analyst Michael Van de Poppe shared his forecast with Beincrypto:

If the CPI report is lower than the expected 2.8% and retains the current 2.7% in the annual calculus since July, Bitcoin can break through the resistance of $ 120,000. A positive CPI report can open the way for Bitcoin to reach $ 122,000 and, possibly, continue the rally to the historical maximum of $ 123,218.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.