At the end of July, important events occurred in the Bitcoin market (BTC). In the last week of the month, profit fixation was activated. This warns of a possible turn in August.

According to experts and onchain analysis, four key bear factors can soon change the Bitcoin course (BTC). Consider them in more detail.

1. Fixing profit with “awakened” whales

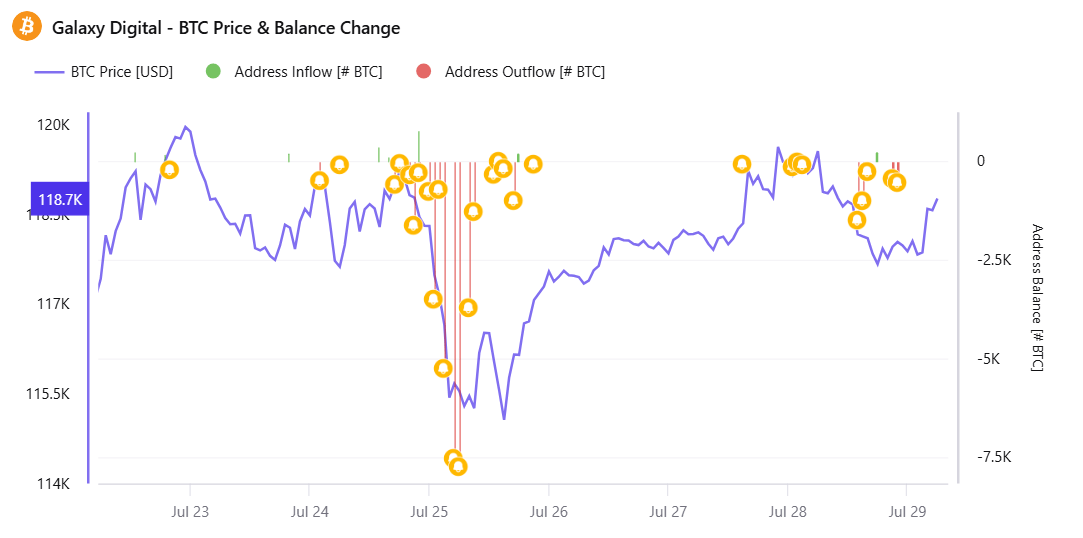

In early July, the whale with 80,000 BTC was activated after more than 14 years of hibernation. Sale from this wallet through Galaxy Digital slowed the growth of bitcoin in the last week of July.

Cryptoquant data show that large outflows of Galaxy Digital wallets often coincide with bitcoin prices. On July 29, Lookonchain analysts recorded new outfills. This is fraught with a new sale.

In addition, two sleeping wallets, inactive from 6 to 14 years old, began to act again. Spotonchain recently reported three large wallets, possibly belonging to the same owner who moved 10,606 BTC ($ 1.26 billion) after 3-5 years of inaction. The activation of whales enhances the pressure on the sale on the eve of August.

2. Signs of sales among long -term BTC holders

The second source of pressure on the sale is long -term holders (LP), who are considered the key pillar of the Bitcoin market. According to Cryptoquant, these investors began to withdraw funds when Bitcoin reached $ 120,000 at the end of July. This may indicate caution. Many investors prefer to fix profit, and not risk in conditions of possible volatility.

In the first quarter of 2025, the sales of long -term holders contributed to a decrease in bitcoin below $ 75,000. If they continue to sell, this could increase pressure on the market and lead to significant correction in August.

3. Increase in BTC outfills in the miner segment

The third factor is the growth of outfills from the reserves of miners, which indicates pressure from the sellers. Cryptoquant data shows that in July, the outflows began to grow again after a period of decrease. This may indicate a possible change in the trend.

Miners often sell to cover operating expenses or fix profit after price rising. If this trend continues, the pressure on the sale may increase, especially in combination with the activity of whales and long -term holders. “If miners simultaneously begin to sell their reserves, this can collapse the price,” said Cryptoquant.

4. Sales pressure by investors from the USA

The Coinbase Premium indicator shows the difference in price between Coinbase and Binance. If the bonus is negative, bitcoin is cheaper on Coinbase, which indicates a weak demand or strong pressure in the USA. This indicator mainly reflects the behavior of American investors. He mainly remained positive, but at the end of July became negative.

As history shows, a negative prize does not always change the trend. However, it often indicates a slowdown in growth. If sales pressure intensifies, a negative outcome is possible.

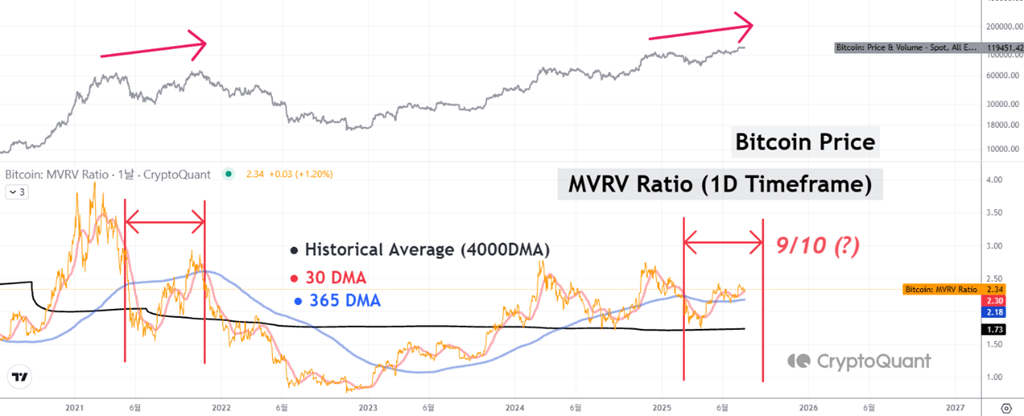

MVRV metric reversal signal

Some analysts are careful, especially after four -month bitcoin growth. According to Coinglass, the third quarter is traditionally the weakest in the year, and August often turns out to be the worst month.

The analyst Cryptoquant Yonsei noted that the MVRV coefficient (the ratio of market and realized value) is approaching the top of the cycle. This signal may appear by the end of August.

In 2021, the MVRV coefficient predicted the top of the market, forming a double peak. If the story is repeated, August can become a local peak for bitcoin before correction or consolidation.

Despite the fears, the last Kaiko report expresses confidence in the depths of the Bitcoin market. They believe that the market is able to absorb the current pressure of sales.

Although whales, long -term holders and miners can cause volatility, the current market structure can prevent a serious collapse.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.