Ripple (XRP) will remain under pressure from sellers. Since the beginning of August, the token has been moving in the descending channel, and the growth of exchange reserves and indicators enhance the risks of falling.

From August 2, the XRP is traded in a descending parallel channel, forming lower maximums and minimums. Attempts by altcoin to get out of this bear structure have not yet been crowned with success: growth is limited by sales and increasing token reserves on exchanges.

XRP is locked in a descending channel

The descending channel reflects the surrender of customers: sellers suppress attempts by bulls to resume growth. The day schedule XRP/USD shows that the token is held in this channel for more than a month. Several times the price tried to break out of the bear structure, but each upward movement was accompanied by a new wave of sales.

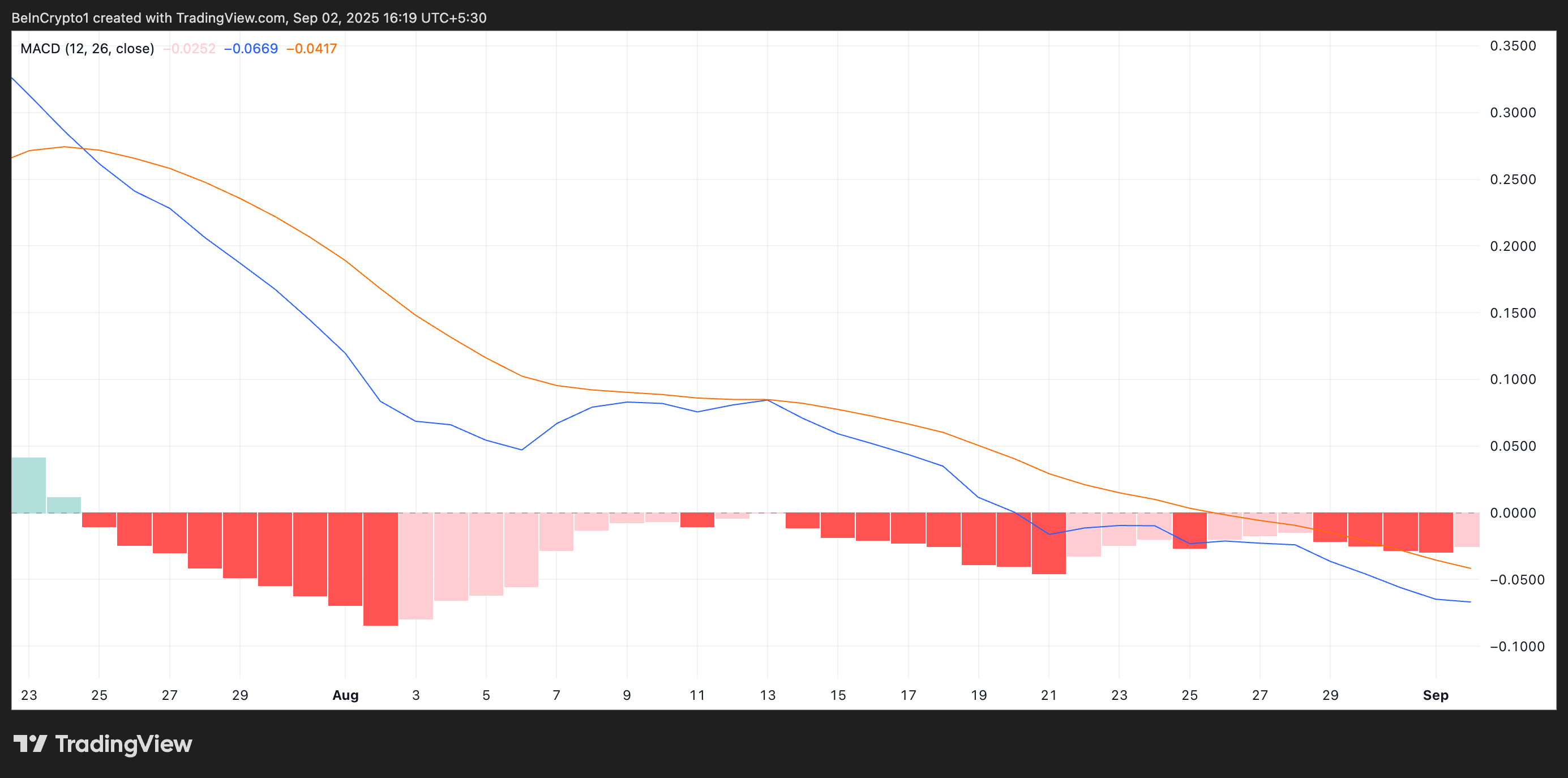

Technical indicators also confirm the bear scenario. The MACD line (blue) is located below the signal line (orange) from July 25, which indicates a preserved decrease in customer activity.

XRP reserves on exchanges are growing

Onchain-data confirm the pressure of sellers. According to Glassnode, from August 27, XRP reserves on centralized exchanges increased by 2%. This suggests that the holders of the coin fix profits and are preparing for further sales.

Now 3.32 billion XRP (about $ 9.3 billion) is stored on the exchanges. An increase in exchange reserves means an increase in liquidity for trading, which often leads to a decrease in price if demand does not have time for a proposal.

Key support is $ 2.63

The nearest support for the XRP is located at $ 2.63. If sellers increase the pressure and the price drops below, the next purpose will be $ 2.39. At the same time, the resumption of purchasing activity and confident growth above $ 2.87 can become a signal for the turn and the beginning of recovery.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.