The Fed may leave the rate unchanged, despite almost one hundred percent expectations of a decrease. We understand how such a script will affect the dynamics of bitcoin and altcoins.

Wall Street investors almost have no doubt that the Federal Reserve System (Fed) will reduce the key rate. However, some analysts are sure that economic data speaks the opposite.

Why the Fed may not reduce the rate

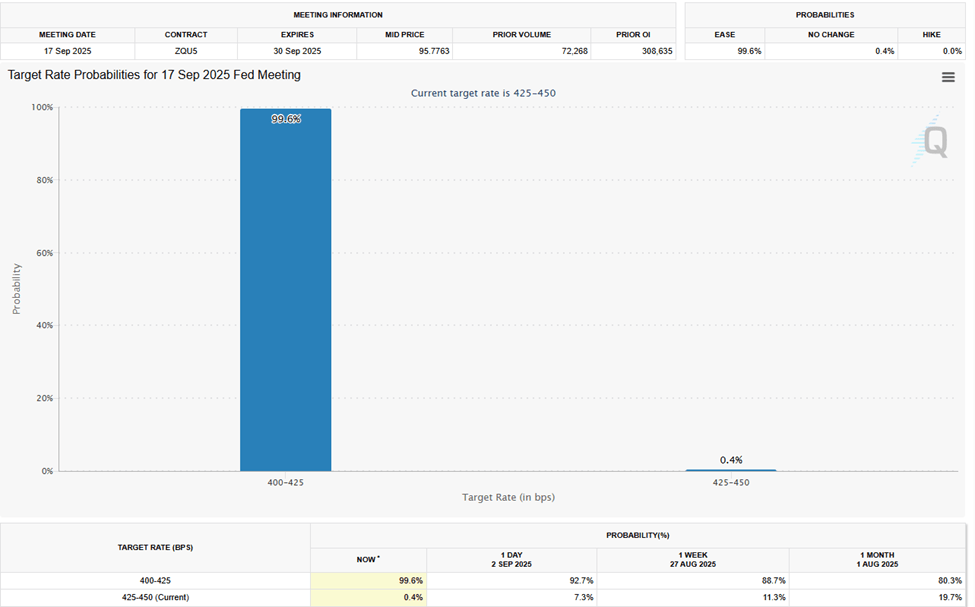

According to CME FedWatch Tool, the probability of reducing the rate at the September meeting of the Fed is estimated by a market of 99.6%. This instrument monitors the pricing for futures by federal funds and is considered one of the key indicators of investor expectations regarding the decisions of the Fed. It is on its basis that market forecasts for the US monetary policy are formed.

The traders perceive the “pigeon” decision of Fed as almost guaranteed and expect that a milder monetary policy will give a new impetus to assets that depend on liquidity. However, experts warn: such expectations are built more on market moods than on economic indicators.

“Hard” data against “soft” expectations

Justin d’Erkole, the founder and Cio ISO-MTS Capital Management, noted in a comment to Tradfi that the Fed does not have good reason to reduce bets. According to him, the regulator risks succumbing to a false narrative based on subjective surveys and consumer moods, and not on macroeconomics.

D’Erkole added that salaries and other labor income increase by 4-5% per year, delay in credit cards decrease, and even commercial real estate, which is often indicated as a “weak link”, shows an improvement in the quality of assets and reducing the number of defaults.

A similar opinion was expressed by Kurt S. Altrichter, founder of Ivory Hill. In a recent publication on X (Twitter), he drew attention to the latest PCE inflation data:

Altrichter emphasized that the concession to market expectations could undermine the long -term reputation of the Fed as a fighter with inflation.

Scenario of 2024 It may be repeated

The cryptocurrency market also carefully monitors the actions of the Fed. Historically, a decrease in bets often became a catalyst for the growth of bitcoin and altcoins, but experts note that this year the situation is different. Even if the forecast for the rate is justified, the bull effect will not be so pronounced.

However, experts warn: the reduction of the rate itself is already in many ways taken into account in prices. According to Mala Zeyn, the regional manager of the Coinex cryptocurrency exchange in the CIS, the expectations of mitigation of monetary policy have long been laid down in quotes: Bitcoin managed to test $ 123,465, after which he rolled into the zone $ 113,000–115,000.

Zane adds that now the attention of the market participants is focused on the rhetoric of the Fed.

From a technical point of view, the key level remains $ 112,500.

According to Binance Futures, open interest in bitcoin has grown, but some of the traders prefer to hedge and fix the profit. This reflects the nervousness of the market: participants are laid both the probability of a strong jerk up and deep correction in case of disappointment with the actions of the Fed.

The BTC dynamics over the past month confirms the uncertainty in the market:

- Since the beginning of August, the price has increased from $ 114,000 to a peak of about $ 122,000 by the middle of the month;

- Then the correction followed, and by August 30, Bitcoin dropped to $108 000;

- In September, the quotes partially recovered and now fixed at $ 111,700.

Some analysts remind of last year’s events. An independent expert named Ted compared the current situation in September 2024. Then the unexpected decrease in the rate provoked an increase in the capitalization of the crypto market, but soon a collapse followed.

Fed at a crossroads. As always

A decrease in the rate could really facilitate the situation of households and companies experiencing a debt load. But critics believe that the price of such a step is the acceleration of inflation, the growth of bubbles in the markets and the undermining of long -term stability.

D’Erkole asks the question:

Today, markets are already celebrating a decrease that has not yet been. But right now, in front of the Fed has one of the most difficult challenges over the past decades: to follow the data or give in to the crowd.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.