By Leonidas Stergiou

The highest deposits from foreigners come from overseas financial centers, according to data from the Bank of Greece. In the first quarter, of customer deposits of 13.9 billion euros, 2.3 billion concerned offshore accounts, which mainly concern foreign shipping companies.

The European Investment Bank (1.6 billion euros) is in the next place with the highest deposits in Greek banks due to the programs it has signed for co-financed and guaranteed loans.

At the level of purely private investors, the highest amounts of deposits from abroad come from Britain (1.9 billion), Ireland (1.4 billion) and Cyprus (1.3 billion euros). Deposits from Ireland, which until less than two years ago amounted to less than € 500 million, mainly concern payments for special purpose vehicles (SPVs) of securitized loans to banks.

Bank customer deposits from Germany are at lower levels, but with an obvious upward trend in recent quarters. In March, they reached 650 million euros, from 455 million in 2021 and 348 million euros in 2020. Deposits from the US show a smaller increase (from 364 million euros in 2020 to 470 million in 2021 and 500 million in first quarter of 2022), while deposits from Luxembourg are declining (244 million in the first quarter of 2022 from 283 million in 2021 and 318 million in 2020).

In terms of deposits of other credit institutions in Greek banks, the highest come from Cyprus (1.7 billion euros), Germany (880 million euros) and Luxembourg (742 million euros). These three countries represent almost half of the deposits of foreign institutions in Greek banks, which in the first quarter totaled 5.6 billion euros.

Loans

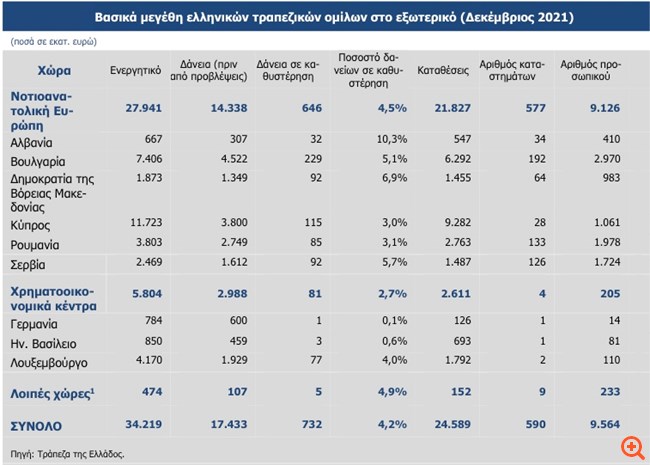

Greek banks’ loans to businesses and other foreign credit institutions rose to 22.9 billion euros at the end of March, from 24.8 billion euros at the end of 2021. This decrease, according to bank executives, comes mainly from securitizations. red loans of their subsidiaries, but also the restructuring of international activities.

According to the Bank of Greece, out of the loans of 22.9 billion euros, 10.2 billion euros relate to financing to other credit institutions, with headquarters mainly in Germany (1.7 billion), Luxembourg ( 1.8 billion) and Britain (1.6 billion)

Total loans to the private sector abroad amount to 12.7 billion euros, the majority of which (8.9 billion euros) relate to companies in offshore financial centers. According to banking sources, this amount actually corresponds to loans to shipping companies, mainly of Greek interests. As the same sources explained, the headquarters is related to the registry and special characteristics of the industry and the relevant law. The flag indicating the nationality of the ship based on the register of the country where it is registered, defines the law which governs it and the crew both in domestic and in International Law. Because the ship is considered a floating part of the territory of the country that carries the flag, while it is common for each ship to be a different company.

The immediately higher loan amounts (balances) relate to loans to Romania (804 million euros) and Britain (831 million euros) in the first quarter, compared to 944 million and 1.1 million euros at the end of 2021, respectively.

International activities

From the results of the first quarter and the presentations of the four systemic banks, their presence is evident mainly in Cyprus, Bulgaria, Romania, London and Luxembourg, mainly of Eurobank and Alpha Bank. There is also traditionally increased cooperation with German banking institutions, investment firms and other companies in the financial sector.

According to the Bank of Greece, in 2021 the presence of Greek banking groups abroad was strengthened as a result of the merger of Direktna Bank with its subsidiary Eurobank in Serbia as well as the acquisition by Eurobank of a 12.6% stake in Hellenic Bank of Cyprus.

Source: Capital

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.