The Toncoin cryptocurrency associated with Telegram has become one of the leaders in the crypto, increasing by 14% from July 24, we are talking about what is happening on the Toncoin (Ton) market and what to expect from the price of cryptocurrency.

Toncoin price is ready for further growth

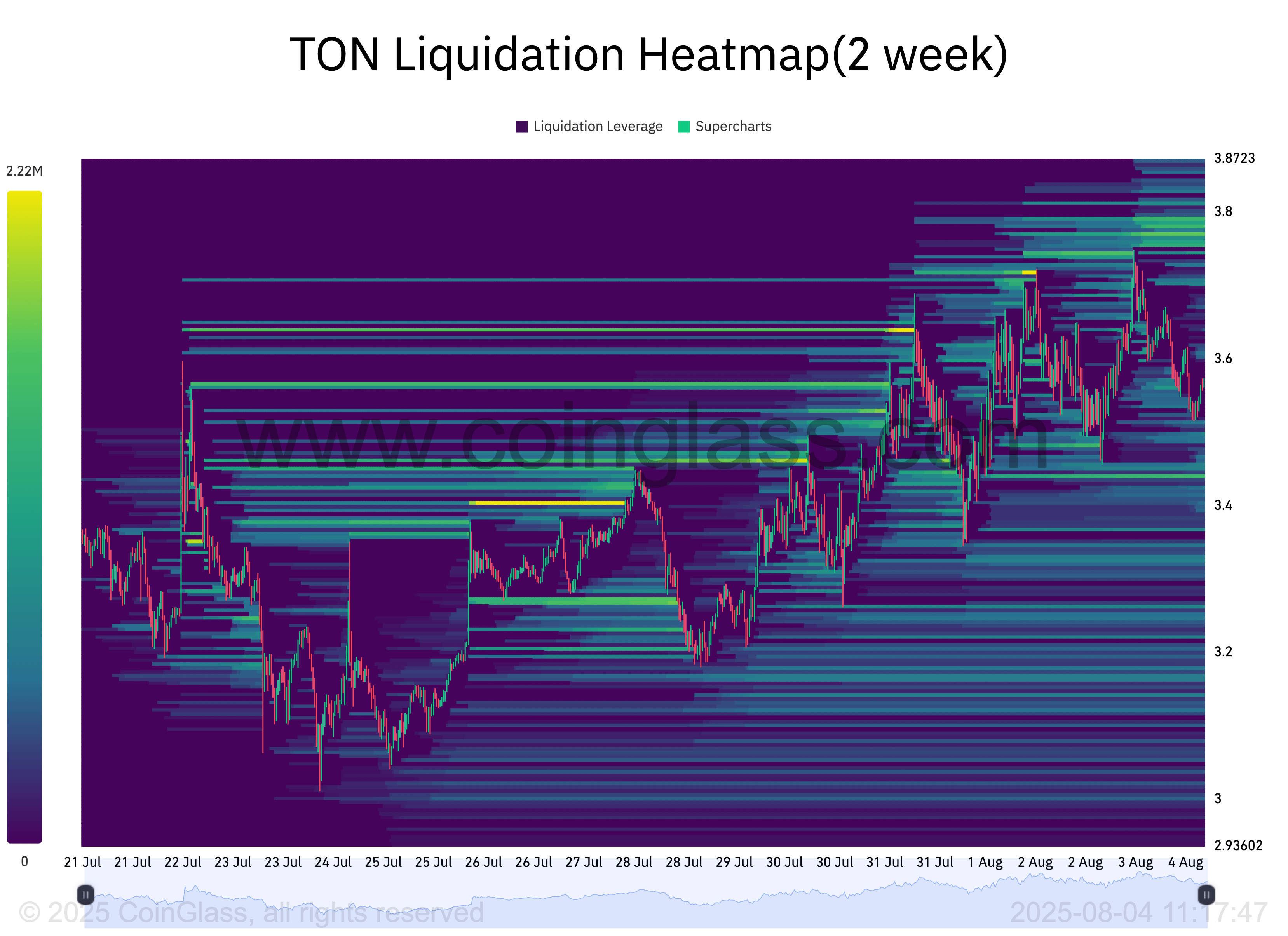

According to Coinglass, the Ton heat card of liquidation shows a significant concentration of liquidity in the area of $ 3.77.

Heating cards are tools that help traders determine levels where large liquidations are likely. They distinguish high liquidity zones, where brighter areas indicate a greater probability of liquidation.

For Ton, a liquidity cluster of about $ 3.77 attracts traders who want to buy or close short positions. This can provoke a new price increase in the near future.

On the technical side of the relative force (RSI) index remains in a healthy range, which indicates the possibility of further growth. At the time of writing, the pulse indicator is 67.21.

The current RSI readings for Ton show that the market is optimistic, and there is a potential for further growth before buyers exhaust their forces.

Toncoin traders put on growth

Despite the volatility of the market and attempts to reduce prices, the Ton financing rate remains positive, confirming the bull mood among the traders futures. At the time of writing, it is 0.0061%.

A constantly positive financing rate indicates a strong confidence in Ton growth potential, even despite the general uncertainty in the market.

Buying pressure is growing

Head and technical indicators show that the purchasing pressure is growing, and Ton is ready for a short -term rally. In this case, the token can overcome the resistance at the level of $ 3.68 and reach $ 4.02.

However, if the demand decreases and the bears will prevail, the price of altcoin risks falling below $ 3.49.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.