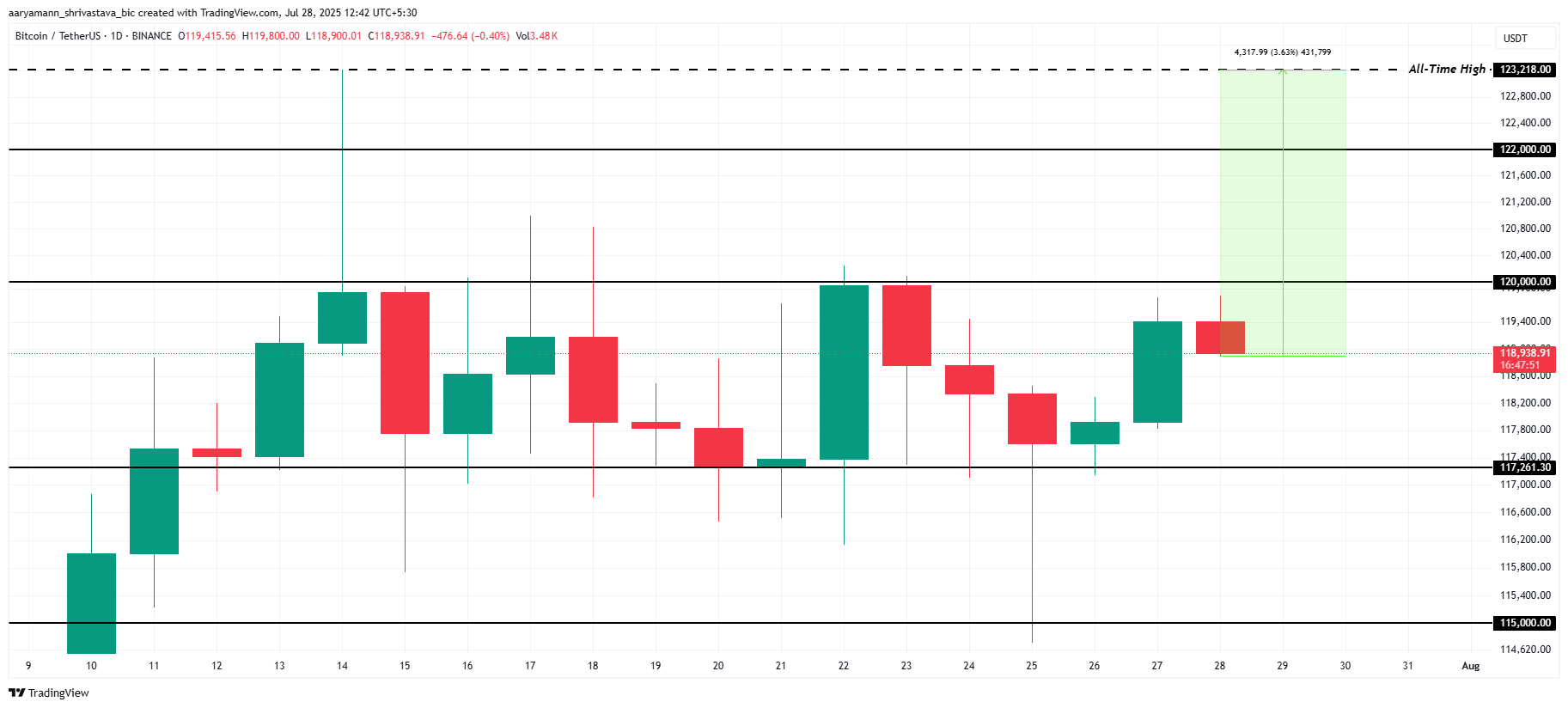

In the last two weeks, Bitcoin (BTC) has stabilized, remaining in the range from $ 117,261 to $ 120,000. This does not allow him to reach a new historical maximum.

We figure out what is happening in the Bitcoin market (BTC) and what to expect from the price of cryptocurrency.

Positive signals appeared on the Bitcoin market

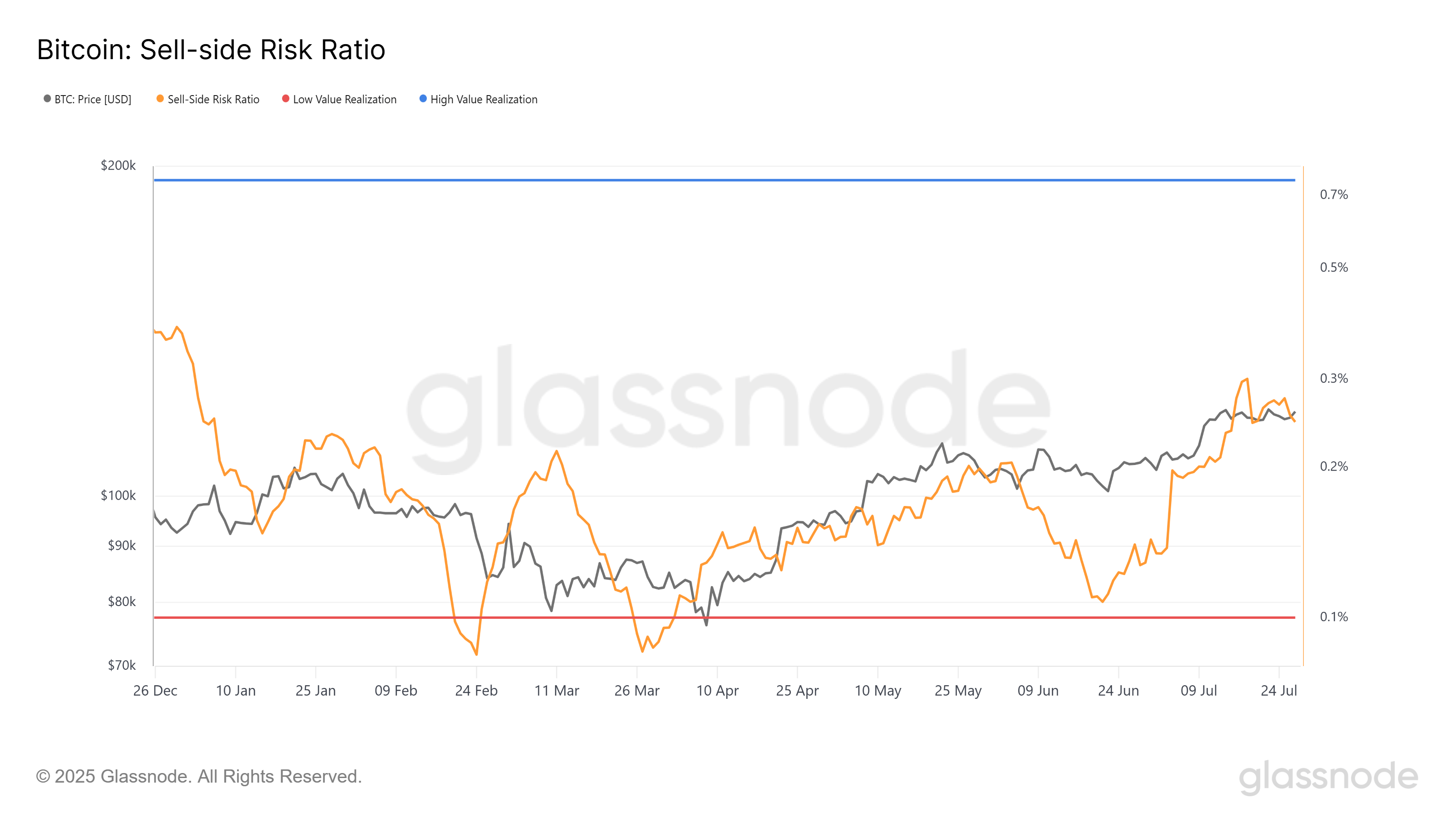

The current risk coefficient for Bitcoin is 0.24 – this is a maximum of the last six months. However, it is still lower than a neutral level of 0.4 and closer to a low level of 0.1. This indicates the consolidation of the market and a pause in large sales.

Historically, periods of low sales risk meant market bottom or accumulation phase, when investors are waiting for a suitable moment for rising prices. This accumulation is important, as it may mean that the price of bitcoin is ready for growth.

In the past two weeks, the Bitcoin accumulation indicator approaches 1.0, which suggests that large holders, including whales, are actively buying cryptocurrency. This can create reliable soil for the growth of bitcoin prices.

Stable purchases by large players show that confidence in the long -term value of bitcoin is growing. This can lead to an increase in its price, since more capital from investors enters the market.

BTC Forecast: A Return to ATH is possible

At the time of writing, Bitcoin is traded about $ 118 938, being in the range from $ 117,261 to $ 120,000. Although this range is stable, there is a high probability of a breakdown of a level of $ 120,000 if investors retain a positive attitude. Then the coin will overcome $ 122,000 and rush to the historical maximum.

The market can become bear if investors change their position due to unforeseen factors. In this case, Bitcoin risks losing support at $ 117,261 and fall to $ 115,000, which will cancel the bull script.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.

.jpg)