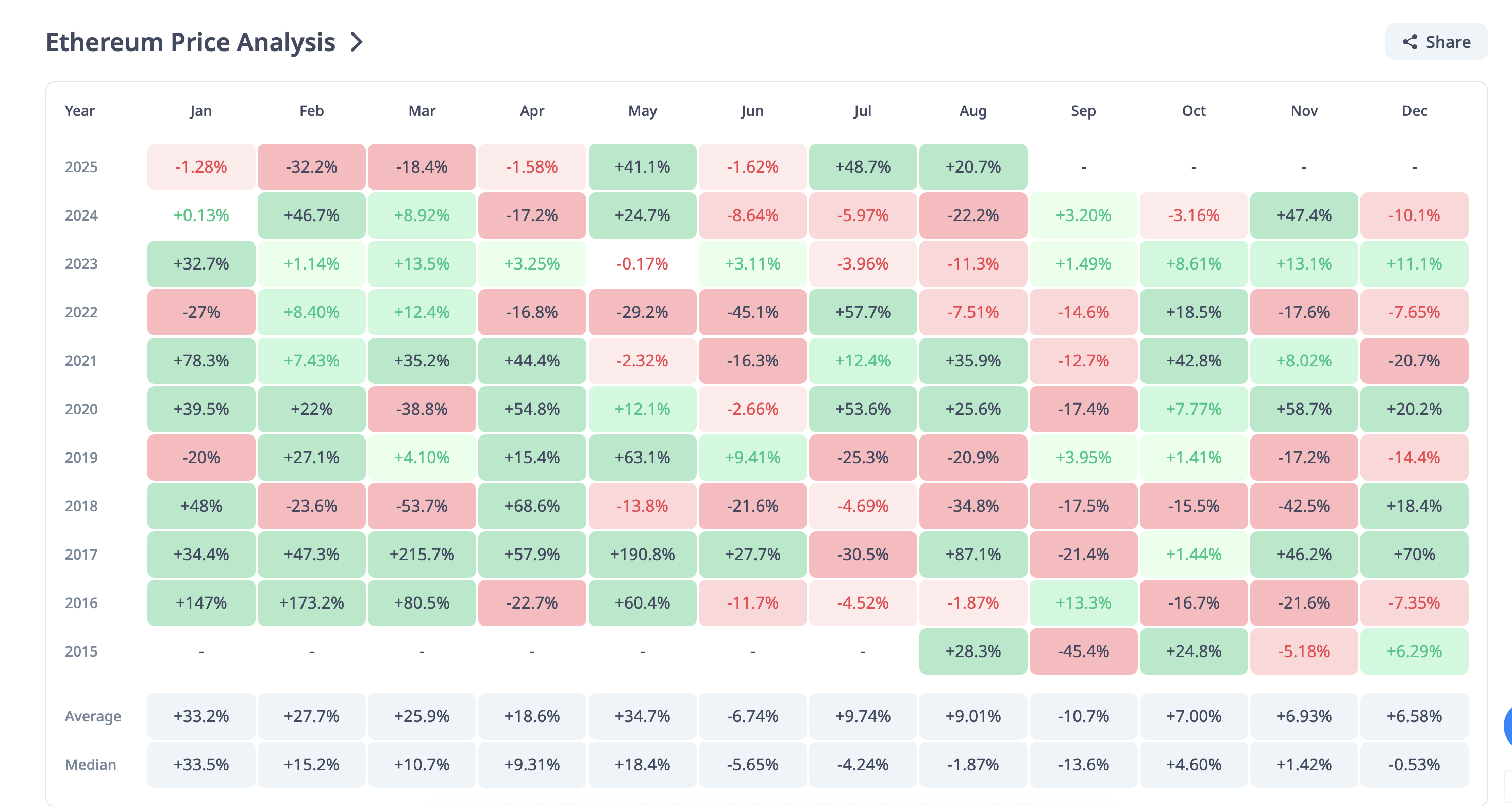

Ethereum (ETH) ended a month with more than 23%tall, interrupting the three -year strip of unprofitable Augustus. Unlike Eth Bitcoin, which was encountered with difficulties, showed stability.

September is rarely successful for Ethereum. In 2024, the increase amounted to only 3.2%, in 2023 – 1.49% after a series of unprofitable years. Now the graphs give mixed signals, and the market is preparing for volatility.

Long -term holders can fix profit

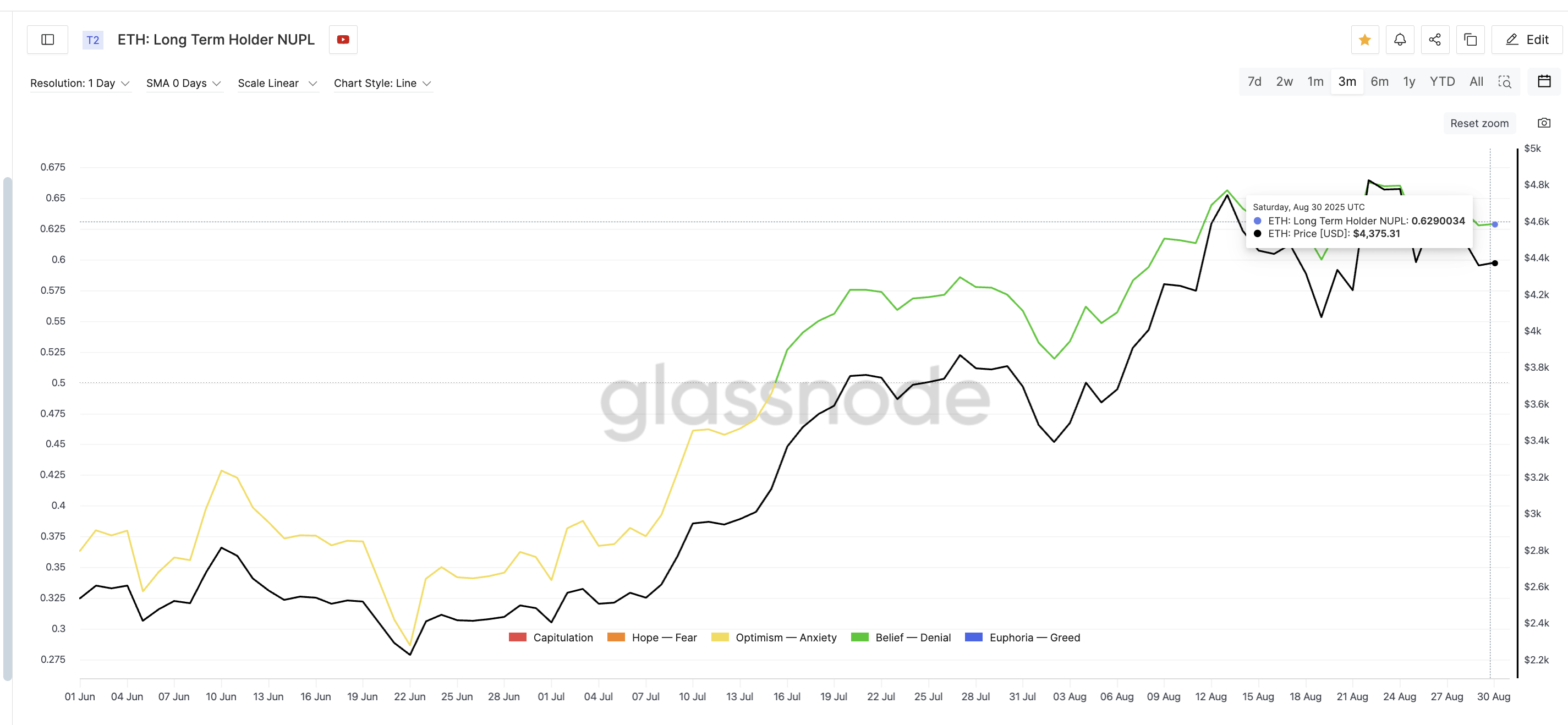

To understand what is happening with ETH, let’s look at Net Unrealized Profit/Loss (NUPL). This indicator helps to evaluate the profits and losses of current asset holders. At the end of August, the NUPL value for long -term investors reached 0.62 – this is a maximum of the last three months. High levels usually indicate the risk of profit fixation.

So, on August 17, at NUPL = 0.63 ETH fell from $ 4,475 to $ 4,077 (-8.9%). Later, at 0.66, the price decreased from $ 4,829 to $ 4,380 (-9.3%). Such values increase the probability of correction and trade in the lateral range.

He noted that the institutional accumulation, together with the role of Ethereum in Defi and the tokenization of real assets (RWA), can smooth out short -term fluctuations.

Thermal card identifies support and resistance zones

The heat card of cost – another important indicator – shows at what levels the investors bought ETH.

- The largest support cluster is formed between $ 4,323 and $ 4,375 (962 000 ETH).

- Additional support levels are located at $ 4,271– $ 4,323 (418 872 ETH) and $ 4,219– $ 4,271 (329,451 ETH).

- The main resistance is higher – in the range of $ 4,482– $ 4,592, where almost 1.9 million ETH is concentrated.

Overcoming this barrier will open the path to $ 4,956.

The bull impulse weakens

On the 2-day graphics it is clear that the price of ETH struck the ascending trend line. It is too early to talk about the reversal, but it is obvious that the bulls are gradually losing ground. RSI forms a bear divergence: the indicator decreases against the background of price growth. This usually portends trade in the range.

- Support: $ 4,345 and $ 4,156. A breakdown below $ 4,156 will increase the risks of a decrease.

- Resistance: consolidation above $ 4,579 will allow the price to rise to $ 4,956.

The psychologically important goal remains $ 5,000.

September will be unstable Ethereum

September may be a difficult month for Ethereum. High NUPL and signs of profit fixation increase the risks of correction, and technical indicators signal the slowdown in the pulse. On the other hand, the institutional accumulation and fundamental role of ETH in the ecosystem of digital assets create the basis for long -term growth.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.