Bitcoin entered a correction after updating its maximum value, forcing members of the crypto community to analyze options for the further behavior of the coin.

We tell you why Bitcoin fell and what forecast BTC is given by representatives of the crypto industry.

Why did Bitcoin fall?

Bitcoin entered a correction on March 14, 2024 after updating the absolute maximum value (ATH) at $73,750. At that moment, the depth of the correction exceeded 17%. At the time of writing, the coin is trading at $61,881, which is 16% higher than its high.

Many members of the crypto community call the fall in Bitcoin an expected correction necessary to cool the market before the next surge.

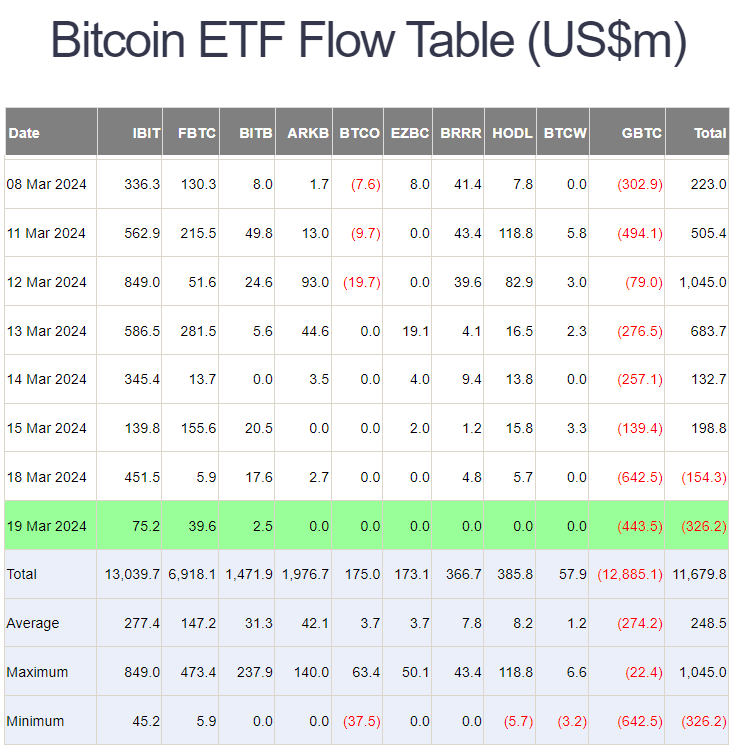

Bitcoin is falling amid the largest outflow of funds from instruments since the launch of spot Bitcoin ETFs in the United States. We are talking, first of all, about GBTC from Grayscale. Its sales were one of the reasons for the fall of Bitcoin at the beginning of the year. On March 19, the outflow of assets from GBTC stopped at $443.5 million. A day earlier, the figure was $642.5 million (a record). The total outflow of assets from spot Bitcoin ETFs on March 18 stopped at $326.2 million. This is the maximum for all time recorded.

Statistics of inflows/outflows of funds into US spot Bitcoin ETFs. Source: farside

Statistics of inflows/outflows of funds into US spot Bitcoin ETFs. Source: farside

The outflow of assets from the Grayscale Bitcoin ETF is a reason for the sale of coins that were previously purchased for the fund. Therefore, the depletion of GBTC reserves may ease the pressure on the BTC price.

As of the time of writing, Grayscale controls 368,558 bitcoins worth almost $23 billion. This is the best result in the top 10 largest bitcoin ETFs.

Top 10 largest Bitcoin ETFs by volume purchased for the BTC fund. Source: bitcointreasuries

Top 10 largest Bitcoin ETFs by volume purchased for the BTC fund. Source: bitcointreasuries

Meanwhile, before the Bitcoin halving left about 30 days. The event, as observations show, triggers BTC growth cycles.

When will the correction end?

To answer the question of when Bitcoin will start to rise again, trader Doctor Profit turned to history. He considers the position of BTC in 2024 to be special, since previously the cryptocurrency has never managed to update its absolute maximum value before halving. In his opinion, the Bitcoin forecast can be based on an analysis of behavior after the previous ATH update.

According to the trader’s logic, Bitcoin is unlikely to fall deeper as part of the correction, which, as he believes, could last until the halving. After Doctor Profit, BTC will enter active growth.

With the view that Bitcoin is repeating the behavior patterns of past cycles, agreed analyst Michael van de Popp. He also believes that BTC may remain sideways for the entire period before the halving.

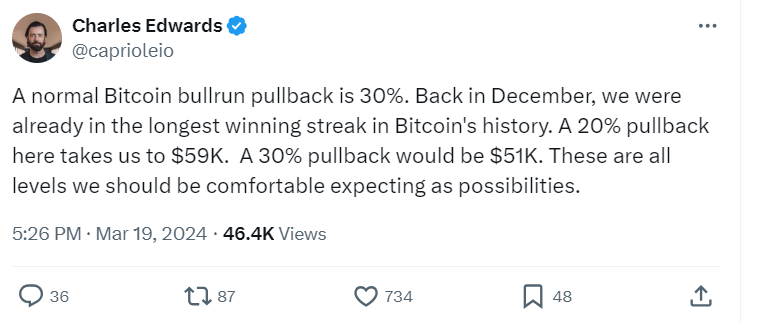

The founder of Capriole Fund, Charles Edwards, in turn admits Bitcoin correction from ATH by 30%. In his opinion, the fall of BTC to $51 thousand will fit into the norms of cryptocurrency behavior.

Top manager of Blockstream and head of Jan3 Samson Moe gave a different forecast for Bitcoin. He believes that the correction will end earlier. In his opinion, before the halving, investors will be able to see BTC at $100 thousand. The likelihood of an early resumption of Bitcoin growth, according to trader Matthew Hyland, is indicated by signals from the RSI indicator.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.