As Ethereum Spot ETF Launch Approaches Analysts were divided into two camps.

Some experts predict a rapid rise in the price of ETH, while others doubt its success.

What to Expect from Ethereum After ETF Launch

On July 9, a well-known analyst on crypto Twitter, Follis, said that the launch of an ETF on Ethereum could lead to the second-largest cryptocurrency repeating the dynamics of Bitcoin.

At the time of writing, ETH is trading at $3,108. According to the trader, the asset will reach $9,324 in less than a year.

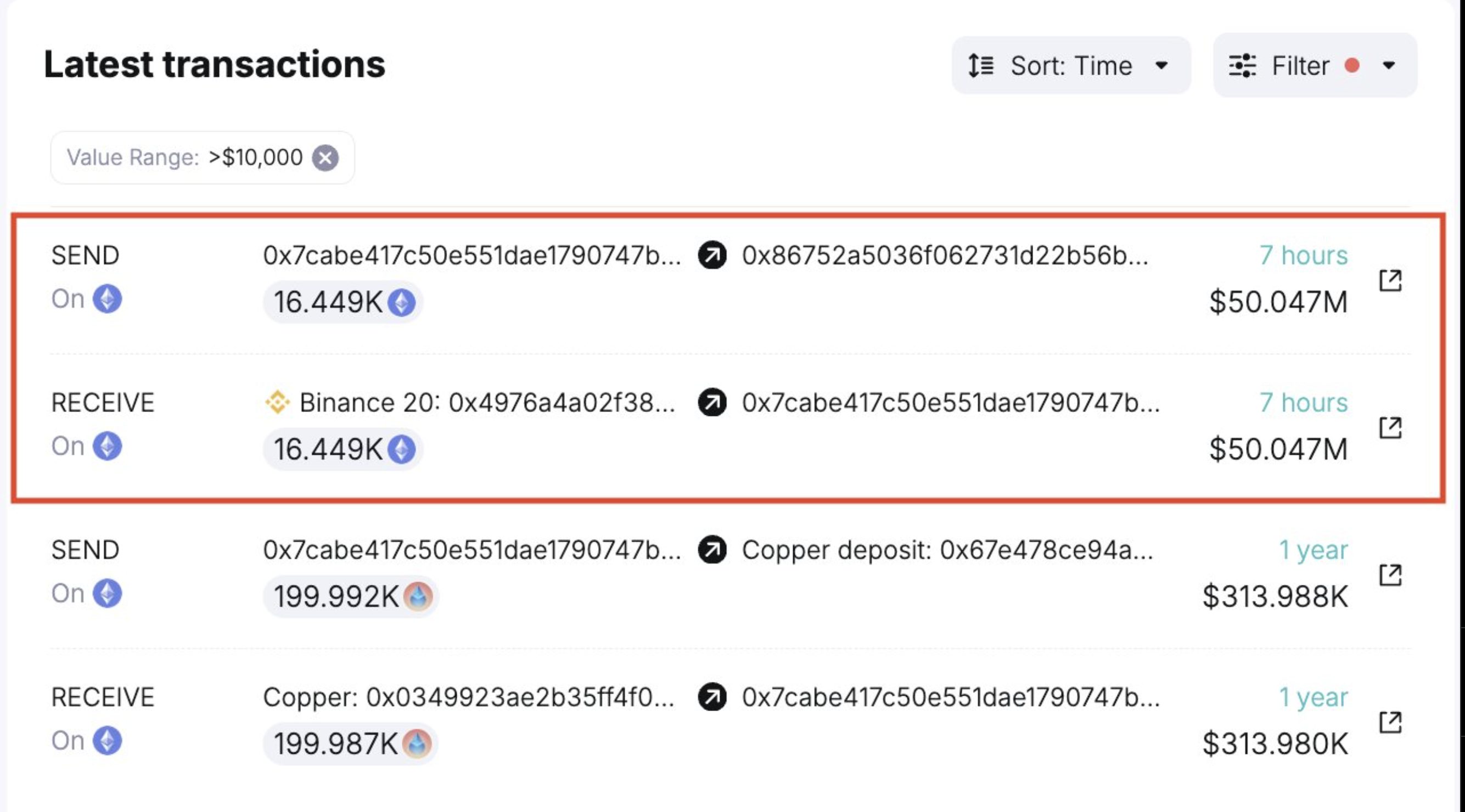

While this forecast does not seem particularly realistic at the moment, the whales’ actions suggest that large holders are becoming more confident in the future of Ethereum. Thus, the analytical platform Spot On Chain reported that on July 10, the whale withdrew $50.3 million in ETH from the exchange. The company noted that this was the first significant accumulation since the start of speculation around the ETF.

Ethereum Accumulation. Source: Spot On Chain

Ethereum Accumulation. Source: Spot On Chain

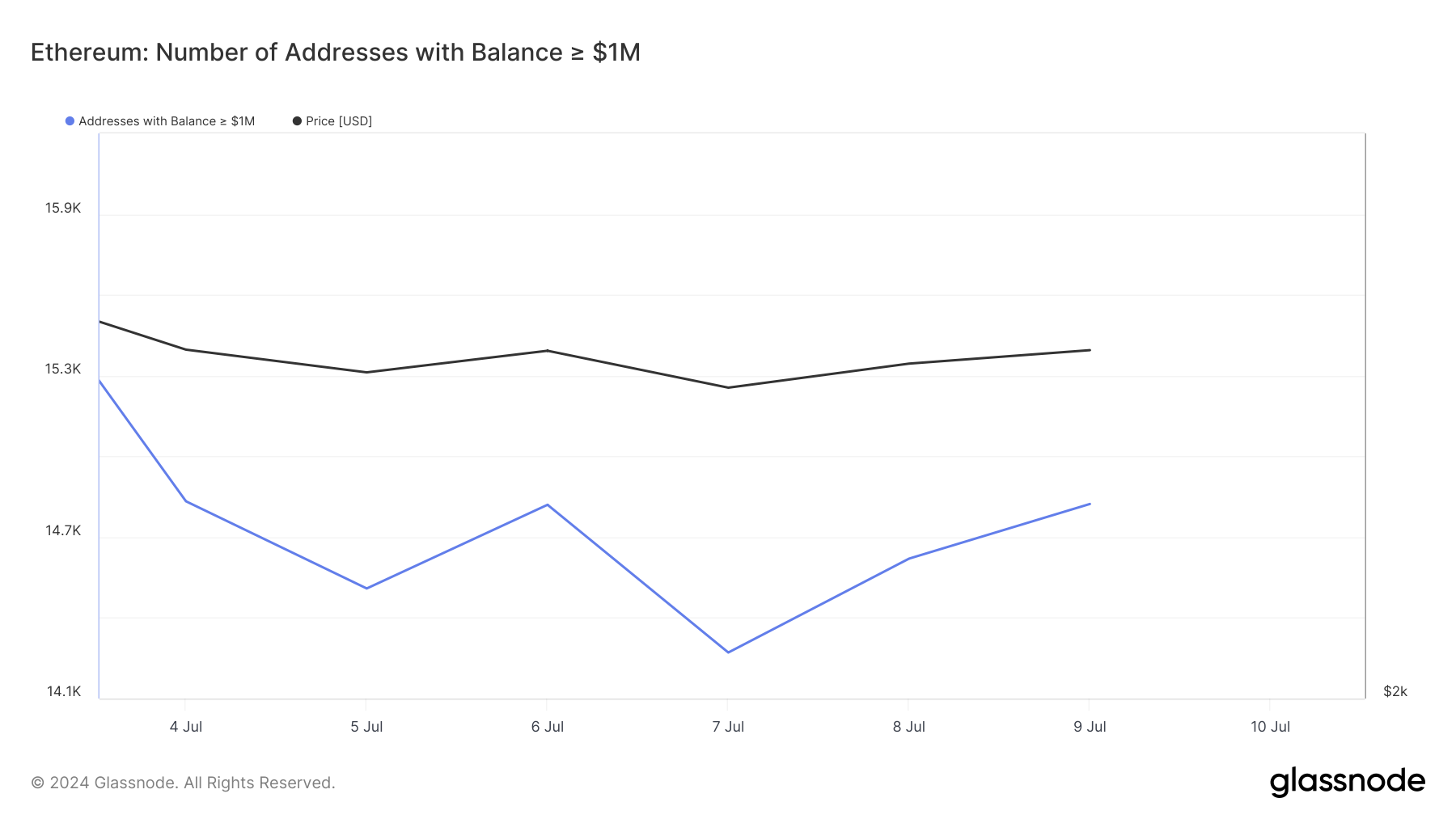

The rise in the number of addresses holding $1 million or more of ETH supports this hypothesis. On July 7, the figure was 14,217. However, at the time of writing, it has increased to 14,823, reflecting interest in the cryptocurrency and optimism about the launch of spot ETFs.

Ethereum addresses with balances of $1 million or more. Source: Glassnode

Ethereum addresses with balances of $1 million or more. Source: Glassnode

ETH Price Prediction: Possible BTC Trajectory Retracement

The correction that has been ongoing for the past few weeks has affected almost all cryptocurrencies. However, Ethereum has suffered much more than Bitcoin: between May 28 and July 9, the price of ETH fell by 24.65%, while BTC fell by 19.43%.

This indicates that the number one digital asset continues to outperform ETH despite all the bullish signals. However, deeper corrections historically provide an opportunity for price gains.

Ethereum and Bitcoin price dynamics. Source: TradingView

Ethereum and Bitcoin price dynamics. Source: TradingView

Technical analysis of the ETH daily chart confirms the possibility of a reversal: the altcoin price has formed a “double bottom” pattern, which usually signals a potential bullish momentum.

The last time a similar pattern appeared was in January 2024. Three months later, Ethereum grew by 81.94% and reached a solo maximum of $4,067. If the situation repeats itself, the asset price could soar to $5,625 by the end of September.

The short-term outlook for the token also remains positive, provided that the bulls can defend the $2,934 level. If this happens, ETH could enter the resistance zone around $3,555 and then approach the $3,758 mark.

However, rising pessimism in the broader market and the lack of positivity following the ETF launch could see Ethereum price fall below $3,000 again.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.