While Bitcoin (BTC) is trying to stay higher than $ 105,000, short -term holders (STH) coins significantly increase their reserves. This can negatively affect the price of cryptocurrencies.

We figure out what is happening in the Bitcoin market (BTC) and what to expect from the price of cryptocurrency.

Bitcoin market is controlled by sellers

According to Glassnode, the reserves of coins at short -term holders (STH) BTC fell to 2.24 million coins on June 22, but then to 2.31 million recovered. These new or more jet investors, known as “weak hands”, acquired 70,000 coins.

Short -term holders are investors who hold coins for less than 155 days. They are known for their sensitivity to changes in prices. When their reserves grow, the asset becomes vulnerable, as they can quickly sell coins at the first signs of instability, enhancing the volatility.

In addition, Glassnode data show that the reserves of long -term holders (LP) were slightly reduced by 0.13%. When these investors sell part of their coins, market support can weaken, making BTC more vulnerable to sharp fluctuations in prices in the near future.

BTC under the pressure of bears

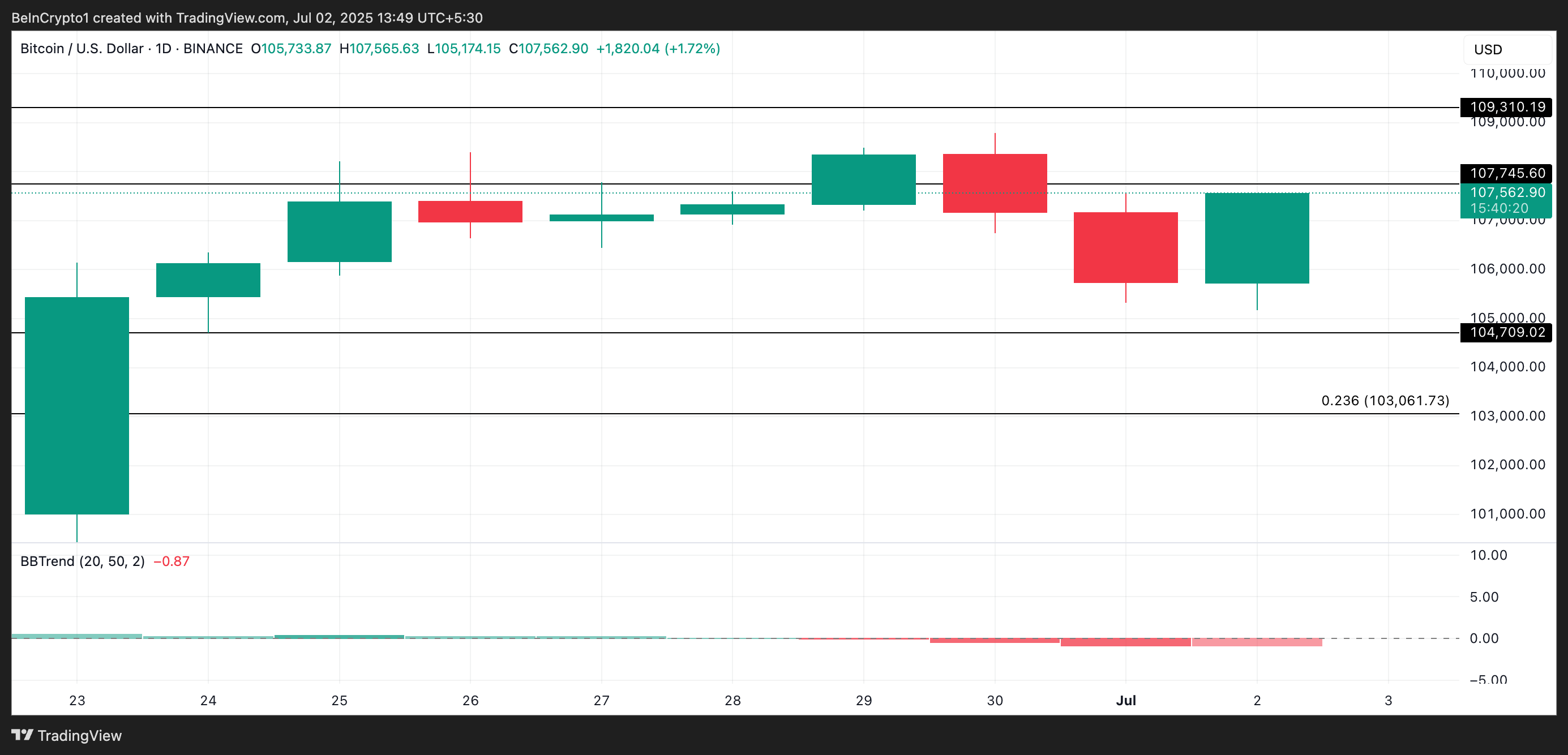

The BBTREND leaning red bars for BTC show that the pressure of the bears is growing. This signals that sellers are gradually returning control of the market, increasing the descending trend. If the dynamics does not change, the coin can threaten a rollback to $ 104 709.

On the other hand, if the demand increases sharply, then the BTC price above $ 107,745 pushes the price of $ 109,310.

Be in the know! Subscribe to Telegram

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.