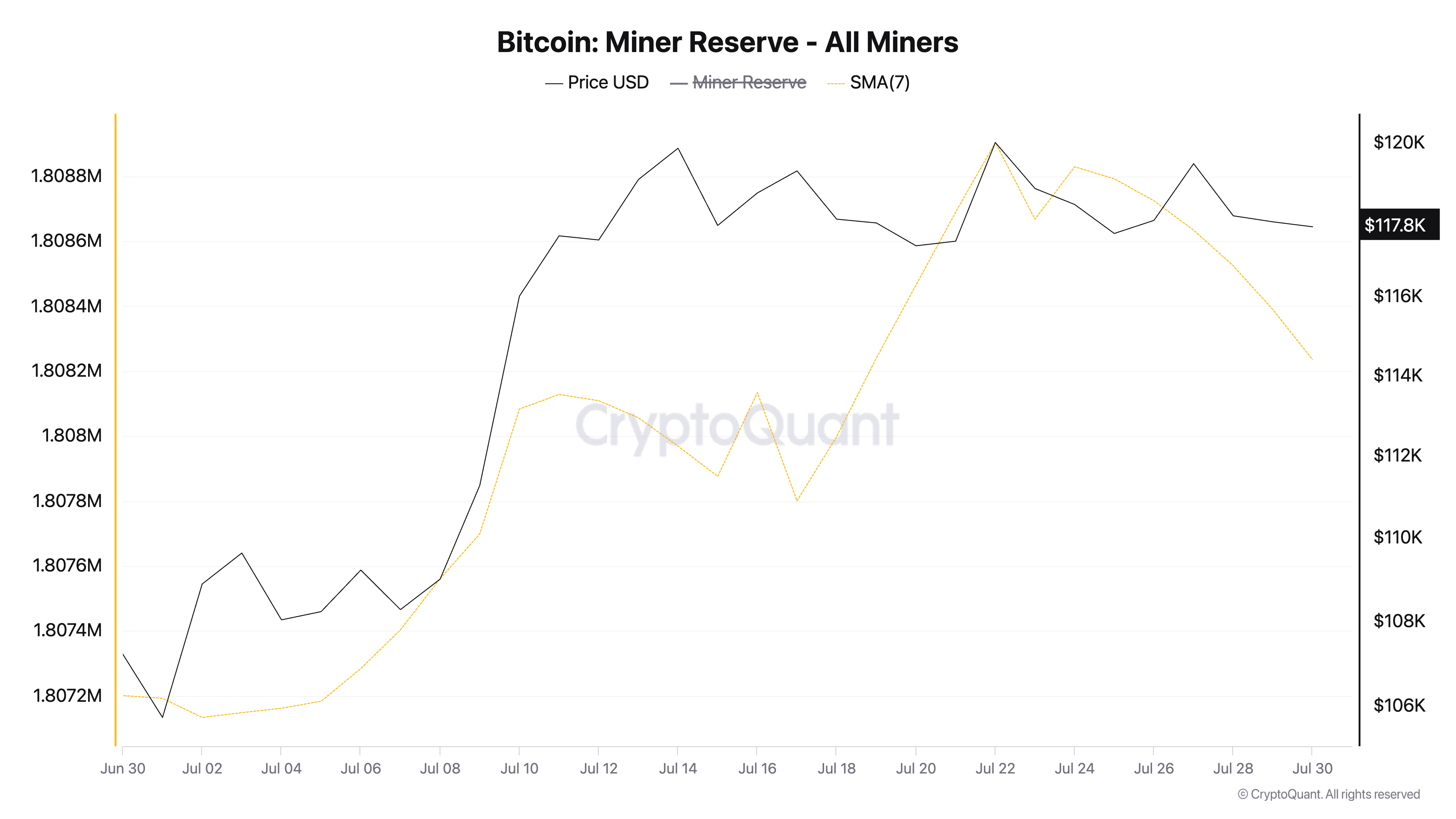

From the second to July 22, the reserve of Bitcoin miners increased steadily when on July 14 the coin reached a new historical maximum of $ 122,054.

At that time, miners believed in the growth of bitcoin and kept profit, waiting for the increase in prices. However, since then, BTC has not been able to enter a stable upward trend. In response, miners began to sell their reserves to fix profit, which creates new challenges for BTC in August.

Bitcoin major sell accumulations

When the cost of BTC began to grow at the beginning of the month, miners began to accumulate the coin more actively, which affects the growth of their reserves. According to Cryptoquant, this indicator from the first to July 22 increased by 0.05% and reached a peak of 1,808 million coins.

The metric of the reserve of miners shows the total amount of BTC in wallets associated with mining organizations. The growth of the reserve signals that miners hold their coins, expecting a price increase.

After the BTC rally before the peak on July 14 and subsequent consolidation, bull sentiments among the miners began to weaken. According to Cryptoquant, from July 22, the reserves of miners began to decline, which indicates a fixation of profit or reducing confidence in the short -term increase in BTC prices.

Miners control a significant part of the new BTC offer, so their behavior can affect the price. The decrease in reserves threatens to increase the pressure on the sale and increase the risk of BTC price correction in August.

Institutionals balance the BTC market

In an interview with Abdul Rafai Gadit, the co -founder and financial director of Zignaly, noted that the recent growth of miner reserves in early July was “probably a short -term pause, and not the beginning of aggressive accumulation”.

When he was asked about the influence of the activity of miners and institutional demand on the pricing dynamics of BTC and what to expect, Gatit noted:

He added:

With an increase in institutional demand on BTC and stable tributaries in BTC-ETF, any pressure from sales of miners can be compensated, which will help to maintain the price of a stable in August.

According to Sosovalue, ETF on BTC recorded a clean influx of $ 237 million this week, despite the side trend of the coin.

This confirms the opinion of Gadit that institutional capital, and not the activity of miners, supports the BTC price and can stabilize it next month.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.