At the time of writing this analysis, Ethereum (ETH) is traded at $ 2,540, increasing by 3.57% in the last week. Meanwhile, onchain-indicators give negative signals.

We figure out what is happening on the Ethereum (ETH) market and what to expect from the price of cryptocurrency.

The activity of developers no longer supports the excitement around $ 5,000

The most obvious alarming signal is the activity of the developers. Since mid -May, the contribution of Ethereum developers, measured by the number of communities and updates in the main repositories, has decreased from 71 to a little more than 25, according to Sentiment.

Such a discrepancy often indicates that the innovations are mainly protocol and the heater lag behind market stiring. If the main network of the Ethereum does not actively develop, this will limit the long -term prospects of altcoin and will impact its bull forecast.

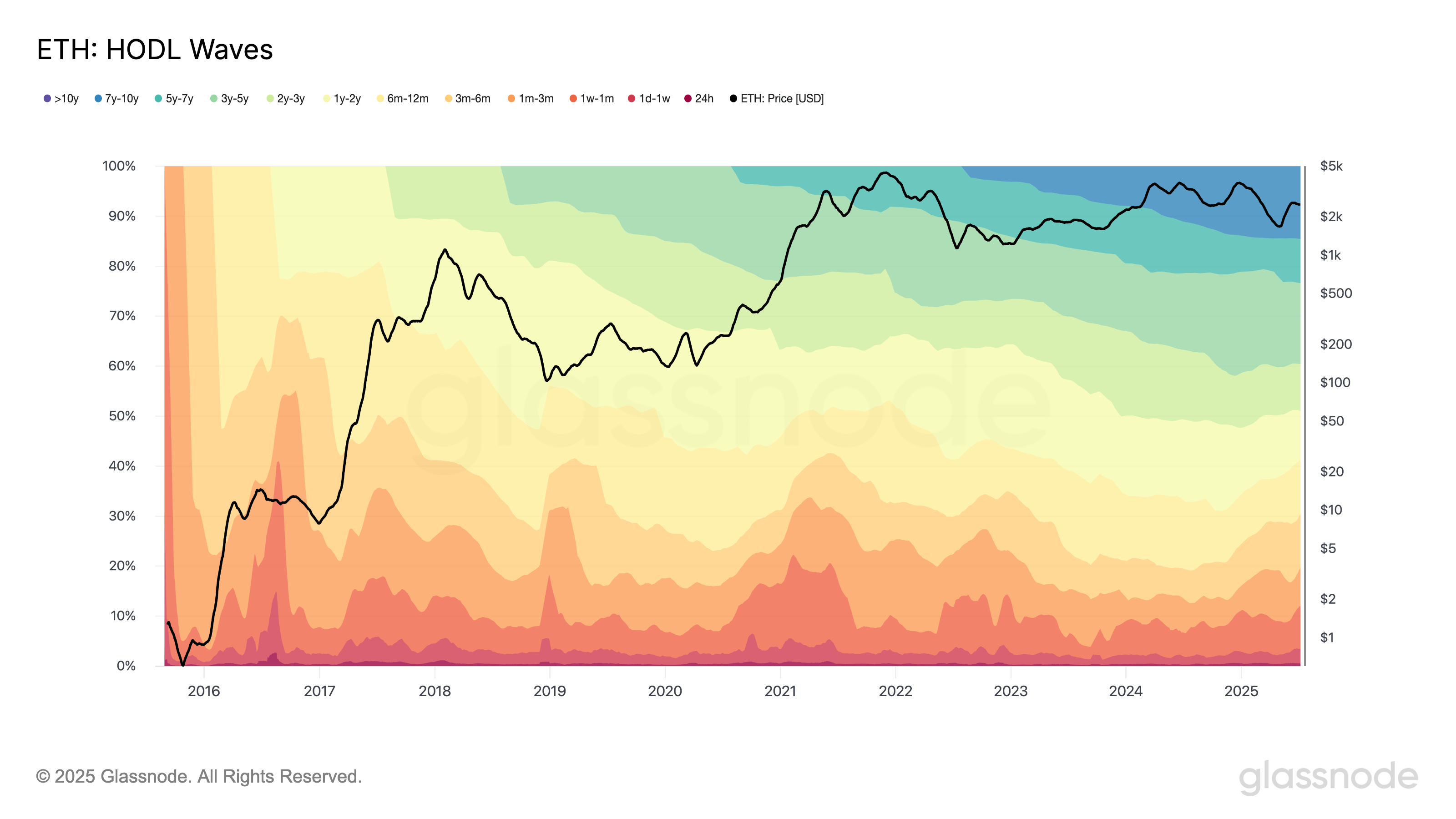

Hodl Waves, which classify the wallets according to storage time, also reflect an alarming trend. The share of ETH, stored for more than 6 months, decreased, even despite the recent price rally.

Most ETH is now stored from 1 to 6 months. Unlike past price breaks, when long -term holders dominated, this indicates weak confidence. This position may mean that many ETH holders are ready to sell assets if the price encounters resistance.

Chaikin Money Flow (CMF), a metric for tracking the accumulation taking into account volume, stabilized after a short surge in April-May, when Ethereum grew from $ 1,300 to $ 2,700. From then it did not exceed 0.10, which indicates a pause in significant customer pressure.

ETH forecast

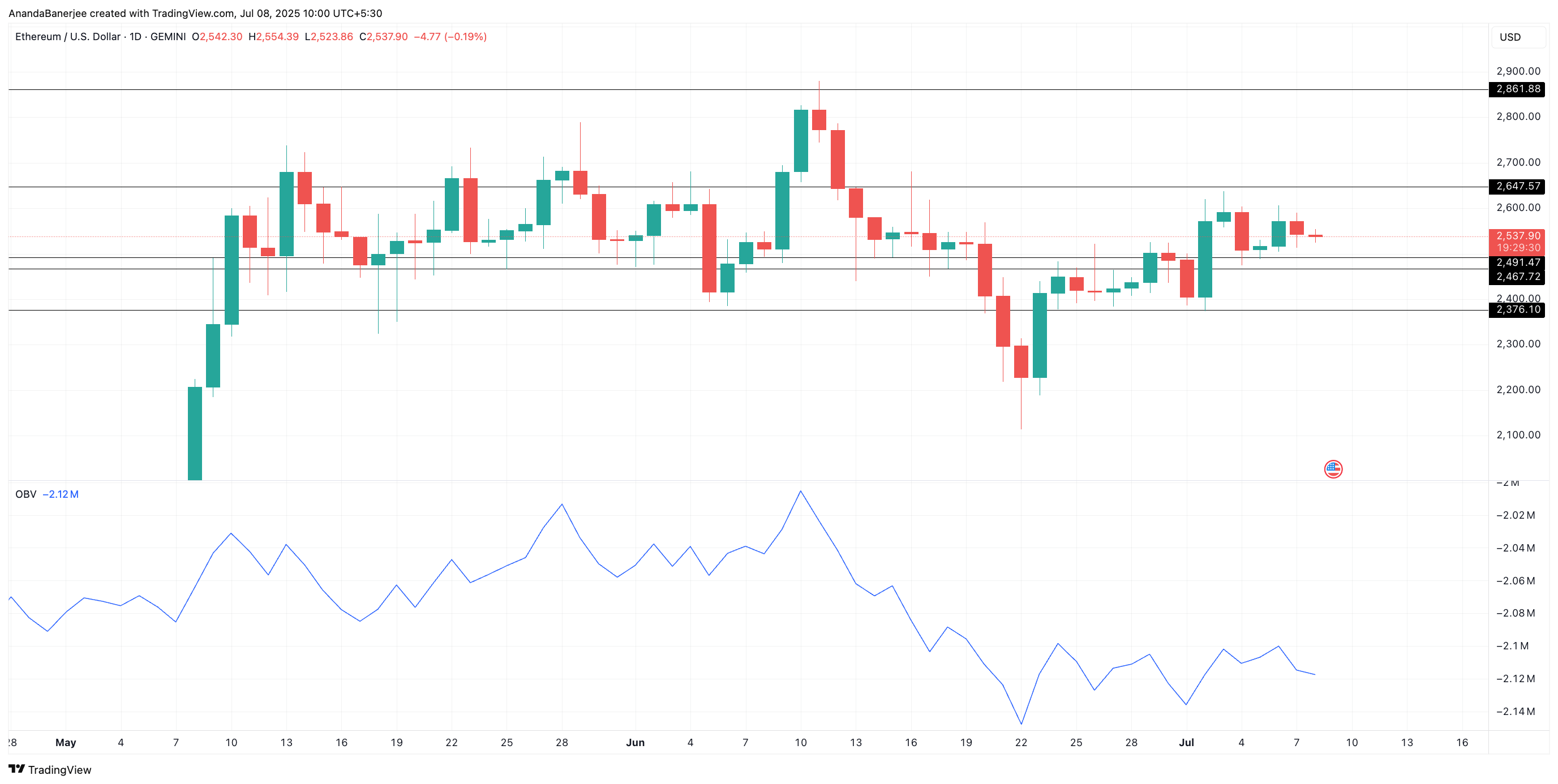

Ethereum is now below the key resistance at the level of $ 2,647. If the impulse weakens, support will be met by altcoin at levels of $ 2,491 and $ 2,467. A breakdown below $ 2,467 is fraught with a decrease to $ 2,376.

Meanwhile, on -Balance Volume (OBV), which takes into account the volume depending on the direction of the price, was stuck just below -2.12 million. The absence of significant volume from large players and large wallets is doubtful of the stability of current levels, not to mention $ 5,000.

Without strong indicators OBV or CMF to support a breakthrough, the level of $ 2,861 will probably become a tight resistance area. This makes $ 5,000 rather a psychological mark than a real goal.

However, if Ethereum turns $ 2,647 in support, this can change a bear forecast. This will open the path for the increase in the price of ETH above $ 2,800. But this is necessary for the renewal of the impulse, especially if it is accompanied by the activity of the developers and the improvement of CMF.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.