How does Bitcoin usually behave at the end of summer, is there potential for growth of the coin in August, based on the theory of cyclicity and what factors can determine the trajectory of the cryptocurrency this time? Let’s figure it out in the material.

A typical August for Bitcoin

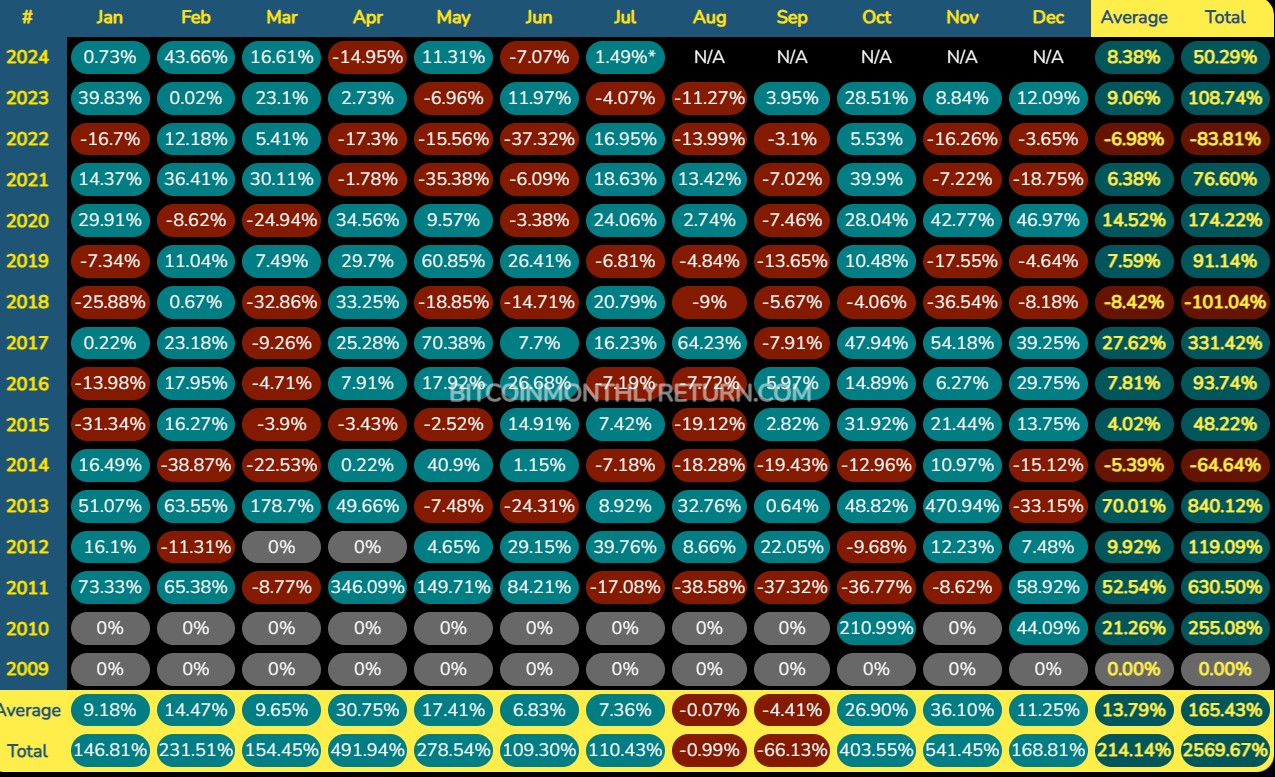

Over the past 13 years of observation, Bitcoin has spent August falling 7 times. For example, at the end of summer 2019, BTC fell by 13.65%. Statistics show that August is one of the worst months for Bitcoin.

Bitcoin behavior by month. Source: bitcoinmonthlyreturn

Bitcoin behavior by month. Source: bitcoinmonthlyreturn

August adjusted for halving

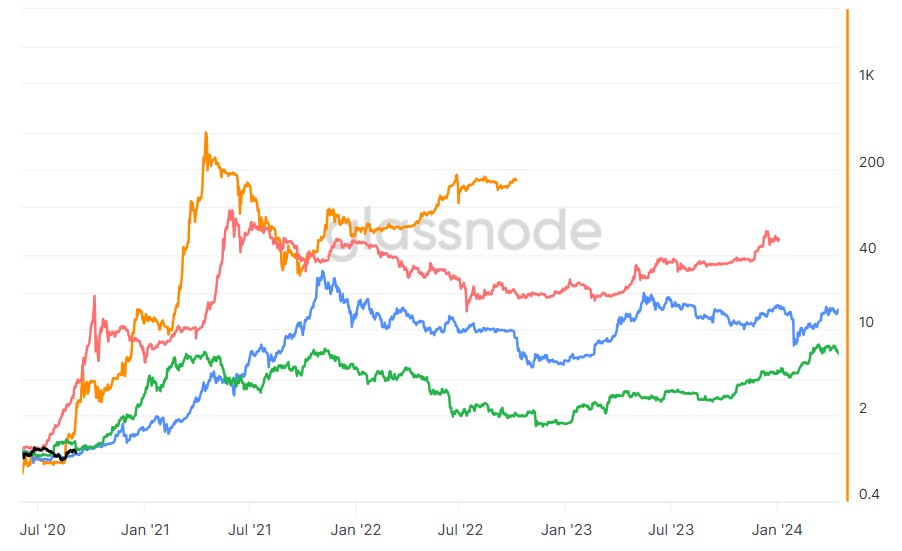

In April 2024, the Bitcoin network experienced its fourth halving. Cyclical theory suggests that the event triggers new growth cycles for BTC. The GlassNode chart below compares Bitcoin’s trajectory:

- from the network launch to the first halving (orange curve);

- after the 2012 halving (pink curve);

- after the 2016 halving (blue curve);

- after halving 2020 (green curve);

- after the 2024 halving (black curve).

So far, Bitcoin’s behavior after the 2024 halving fits into the trajectory of past cycles. In the near future, as the comparison shows, BTC may start growing. On average, Bitcoin needs about four months to demonstrate positive dynamics after the halving. The expected period expires in August.

Comparison of Bitcoin’s behavior after halvings. Source: glassnode

Comparison of Bitcoin’s behavior after halvings. Source: glassnode

Meanwhile, Bitcoin met the last month of summer with a fall. The cryptocurrency demonstrated negative dynamics against the backdrop of the Fed’s decision not to change the key interest rate and the escalation of the situation in the Middle East.

As of the time of writing, BTC is trading 14% below its all-time high of $73,750, which was recorded on March 14, 2024.

Bitcoin has never previously updated its maximum (ATH) before the halving. BTC’s special behavior can be explained by the influence of the long-awaited launch of spot ETFs at the beginning of the year on the coin.

Bitcoin Forecast for August

Financier and asset manager Alexander Ryabinin drew attention to the uncertainty in the market. In his opinion, investors will see BTC movements in the range of $61-73 thousand per coin at the end of summer. The expert believes that going beyond the designated boundaries may happen closer to the end of August or the beginning of autumn.

StormGain crypto exchange expert Dmitry Noskov, in turn, warned that at the end of summer, BTC may come under pressure from the distribution of payments to creditors of the collapsed Mt.Gox exchange. He also drew attention to the risks of the sale of a large volume of BTC by the US government. If the sale happens, Dmitry Noskov warns, Bitcoin risks falling below $60,000 again in August.

A much more optimistic Bitcoin forecast for August was given by Ryan Lee, chief analyst at Bitget Research. In his opinion, the Fed’s preparations for a key rate cut in September make the end of summer the best time to prepare for the release of dollar liquidity, which can enter the cryptocurrency market via the BTC-ETF.

He also believes that Bitcoin’s potential growth is indicated by the steady increase in the market capitalization of stablecoins. He also drew attention to the likelihood of positive news about crypto ahead of the 2024 US presidential election.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.