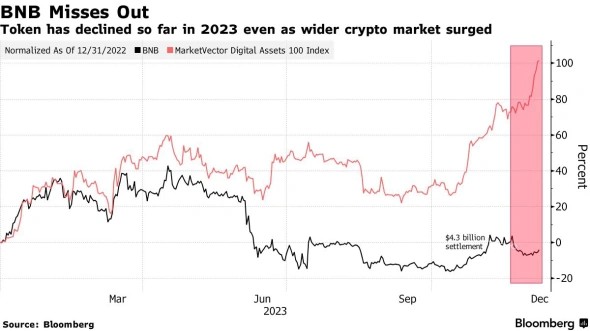

The BNB token of the largest cryptocurrency exchange Binance has become the only major crypto asset that has missed out on much of the current rally in the crypto market. According to experts, the price of the token indirectly reflects the attitude of market participants towards the exchange itself, writes RBC Crypto.

Due to the sharp increase in the Bitcoin rate, the total capitalization of the crypto market, according to CoinGecko, grew by about $180 billion or 12% over the past week. Over the same period, BNB gained only 1.7% in price and is trading at $231 at the December 7 exchange rate.

The token is second in capitalization only to Bitcoin (BTC), Ethereum (ETH) and the stablecoin Tether USD (USDT), but BNB is the only major crypto asset that has not yet turned positive for the year.

Besides the speculative component, BNB gives holders the opportunity to enjoy lower fees on Binance. At the same time, the dynamics of the token price can be considered as a reflection of the sentiments of market participants regarding the exchange itself, writes Bloombergciting comments from experts interviewed by the publication.

Binance has faced a series of regulatory probes in several countries this year, leading US authorities on November 21 to find it guilty of violating anti-money laundering rules and aiding sanctions evasion. The exchange agreed to pay a record $4.3 billion in fines, and its then-head, Changpeng Zhao, resigned.

Binance remains the largest platform for trading cryptocurrencies and other digital assets, as well as cryptocurrency derivatives, but its market dominance is declining. The exchange’s share of spot trading volumes fell to 32% in November from 55% at the start of 2023, according to CCData. Its derivatives market share fell to 48% from more than 60%. In November, the Chicago Mercantile Exchange (CME) surpassed Binance in Bitcoin futures trading volume for the first time.

Dynamics of the 100 largest cryptocurrencies and the dynamics of BNB. Source: Bloomberg

Dynamics of the 100 largest cryptocurrencies and the dynamics of BNB. Source: Bloomberg

After the deal with the US authorities, Binance risks losing its status as a leader in trading volumes, says in a commentary Bloomberg, head of digital asset research at asset manager VanEck Matthew Siegel. Competitors such as OKX, Bybit, Coinbase or Bitget have the potential to take first place, he added.

Experts came to similar conclusions when commenting on the exchange’s settlement agreement with the US Department of Justice. According to Roman Nekrasov, co-founder of the ENCRY Foundation, the exchange faces a risk of redistribution of market shares among the largest platforms, each of which will try to strengthen its position. We can expect new promotional campaigns and favorable conditions for switching to other crypto exchanges, he admits.

Against the backdrop of Binance’s problems, shares of the second largest crypto exchange, Coinbase, rose sharply in price. By observations Kaiko analysts also saw a significant increase in trading volume after the announcement of the decision in the Binance case, but the turnover on the Bybit exchange increased even more.

Binance did not respond to journalists’ requests to comment on the movement of the BNB price and the development prospects of the exchange.

Exchange flows

Users withdrew $1.6 billion in assets from Binance in November, according to DefiLlama, which was the second-largest recorded monthly outflow from the exchange this year. In December, the mass withdrawal of funds slowed down; about $400 million was received into exchange wallets.

Since the announcement of the Binance fine, the BNB rate has already fallen 8%. The index of the 100 largest digital assets rose about 14% over the same period. “BNB is now seen as an indirect indicator for Binance, which explains its dynamics,” explains Kaiko Research Director Clara Medali.

Over longer time periods, BNB has still outperformed its peers – for example, over the past three years it has grown by about 700%, compared to a 121% increase in the index of the top 100 crypto assets.

“Binance’s reputation among users outside the US remained high throughout the crisis,” Bernstein experts previously wrote. In their opinion, Binance will remain the main trading platform for users outside the United States for now, but competition from Coinbase and other large crypto exchanges will increase. “In our view, the settlement of the allegations by the authorities is the last step before the approval of the Bitcoin ETF,” their report said.

After founder Zhao pleaded guilty and resigned as head of the exchange as part of a settlement with US authorities, his successor Richard Teng was faced with the task of overhauling the exchange so that it would not suffer further regulatory pressure and at the same time not lose market share.

Teng has already announced that Binance will begin to build a traditional corporate structure, including having a board of directors, a physical address and transparent financial activities. According to his forecast, such a transformation can bear fruit in the long term.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.