Market conditions have changed. The weakening of the tariff war of the United States and China and the dynamics of relations between Trump and Musk changed the mood of investors from negative to positive.

However, the optimism of investors can cause concern compared to past market reactions. Let’s figure out why.

Mood indicators can be a stick about the two -edges

According to the Santiment analytical platform, now there are twice as many positive comments on Bitcoin (BTC) on social networks than negative ones. The ratio of 2: 1 is the highest since the presidential election in the United States in November 2024, when Donald Trump’s victory caused enthusiasm in the crypto community.

It may seem a strong signal. However, historical templates show that such enthusiasm often precedes significant market corrections. Santiment also notes that such keywords as “historical maximum” appear in discussions related to bitcoin, more often than at any other moment of this month.

This month, the periods of high enthusiasm of retail investors often preceded Bitcoin prices.

This month, the periods of high enthusiasm of retail investors often preceded Bitcoin prices.

This trend coincides with the index of fear and greed Coinmarketcap. This is a popular mood indicator on crypto. In June 2025, the index reached the “greed” zone with an indicator above 60. Over the past year, such high indicators often warned about the market overheating and a possible rollback.

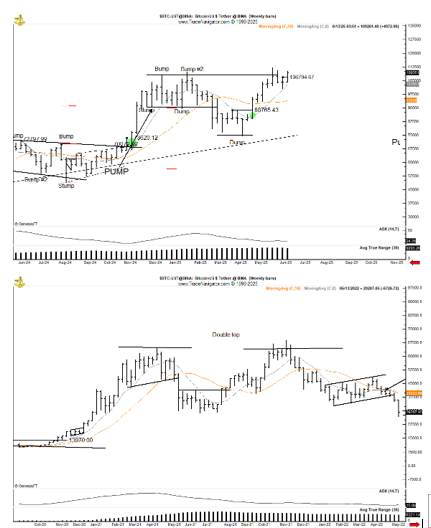

An experienced trader spoke about a double peak

Experienced trader Peter Brandt recently expressed concern about the possible repetition of Bitcoin Bear 2022. He pointed out the probability of falling 75% after the formation of a “double peak”.

He did not make a final forecast, but his comments hint at a possible significant fall. It can be similar to a deep decline in 2022, when Bitcoin collapsed from maximum values. Brandt observations show that financial markets often repeat behavioral patterns. The current structure of the schedule resembles the one that preceded the previous collapse.

He did not make a final forecast, but his comments hint at a possible significant fall. It can be similar to a deep decline in 2022, when Bitcoin collapsed from maximum values. Brandt observations show that financial markets often repeat behavioral patterns. The current structure of the schedule resembles the one that preceded the previous collapse.

One of the strongest counterarguments against this scenario is the key difference between the current cycle. User X under the nickname Death Ca₿ to QE noted that the previous bitcoin cycles mainly depended on the mood of retail investors. However, today the psychology of retail investors may not be the main driving force. Now the price of BTC is largely determined by corporate and institutional investors.

These changes interfere with accuracy to predict how long the institutional FOMO will last (fear of missing benefits) or when it ends. We simply have no historical examples for comparison.

These changes interfere with accuracy to predict how long the institutional FOMO will last (fear of missing benefits) or when it ends. We simply have no historical examples for comparison.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.