Bitcoin remains in the spotlight, pushing conversations about the possible start of the altsyzon in the near future. An “perfect storm” was formed on the market to continue BTC growth, and this is in the conditions of almost complete absence of retail in the market.

We tell you what features of the Bitcoin position should pay attention to, what levels to monitor and why growth potential is open before the cryptocurrency.

Mood

BTC, according to Santiment, remains the most discussed cryptocurrency. The number of BTC posts on social networks began to grow rapidly on May 13 amid the positive dynamics of the coin course. The new surge of the Bitcoin discussion on the network is associated with a breakthrough of the level of $ 107,000, which was recorded on the morning of May 19. Despite the subsequent correction, the growth of bitcoin attracted the attention of investors.

Moreover, the number of negative and positive statements about BTC is at about the same level. Less common about bitcoin is expressed in a neutral way.

Most often, bitcoin is discussed in the context of a breakthrough with a course of cryptocurrency of important levels and the likely movement of the coin to update the absolute maximum. Recall that the BTC peak was recorded on January 20, 2025 at an altitude of $ 109 114. At the time of writing, cryptocurrency is traded 6% cheaper.

BTC also was in trend due to large-scale discussions on different platforms of the role of bitcoin as leading cryptocurrency with a serious impact on the market.

- Reddit emphasizes the status of BTC as a means of saving savings. Platform users are actively discussing the problems of its implementation in the world financial system, mining issues. Also, Reddit users compare bitcoin with other cryptocurrencies, focusing on the long -term potential and dominance of the coin on the market.

- In telegrams, the main attention is paid to forecasts of prices, trade opportunities, capitalization, bidding and BTC sales.

- In X, institutional purchases of cryptocurrencies fell under the sight. For example, a stormy discussion affected the decision of Metaplanet to buy more than 1,000 BTC. The interest of large investors in the coin, according to users of social networks, strengthens the bull mood.

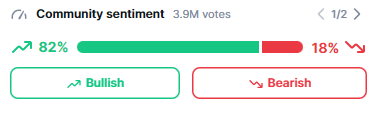

About 82% of market participants shares positive moods.

The index of fear and greed of bitcoin is still in the green zone. The growth of the index indicates an increased interest in cryptocurrency. Investors are very optimistic, ready to enter the asset even with a price increase. At the same time, optimism is far from the peak, which means so far there is no risk of “overheating” of the market and deep corrections.

Metrics

Bitcoin’s volatility remains low. The relative force (RSI) index above 50 indicates the predominance of purchases and the continuation of the rising impulse. The overlap threshold in the classic approach is 70. RSI even lower, so there is a space for growth without a serious risk of immediate correction.

The ratio of the market capitalization of bitcoin to the “realized” (Realized Cap) returned to the “bull” zone after a brief pause. This is a rare signal that in 2020 preceded further growth. It means that BTC has potential for new historical maximums.

Positive add changes in global liquidity. The index shows the growth of metric in recent months. Bitcoin often repeats the movement of world liquidity with a lag of about 3 months. If the story is repeated, BTC will continue the ascending movement.

The market capitalization of stablecoins, meanwhile, continues to grow. The Ministry of Enta of the new “stable” coins is a bull signal. Stebblecoins are considered to be the “fuel” of Bullran.

Bitcoin reserve crypto-rhinas continues to update minimums. The metric began to actively decline in November 2024 amid the victory in the U.S. Crimson President Donald Trump. Despite the fact that the tariff war, unleashed by the politician, provoked BTC subsidence to $ 72,000 in April 2025, the crypto-rope bitcoin-west continues to melt.

Reducing the reserves of bitcoin on crypto -rhms means that users bring their coins to personal wallets. Most often, we are talking about transferring coins to cold storage. As a result, the volume of coins for trading is reduced on the market. A decrease in supply forms a deficiency of cryptocurrency in the market, which can support the further growth of its course.

It is noteworthy that, against the background of an increase in the BTC deficit, in the commission market in the cryptocurrency network, they returned to the maximums of 2025 in the moment. The growth of average commissions on the Bitcoin network means that users are more actively competing for a limited place in blocks – that is, demand is growing. Against the backdrop of approaching new maximums, many want to confirm their translations as soon as possible, for example, to quickly sell coins. Market participants are ready to pay more to get a place in the block. With their requests, they “score” the network, raising the average level of payment for the transaction. The increase in the cost of transactions is a clear sign of increased interest in bitcoin and network workload.

The MPI index, which shows the activity of miners, suggests that in May 2025, participants in the cryptocurrency, who mines cryptocurrency, reduced the sale of their BTC. Changes may say that miners see the prospects for the growth of the bitcoin course.

Optimism is separated by institutionals. This is indicated by tributaries in Bitcoin-ETF. The explicit favorite of investors remains a spare BTC-ETF IBIT from the largest control of the company with Wall Street BlackRock. Under the control of the organization, which launched its Bitcoin Fund traded on the exchange, over 3% of the emission of cryptocurrency. For comparison, Microstrategy, which buys BTC since 2020, is only 2.7% of its emission.

At the same time, the number of new bitcoin addresses does not grow. This position of metric against the background of market growth may indicate that we are observing the whale rally. Retail is still not in the market. This, among other things, confirms a low number of bitcoin requests in Google. Retail entrance to the market can run another BTC growth wave.

Market participants retain optimism despite the fact that 99.6% of bitcoin investments are already in profit. For comparison, the ETH indicator is 66.6%. The higher the metric, the greater the chances of approaching the “overheating” of the market. If ETH statistics indicate open potential, then BTC has come close to maximum values.

On the liquidation map, you should pay attention to several levels that can determine the prospects for the movement of cryptocurrency in the near future.

- Long positions

- Level: approximately $ 100,000– $ 102,000.

- What does it mean: There are traders who opened Long with the shoulder (for example, 50 × or 100 ×).

- Credit shoulder (Leveridge) allows you to control the position several times more than your deposit. With 50 × × –100 ×, a small price decrease in the price so that the margin becomes zero – and the exchange forcibly “eliminates” (closes) your position.

- Long-Square: mass liquidation of the “Longs” enhance the descending movement – the price falls sharper.

- Short positions

- Level: approximately $ 105,000– $ 108,000.

- What does it mean: “Shorts” with the same high shoulders are concentrated here.

- With a breakdown of prices above this zone, all short positions are sharply eliminated, freeing the margin and creating an additional “growth impetus” – Short-Square.

- If the BTC drops to $ 100,000- $ 102,000, you can expect an accelerated fall due to long-org.

- If the BTC breaks $ 105,000 to $ 108,000, the growth will increase short-terming.

Summing up

Bitcoin remains the most discussed cryptocurrency. Despite a number of positive signals, growth prospects are open before BTC. Among the factors that can maintain positive dynamics, we can distinguish an increase in the shortage of coins in the market and the movement of global liquidity.

The fundamental background also remains favorable. BTC volatility at low levels, RSI (~ 65–70) demonstrate a preserved purchasing impulse without signs of outburst.

The implemented BTC rally was carried out at the expense of whales. The institutions continue to buy cryptocurrency, which speaks of their faith in the prospects of continuing the growth of cryptocurrency. The next growth wave can be carried out at the expense of retail.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.