Participants in the crypto community argued about what levels Bitcoin could fall to amid the expected sell-off that could be triggered by Mt. payments. Gox.

What’s happening with Bitcoin

Bitcoin started Wednesday with a sideways movement, which was preceded by a slight recovery after the cryptocurrency’s descent to $58,400 amid news that the Mt. crypto exchange would soon begin paying creditors. Gox. Many members of the crypto community, fearing a sell-off, sold their coins or reduced their positions in them.

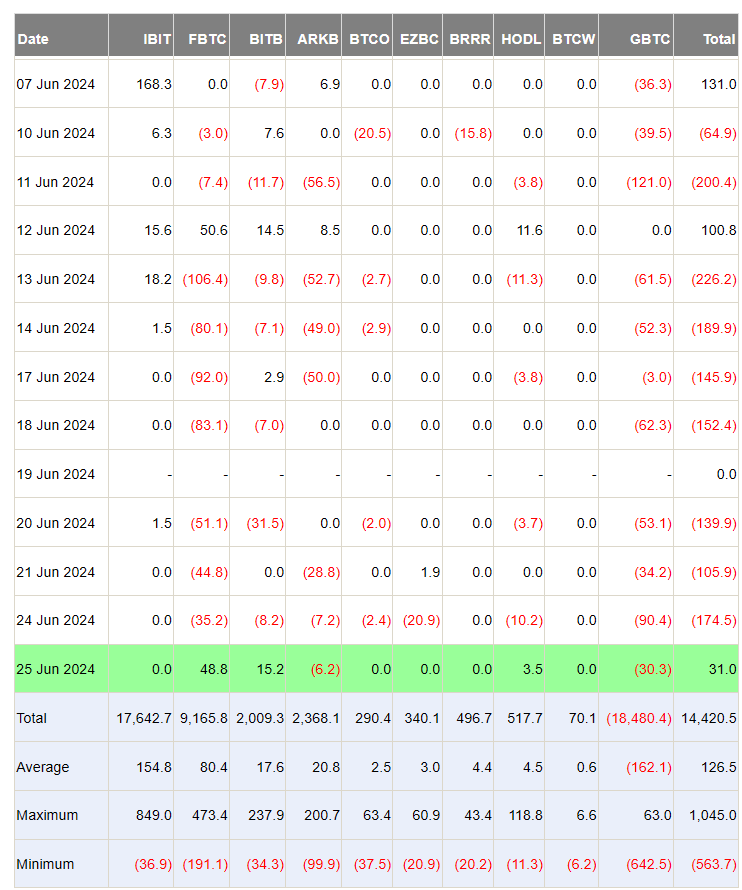

The first shock passed and BTC began to recover. The movement of cryptocurrency to previous positions, according to analyst Mark Cullen, contributed to the influx of funds into spot Bitcoin ETFs. The positive dynamics were preceded by a week of asset outflows.

Statistics of inflow/outflow of funds from spot Bitcoin ETFs. Source: farside

Statistics of inflow/outflow of funds from spot Bitcoin ETFs. Source: farside

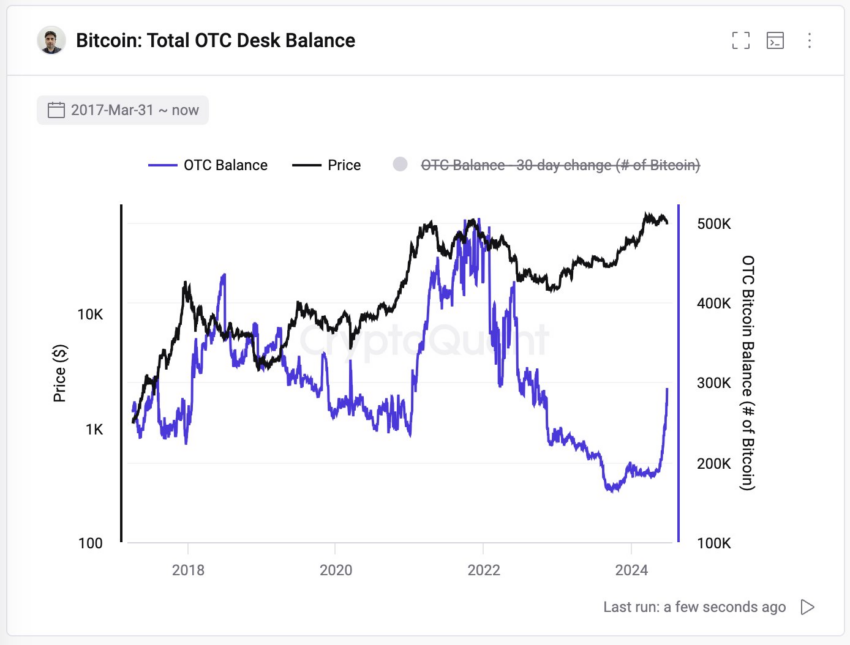

At the same time, in CryptoQuant fix a decrease in demand for BTC on the over-the-counter market. According to platform analysts, 103 thousand bitcoins have been withdrawn to OTC wallets over the past six weeks. The growth of balances against the background of the general negative trend for BTC may indicate low buying interest.

Bitcoin supply on the over-the-counter market. Source: CryptoQuant

Bitcoin supply on the over-the-counter market. Source: CryptoQuant

Bitcoin forecast

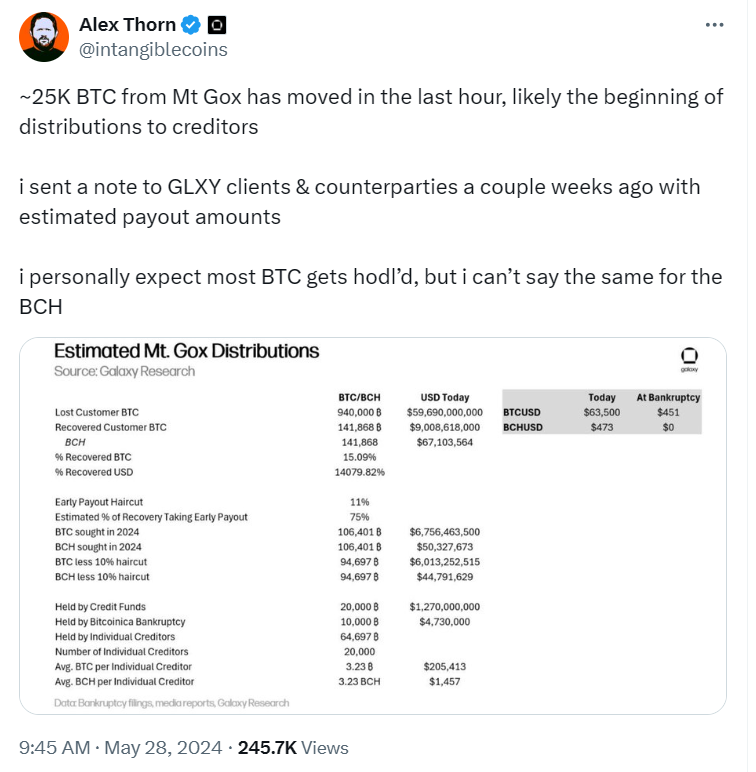

As Bitcoin returns to levels above $60,000, crypto community members have shared their predictions. Many believe that the risks associated with Mt. Gox’s debt repayment are greatly exaggerated. For example, holds this opinion Head of Galaxy Research Alex Thorne. He believes that most of the BTC that the crypto exchange will return to its owners will not be sold, which means the crypto market is unlikely to face a large-scale sell-off. At the same time, Thorne noted that with Bitcoin Cash (which also forms part of Mt. Gox’s debt), the situation is worse – many will rush to get rid of this asset.

Similar opinion shared well-known entrepreneur in the crypto community, Neil Jacobs. He also believes that not all investors will rush to sell bitcoins. Well, Jacobs is sure that the coins that will be put on the market will find their buyers.

Analyst Michael van de Poppe, in turn, notedthat against the backdrop of the hype around Mt. Gox, Bitcoin is falling into the oversold zone. From a technical analysis point of view, such a situation may indicate the formation of an unfairly low price for the asset.

According to Mark Cullen, Bitcoin will continue its decline in July. He believes that the positive dynamics of BTC may be followed by a fall to new local minimums. The analyst does not rule out a decline in Bitcoin to $57 thousand in early July. At the designated level, according to his observations, there is a liquidity pool that can act as a “magnet” for the cryptocurrency rate.

With a forecast that implies a descent of Bitcoin to $57 thousand, agreed Trader Doctor Profit. Unlike Mark Cullen, he is confident that BTC is already close to reaching a local minimum, which will be followed by an update of the absolute maximum.

Current drawdown confident tradershould be used to purchase cheap bitcoins.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.