August turned out to be saturated for Solana: Token tried several times to gain a foothold above $ 210, but unsuccessfully. Now SOL is trading about $ 205, having lost 4.5% over the past day and about 1% per week. At the same time, monthly growth exceeds 13%, and in annual terms the asset remains in a plus by almost 50%.

However, September may be a test for an upward trend: onchain-metrics and technical indicators indicate the probability of correction.

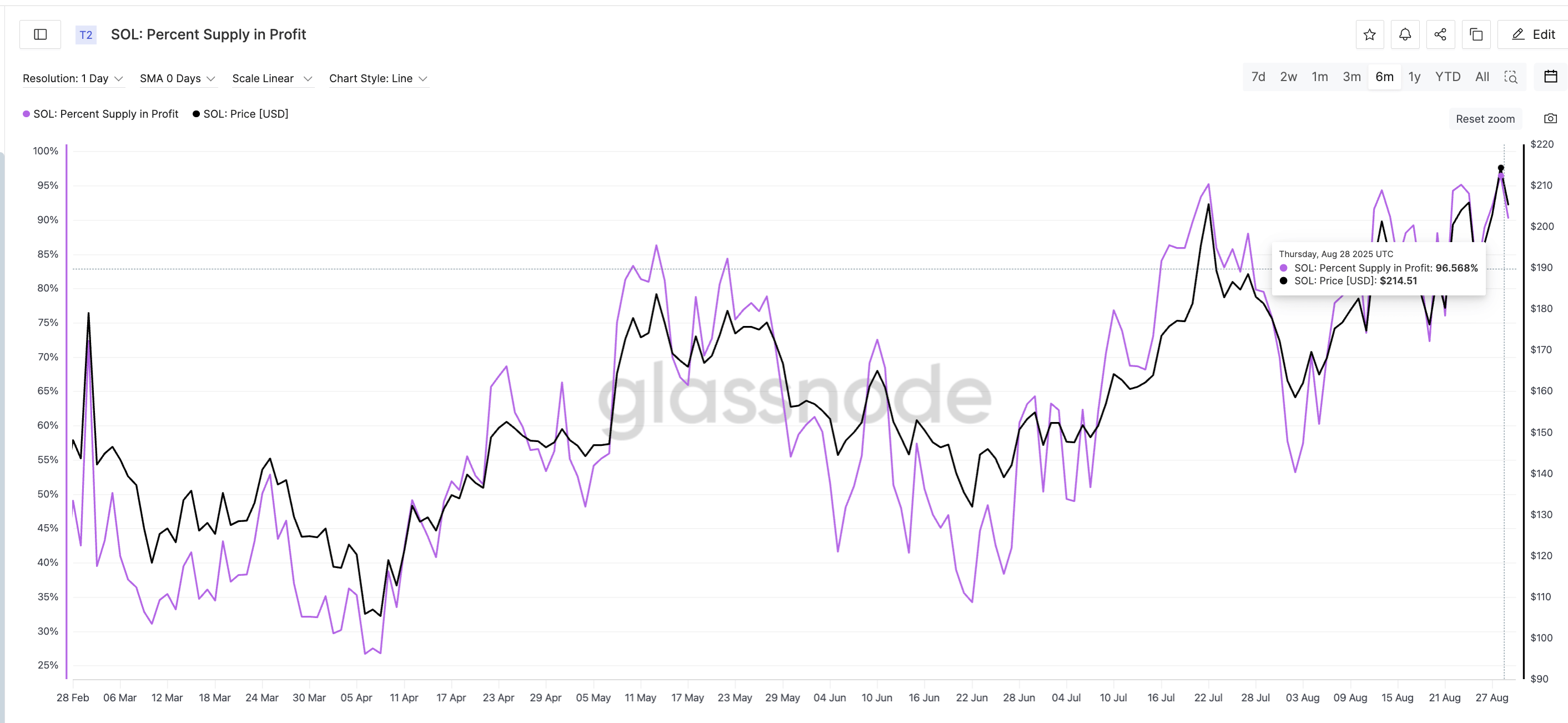

The percentage of proposals in profit is close to maximums

The key signal is an indicator of a proposal in profit, which reflects the share of coins trading above the price of their purchase. On August 28, the metric reached a six -month maximum – 96.56%, and then slightly decreased to 90%. History shows: such extreme values often precede rollbacks.

- On July 13, the indicator grew to 96%, when SOL was trading at $ 205. Soon the price fell by 23%, to $ 158.

- On August 13, an increase of to 94.31% led to a 12% decrease – from $ 201 to $ 176.

- On August 23, the next peak at the level of 95.13% caused a drop by 8% – from $ 204 to $ 187.

The refund to high values again increases the risk of correction in September.

Balances on exchanges enhance the alarm

An additional risk factor remains the growth of SOL balance on centralized exchanges. By August 28, they exceeded 32 million tokens against less than 30 million at the beginning of the month. This usually indicates the readiness of holders to fix profit.

The correlation has already been previously manifested: on August 14, with a similar increase in balance sheets, the price of SOL decreased by 8% – from $ 192 to $ 176 in just a few days. Now the situation is repeated, which enhances the probability of pressure pressure.

Technical picture: ascending wedge and key levels

From a technical point of view, SOLANA is traded inside the rising wedge on a weekly schedule. Such a pattern often indicates a weakening of the impulse and can end with a turn down.

- If the price falls below $ 195 and especially $ 182, a bear script will receive confirmation. In this case, SOL risks going to $ 160, which corresponds to a rollback by 15–20%.

- To cancel the bear forecast, the bulls need to gain a foothold above $ 217 – the local maximum of the late August. Then the price can return to growth.

September seasonality: traditional growth in question

Historically, September turned out to be a successful month for SOLANA: since 2021, Token brought a profit of 29%, 5.3%, 8.2% and 12.5%, respectively. However, now the combination of two factors – a record sentence in profit and growth of exchange reserves – makes 2025 potential exceptions.

If SOLANA cannot stay above $ 217, September can go under the sign of correction, despite the positive seasonality and optimism around the ETF.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.