The price of bitcoin can remain higher than $ 117,500, but market participants record signs of a possible rollback.

The signals of the long-term holders and the activity of the whales coincide with the key prices of prices. Observations show that such a BTC position can lead to healthy correction in the coming days.

SOPR long -term holders as a quiet exit signal

The coefficient of profit of the wounded output (SOPR) for long -term holders, those who hold BTC for more than 155 days shows sustainable signs of profit fixation. On July 21, the Long-Term SOPR was 1.96. The changes indicate that these market participants sell their coins almost twice as much as the cost of their acquisition.

Although this number in itself may not seem alarming, the context indicates risks.

If you look at the schedule for the year, SOPR bursts historically preceded sharp corrections. Consider the following:

- February 9: SOPR reached 5.77, BTC decreased from $ 96,479 to $ 84,365 – a fall by 12.55%.

- June 13: SOPR was 3.47, BTC decreased from $ 106.108 to $ 101.003 – a fall by 4.81%.

Since July 9, SOPR shows a series of high peaks:

- 3.90

- 3.25

- 3.50

Note: the most significant day of the profit was July 4, when the Long-Term SOPR exceeded 24. However, surprisingly, the price of bitcoin after that has not changed significantly. The delay in the reaction creates a voltage and increases the probability of an ambulance.

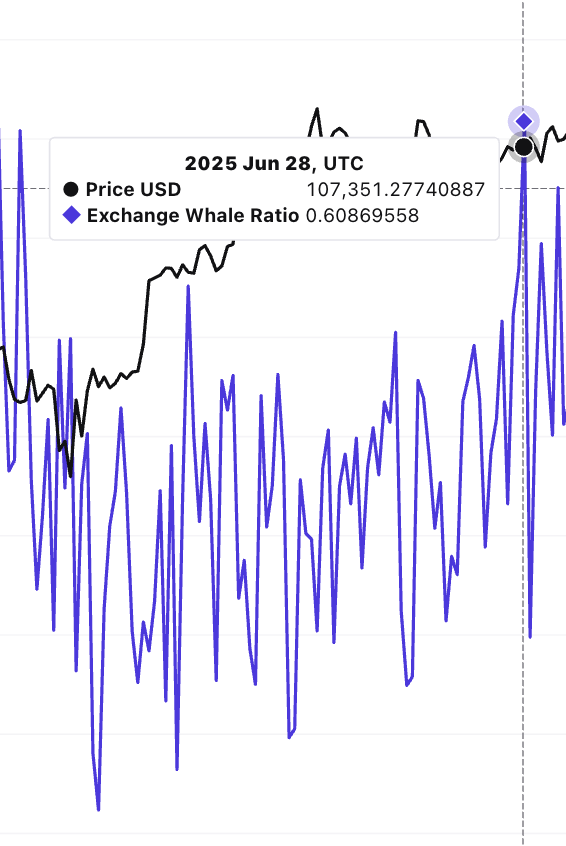

The ratio of whales on exchanges is growing again

Another alarming signal is the Whale-to-Exchange Ratio coefficient, which shows how many bitcoins large holders (whales) are sent to exchanges compared to general market activity.

Historically, when this coefficient reaches or exceeds the trend line of price, the correction usually followed. Here are two recent examples:

- June 28:

- W2E coefficient: 0.608

- BTC: $ 107 351

- A few days later, BTC fell to $ 105 727

- July 16:

- W2E coefficient: 0.649

- BTC: $ 118 682

- The price has stalled and shows signs of weakening

Simply put, when whales move more coins to exchanges, they usually prepare for sale.

With the current peak of the W2E coefficient, this indicates that the pressure on the sale is growing, even if the spot markets seem calm.

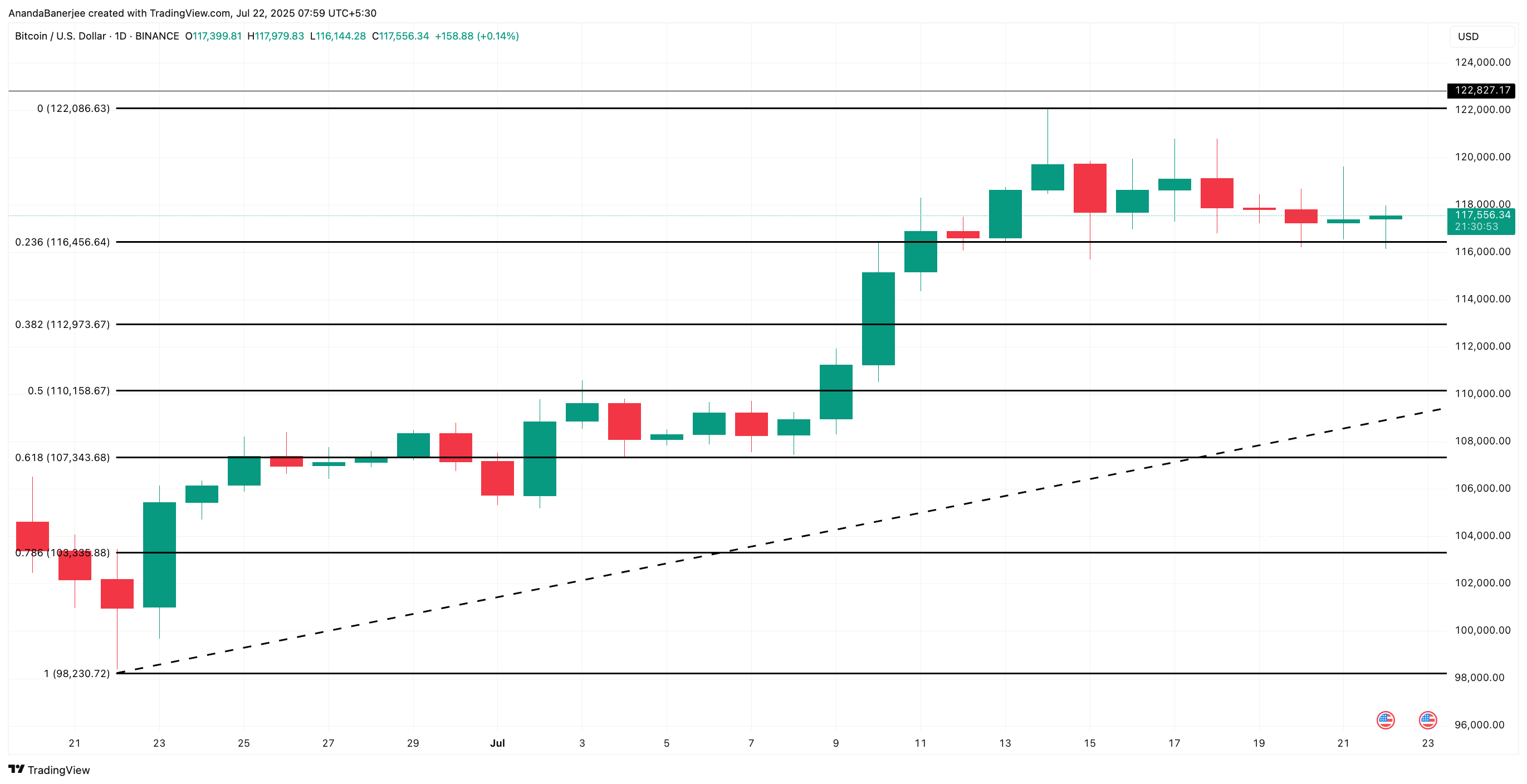

Bitcoin price structure depends on key support levels

From the point of view of the price structure, Bitcoin is now trading about $ 117,500, demonstrating signs of uncertainty. Since July 12, the price has repeatedly tested the level of $ 116,456, which coincides with 0.236 Fibonacci correction of the recent impulse movement from $ 98,230 to maximum $ 122,086.

This zone has become key: holding above it speaks of power, and a breakthrough below can lead to a further decrease.

Strong support is at the level of $ 107,343, which corresponds to the level of 0.618 in Fibonacci, which is called the “golden pocket” during corrections. If this level does not hold, the market can deepen the correction. Since Bitcoin reached $ 122,000, there are few structural supports below this level.

In this case, the next support can be about $ 103,355, which is 12% correction from current prices. (February 9, the surge of SOPR caused a similar correction).

However, a short -term bearish scenario will change if the price of bitcoin triggers $ 122,086 and exceed the previous maximum of about $ 122,827, continuing to grow. The movement is above this zone, especially with a decrease in the SOPR and the fall of the “whale-boiling” coefficient, will indicate the resumption of the bull trend.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.