In August, the capitalization of the cryptorrhist did not reach new maximums, as in July. The rally stopped, as inactive whales were activated, and traders began to fix the profit

The question arises: is it worth it to sell investors in August and wait for new minimums? A recent analysis of experts helps to better understand the situation.

Why is the sale in August may be a mistake

After the peak value of capitalization of $ 4 trillion in July, the market was adjusted by 6.7% and now amounts to $ 3.67 trillion. Although this is a slight correction, the events of Augustus are concerned. Among them are the activity of whales, a slowdown in the ETF, tariff pressure and growth of the DXY index (US dollar index). These factors enhance fears about a stronger correction in August.

However, for Bitcoin, the last Swissblock report is considering a recent drop in prices as a positive phase. The rollback is perceived as the necessary cooling after the previous height.

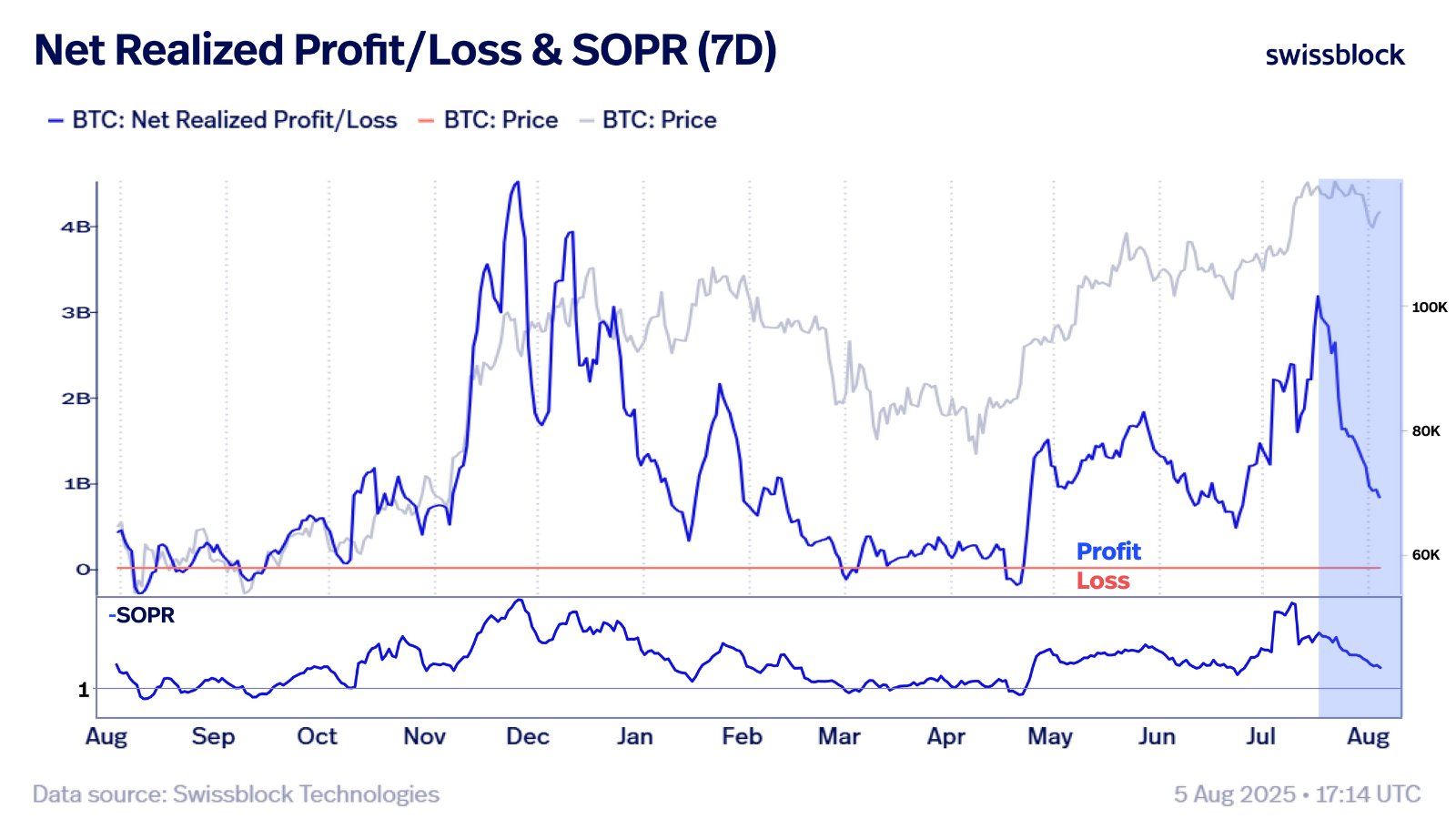

The report is focused on two key indicators: a clean profit/loss (PNL) and a 7-day SOPR (profit factor from spent outputs). Both indicators are reduced, but do not cause anxiety.

Although the report does not indicate the exact price for the restoration of bitcoin, some analysts believe that BTC can fall to $ 95,000 before it begins to grow.

The capitalization of the altcoin market (Total3) decreased by more than 10%, falling from $ 1.1 trillion in July to $ 963 billion in August. Nevertheless, Altcoin Vector reports that altcoins remain promising.

The report uses the quadrant chart that divides the altcoin cycle into four phases. Since July, the diagram is moving counterclockwise and is now going to the “breakthrough zone”.

Virtualbacon cryptoanalyst explained why sale in August could become an expensive mistake.

He noted that although some events can cause concern, there is no reason for panic, because:

- An announcement of tariffs on August 7 can only be a short -term noise, like past events.

- Weak data on employment can increase the chances of the Fed to reduce interest rates.

- The US Department of Finance threatens Remove $ 500 billion, which will cause short -term volatility, but will not lead to a liquidity crisis.

In addition, market moods have cooled. In July, they were in the zone of “greed”, but now they moved to the “neutral” zone. Since February, the market has not been included in a state of “extreme greed”, which is usually considered the ideal time for making decisions on sale.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.

.jpg)