Director of Global Macroeconomics at Fidelity Investments Jurrien Timmer spoke about the recent slowdown in Bitcoin adoption, which could be the main obstacle to BTC’s path to a new all-time high (ATH).

According to Timmer, the price of Bitcoin is primarily determined by the growth of the BTC network. However, recently a gap has formed between the two indicators, wrote he’s on X (formerly Twitter).

Network growth versus price growth

The growth of the Bitcoin ecosystem is driven by scarcity of the asset, monetary and fiscal policy, and market sentiment. Despite the fact that cryptocurrency quotes have increased significantly recently, the development of the network has slowed down. This dynamic has created a gap that explains the recent slowdown in token adoption.

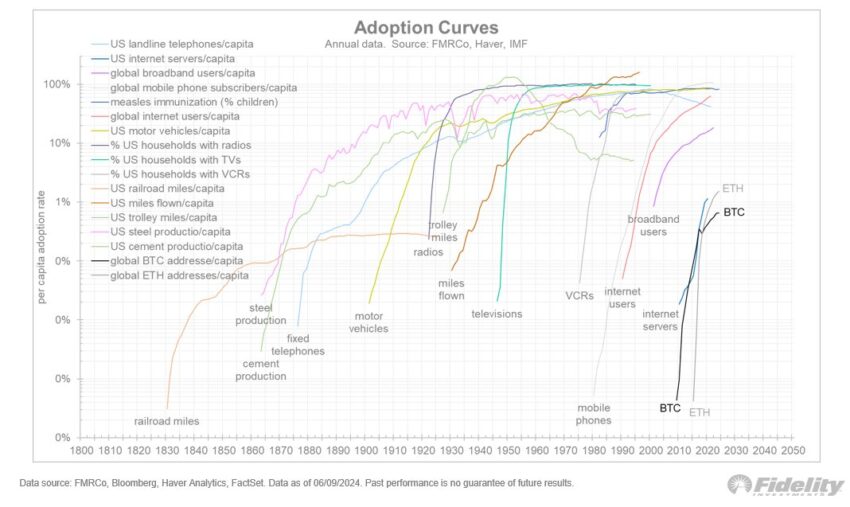

Timmer clearly showedhow the growth curves of Bitcoin and Ethereum (ETH) follow the path of many technological developments throughout history.

The BTC network, represented by the number of addresses with non-zero balances, is following a certain growth trajectory. The price fluctuates around it. The analyst noted that such boom and bust cycles are typical for the leading cryptocurrency.

BTC and ETH adoption curve. Source: X/TimmerFidelity

BTC and ETH adoption curve. Source: X/TimmerFidelity

To Timmer’s conclusions answered experienced and well-known trader in the crypto community, Peter Brandt. According to him, with each bull market cycle, the increase in the value of Bitcoin becomes less and less. This can be interpreted as exponential decay. If this trend continues, the next growth cycles will be less and less significant, Brandt emphasized.

Why Bitcoin’s Slow Circulation Might Not Be So Bad

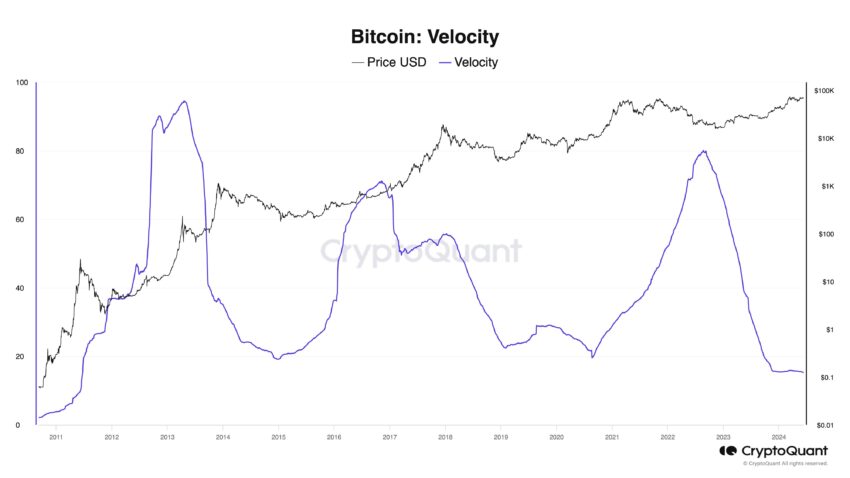

The founder and CEO of the blockchain analytics platform CryptoQuant, Ki Young Ju, also had some ideas. In response to Timmer’s post, he pointed out that Bitcoin’s circulation velocity recently hit its lowest point since 2013.

According to Joo, the rate will peak when BTC begins to be widely used as a legal means of payment for goods and services.

The CEO of CryptoQuant noted that Bitcoin was initially conceived as an electronic means for fast money transfers from card to card. However, over time, the asset has evolved into “digital gold.” At the same time, many institutions hold tokens, often without even using them. Such significant changes in usage mean that traditional BTC adoption metrics may have become irrelevant.

Bitcoin circulation speed. Source: X/ki_young_ju

Bitcoin circulation speed. Source: X/ki_young_ju

Recently, institutional interest in investing in Bitcoin has been growing steadily. Recently, Canadian fintech company DeFi Technologies adopted BTC as a reserve asset. The firm initially purchased 110 BTC.

Earlier, the investment company Metaplanet, known as the “Japanese MicroStrategy,” took a similar step. On June 11, she increased her Bitcoin holdings to 141.07 BTC, purchasing another 23.35 BTC.

According to CoinGecko, at the time of writing, the first cryptocurrency by capitalization is trading at $67,236. This is 9% lower than the ATH, which the asset updated in March of this year against the background of multimillion-dollar inflows into spot Bitcoin ETFs and on the eve of halving. Over the past 24 hours, the price of BTC has dropped by 1.2%.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.