The price of XRP has significantly decreased in the last days, erasing most of the May achievements and changing the direction from growth to decline in early June

We figure out what is happening on the Ripple (XRP) token market and what to expect from the price of cryptocurrency.

XRP is not the best reputation

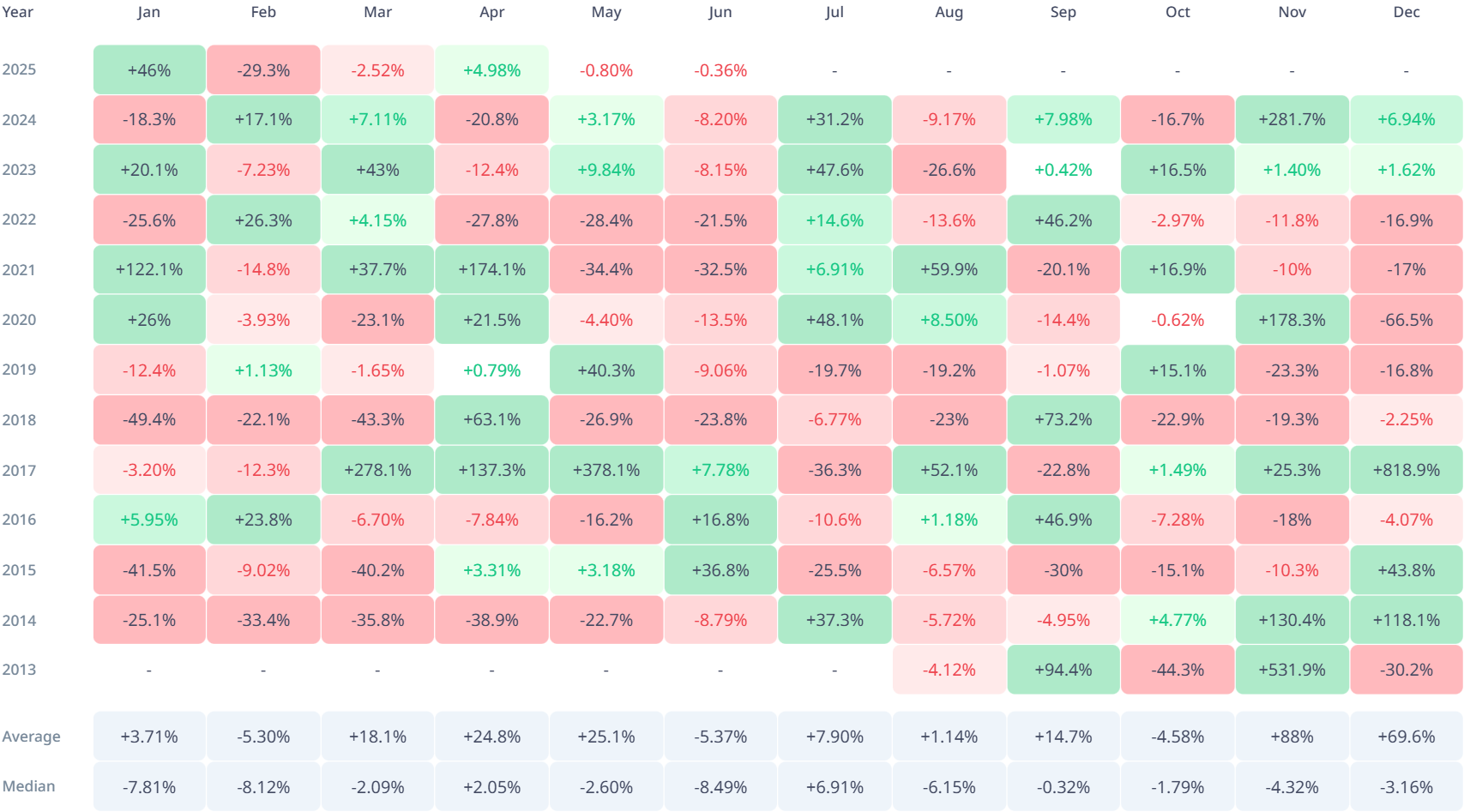

June has traditionally been a difficult month for XRP investors. Over the past 11 years, the XRP median yield in June amounted to -8.49%. Investors should be careful, since seasonal weakness can increase current bear mood, exerting additional pressure on the price.

Investors sell XRP

The Coin Days Destroyed (CDD) metric shows a sharp increase. CDD is the total number of days that were destroyed by the sale of investors, especially long -term holders. For example, if 100 coins were stored 10 days before their waste, CDD will be 1,000 (100 coins × 10 days).

At the time of writing, the CDD for XRP reached 337 billion – this is the highest level since December 2024. This growth indicates that many long -term holders (LP) sell accumulations to fix profit. Such dynamics threatens to negatively affect the price of Ripple token.

Nevertheless, XRP has one advantage – the completion of the trial with SEC. Alexis Sirkia in an interview for Beincrypto noted that this may become a key catalyst to accelerate the ICO Ripple.

XRP price on the threshold of correction

From mid -May, XRP has been moving in a descending trend – at the time of writing this material, it is traded at $ 2.16. Altcoin remains higher than the key level of support of $ 2.12, but forecasts indicate a possible decrease. If the XRP breaks support at $ 2.12, then it risks falling to $ 2.02 or even lower – up to $ 1.94. This will be a two -month minimum that provoke increased sales pressure.

The relative force (RSI) index, located below the neutral line in the bear zone, confirms this forecast, indicating the absence of a purchasing impulse.

Nevertheless, there is a factor that can change the direction of altcoin – this is ETF on XRP. This is one of the most anticipated ETF, which has not yet received approval. When this happens, it is expected that he will attract significant investments in the XRP. However, Alexis Sirkia said that the next step for XRP may not be ETF.

Thus, such an exposition can significantly support the price. Moreover, if small investors begin to buy XRP sold by long -term holders, altcoin can bounce from the support level $ 2.12. A breakthrough above the resistance at $ 2.27 will cancel a bear scenario and raise the price of XRP to $ 2.50.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.