Coinbase and Bybit saw the largest gains in CEX market share after US regulators settled claims against Binance. Such assessments are contained in the report Kaiko.

On November 21, in a deal with the department, the organization paid $4.3 billion, and Changpeng Zhao agreed to a fine of $50 million and resignation from the position of CEO.

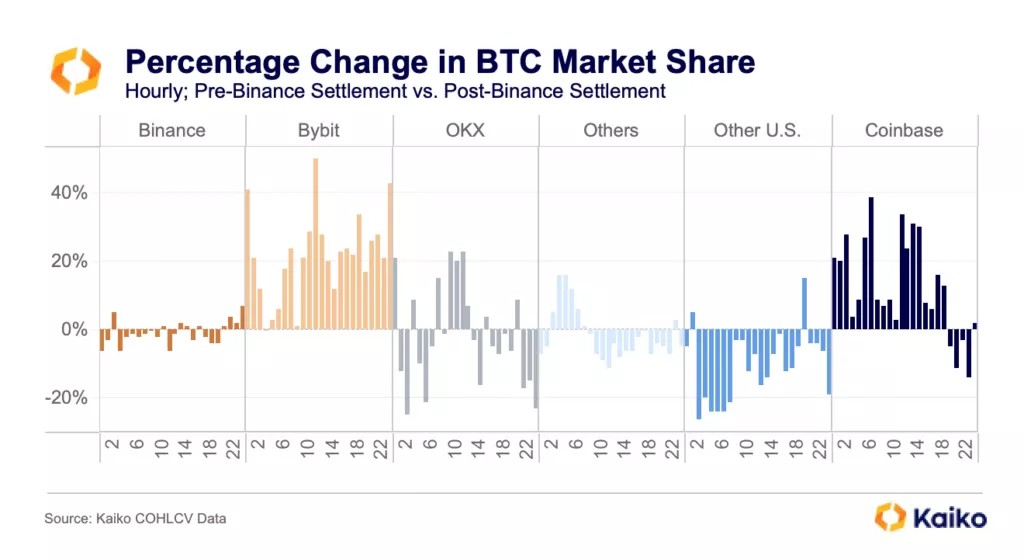

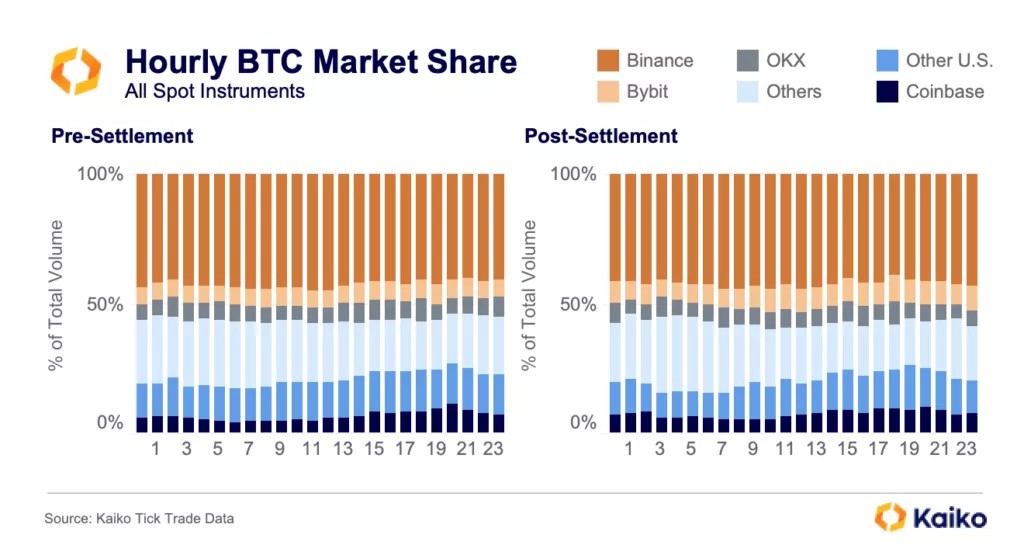

Using Bitcoin as a benchmark, experts recognized Bybit as the “outright winner” of the Binance settlement of claims by US authorities. Digital gold trading volume on the site jumped by more than 20% in every 16 of the 24 hours following the events.

Experts also drew attention to the additional impetus for the growth of the latter’s shares. In November, the capitalization of the largest US Bitcoin exchange grew by 75%, since the beginning of the year – by 250%.

Coinbase’s share rose the most outside trading hours in the US following the settlement, while OKX’s performance rose most notably early in the trading day in Western Europe.

As a summary, analysts noted that Binance lost some market share to Bybit and Coinbase (outside the US session).

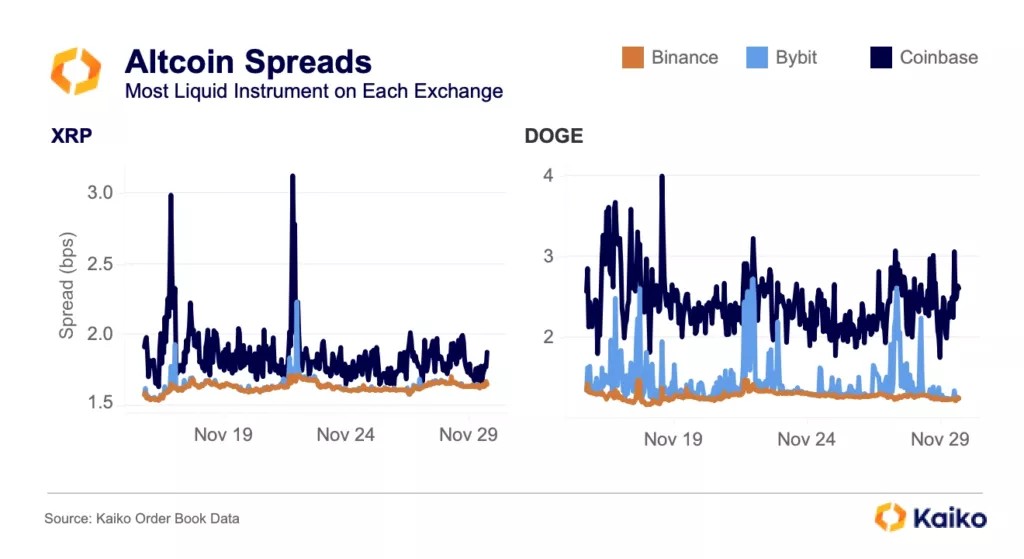

According to experts, despite an outflow of more than $1 billion over the next 24 hours, the platform showed no signs of a sharp decline in liquidity. Market depth indicators began to recover after the events. Bybit is closing the gap, while Coinbase is still slightly behind in terms of spread competitiveness, they added.

Experts urged not to rush into making forecasts due to the absence of “dire” consequences for Binance.

In their opinion, the “saga” is positive for everyone – the US government wins, Binance can continue to operate, and other platforms have opportunities for growth.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.