Bitcoin ended April falling below $60,000, the level at the beginning of March 2024. There could be several reasons for BTC's decline.

Why Bitcoin fell below $60,000

On Tuesday, April 30, Bitcoin instantly dropped to $59,000, a level the coin last touched on March 5, 2024. Afterwards, the cryptocurrency corrected to $60 thousand. As of the time of writing this review, Bitcoin is trading at $60,250.

There are several reasons that could have contributed to Bitcoin's fall. One of them could be a reduction in the premium for BTC futures. The metric reached a five-month low, indicating weakening interest in the coin from investors and a decrease in speculative demand.

The changes came amid news of the launch of spot Bitcoin and Ethereum ETFs in Hong Kong. For many market participants, the start of trading in an instrument has become a sell-the-news signal – a signal to sell, based on the assumption that the cryptocurrency has reached a local maximum.

BTC could also come under pressure from the general sentiment of market participants. According to analysis from Glassnode, the euphoria around Bitcoin that has been observed in recent months has begun to subside. According to analysts, the changes may indicate that Bitcoin is approaching local minimums.

An increase in tension in the crypto community was recorded against the backdrop of legal disputes between the founder of the largest crypto exchange Binance, Changpeng Zhao, and American regulators. On April 30, the judge sentenced the businessman to four months in prison.

Could Bitcoin fall even deeper?

Before the 2024 BTC halving, analysts warned of a likely sell-off of the cryptocurrency by miners. CryptoQuant CEO Ki Young Joo notedthat, despite the decrease in miners' income to the levels of early 2023, there are still no clear signs of their mass capitulation, which could signal a worsening of the crisis.

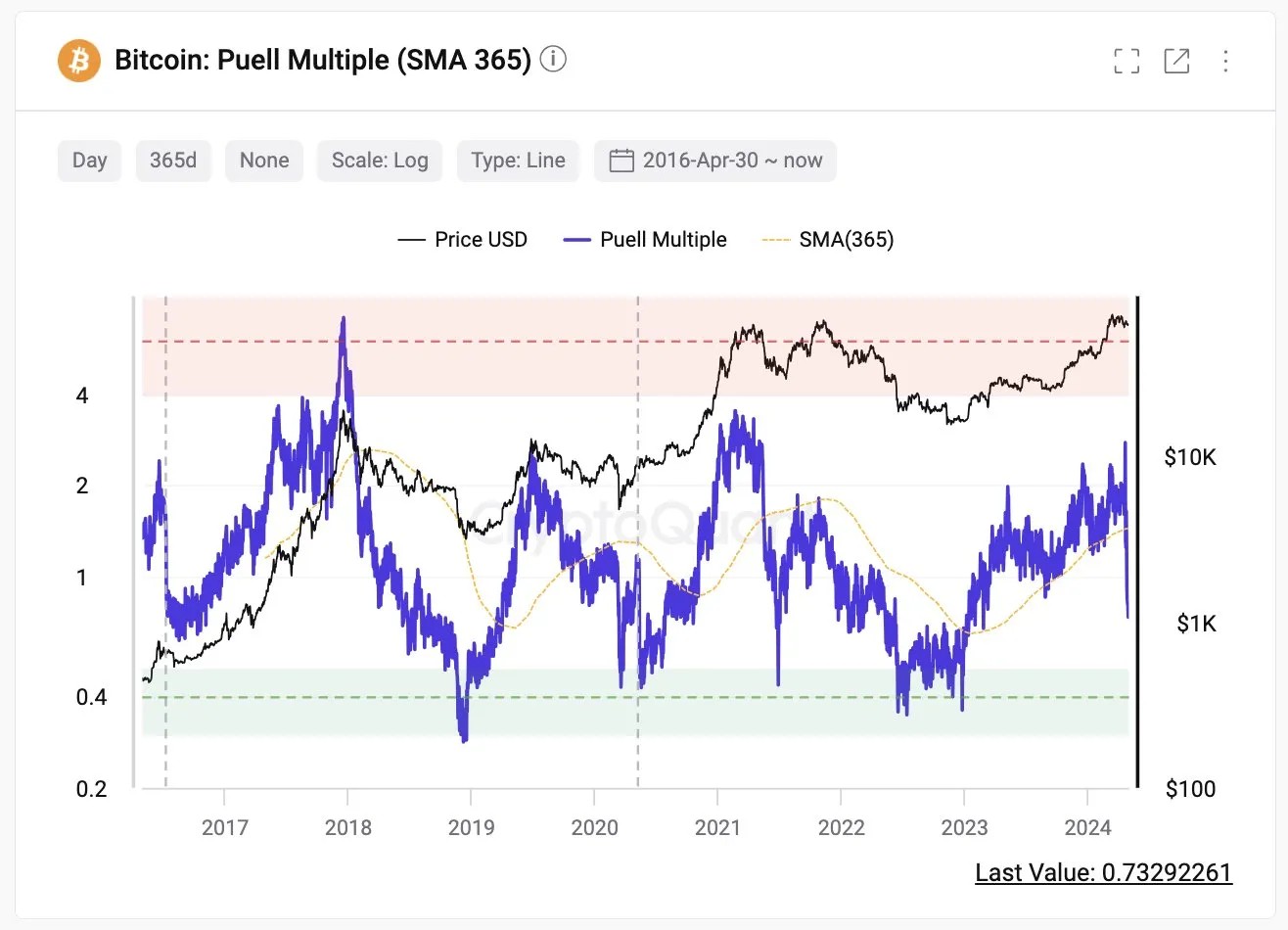

The graph shows the profitability of Bitcoin mining (purple curve) to the cryptocurrency rate (black curve). Source: CryptoQuant

The graph shows the profitability of Bitcoin mining (purple curve) to the cryptocurrency rate (black curve). Source: CryptoQuant

However, there are factors that could support or even accelerate BTC's decline. Forecasts remain uncertain, as much depends on the overall state of the economy, central bank policies towards digital currencies, the geopolitical environment, as well as technological and regulatory changes in the industry.

In particular, we are talking about the decision of the US Federal Reserve System on the key interest rate. Results next meeting The regulator will be announced on May 1, 2024. The US move to lower rates could increase the investment attractiveness of high-risk assets such as cryptocurrency. Not known yetwhen the Fed moves to ease monetary policy.

Bitcoin has previously gone through similar cycles of decline and recovery. The repetition of BTC movement patterns formed the basis of the cyclical theory. Its supporters believe that the Bitcoin halving 2024, like the previous halving of the cryptocurrency mining speed, will bring BTC to new highs.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.