Over the past two weeks, the cryptocurrency market remained sluggish, holding Ethereum in a narrow range.

Since July 21, Ethereum tried several times to break through the resistance of about $ 3,859, and received support at $ 3,524. However, it never went beyond this range. The impulse fades away. Key onchain-metrics now show that ETH can get stuck in lateral consolidation for a long time or even decrease in price.

Large Ethereum players retreat

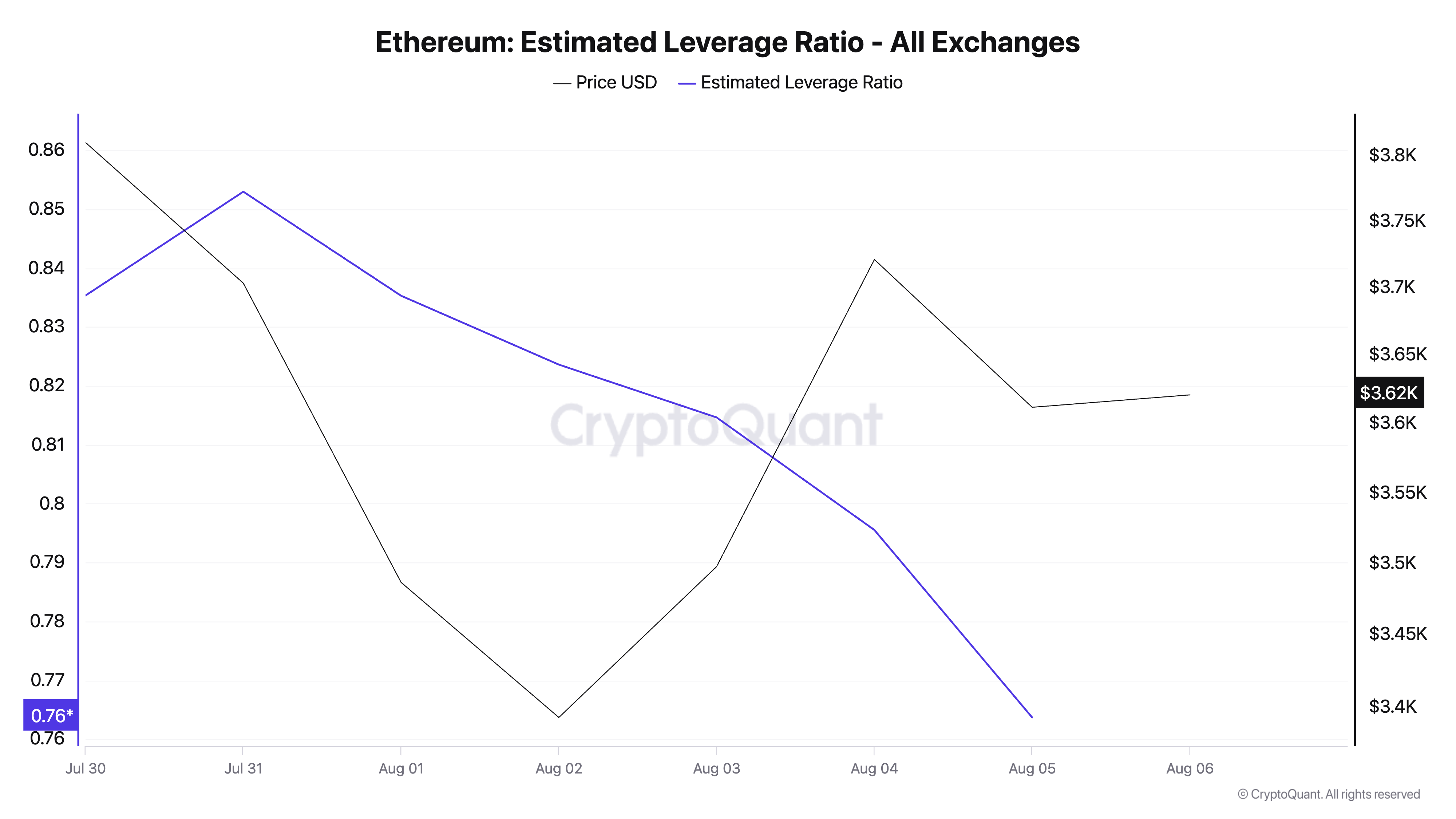

According to Cryptoquant, the coefficient of the alleged leverage (ELR) is reduced on all crypto -rhizas. This indicates a fall in the trust of investors and a decrease in risk among the traders in futures. Now the metric value is at a weekly minimum 0.76.

The ELR metric shows the middle credit shoulder, which traders are used for transactions with an asset on the crypto -rope. Its reduction shows that traders avoid betting with a high credit shoulder. Investors become more careful in relation to the short -term prospects of the coin and avoid positions that can strengthen potential losses.

If the speculative activity continues to decline, the chances of a short -term breakthrough will decrease. Instead, Ethereum is likely to remain in the range.

In addition, ETH whales have reduced savings over the past week, it is possible to fix the profit. According to Intoleblock, the clean stream of large holders of the coin has decreased by 224% over the past seven days. This indicates a retreat of key holders.

The addresses of whales are controlled by more than 0.1% of the circulating offer of the asset. A clean stream shows the difference between the number of bought and sold coins for a certain period. When a clean influx of large holders increases, this means that whales buy more coins on exchanges, possibly waiting for price growth. On the other hand, as in the case of ETH, a decrease in a clean stream signals a decrease in activity and fixation of profit among these key investors.

Whether $ 3,524 will resist $ 3,524

Thus, the metrics reflect a decrease in confidence in the short -term increase in the price of ETH. Key holders are in no hurry to invest significant funds in the market. If this continues, the pressure on the price will increase, and it can break through support at the level of $ 3,524. In this case, the coin can fall to $ 3,067.

However, if the bulls intercept the initiative, they can break through resistance at the level of $ 3,859. Then the price of ETH will have a chance to rise above $ 4,000.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.