Ethereum (ETH) completed August with an impressive growth of more than 23% per month. Technical and hens-indicators hint that at the beginning of autumn the leading altcoin can continue the rally.

We figure out what is happening on the Ethereum (ETH) market and what to expect from the price of cryptocurrency.

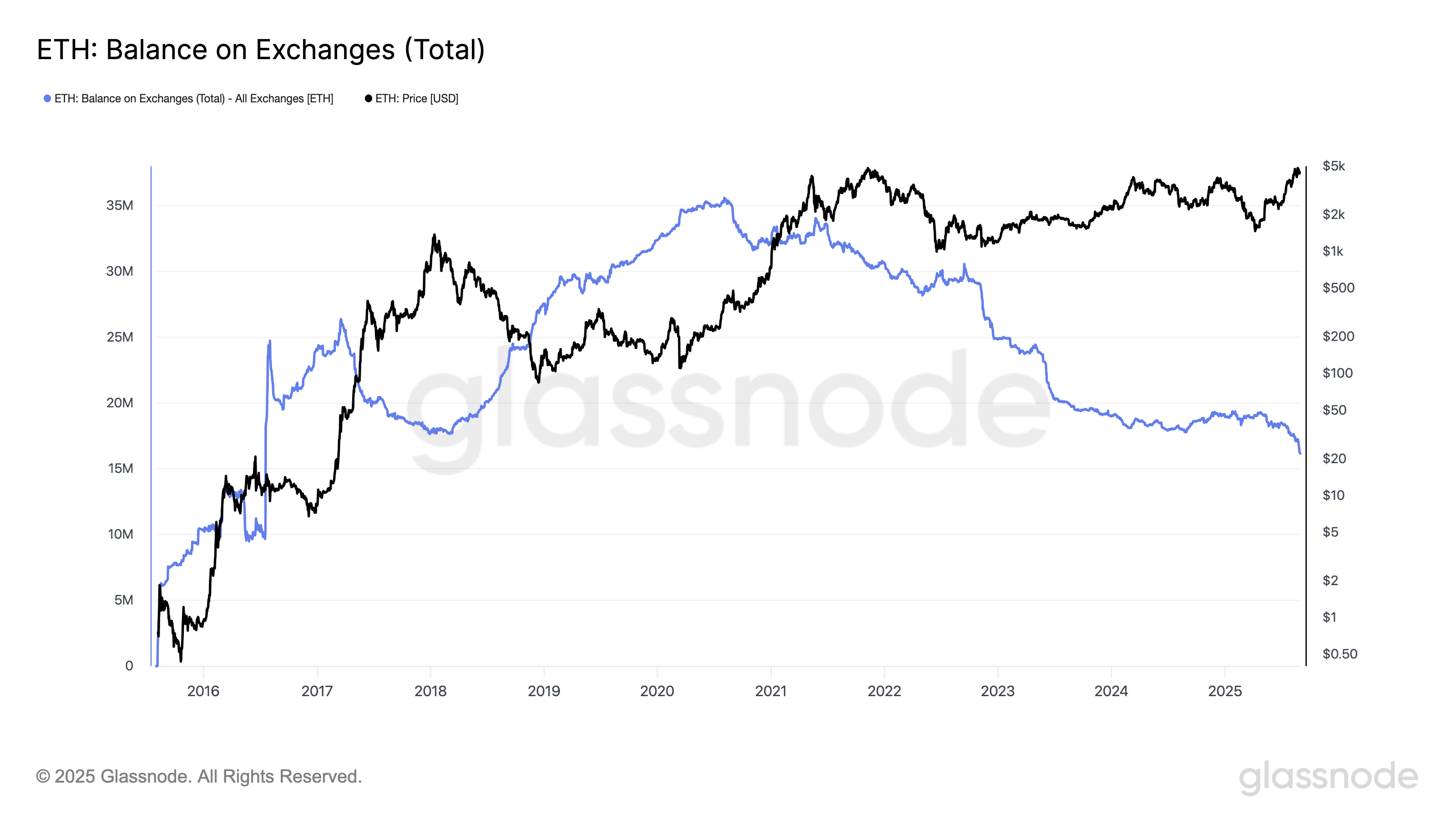

Ethereum balance on exchanges fell to the levels of 2016

According to Glassnode, the volume of ETH on exchanges has decreased to the minimum level since 2016. At the time of writing this material, 16 million ETH, estimated at about $ 70.37 billion, are on exchange wallets.

A fewer tokens on CEX traditionally reduces the pressure of sales, as the supply deficiency is created. If the demand remains high, this factor can push the price of ETH up.

The growing ratio of long and short positions supports an optimistic forecast. According to Coinglass, at the time of writing, the indicator is 1.0096. This means that more traders choose long positions than short ones.

The ratio of long and short positions shows how much traders put on an increase in the price of an asset (long positions) compared to those who expect its fall (short positions). The ratio above 1 indicates the predominance of long positions, signaling more powerful bull moods.

The growth of the ratio for ETH emphasizes optimism among market participants. This suggests that traders are more and more confident in the ability of the coin to maintain an upward trend in the coming weeks.

ETH Forecast: Growth of $ 5,000 or a decline to $ 4,221

If the pressure of buyers continues to grow, ETH will get a chance to break through the nearest resistance at the level of $ 4,664. Successful overcoming of this level will open the way to its historical maximum of $ 4,957.

Sustainable dominance of bulls can make a movement above $ 5,000 more and more likely. On the other hand, if the demand slows down, the bull forecast will be canceled – then the price will threaten the rollback to $ 4,211.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.