If the price of the first cryptocurrency falls below the support level of short-term holders at $58,900, the market risks entering a bearish phase. This was stated by analyst and co-founder of CMCC Crest Willy Wu.

Here's how the markets look to me.

$58.9k STH support, if this breaks we move to a bear market.

CVD selloff has peaked, so a phase of “up” next. CVD measures market orders (impatient buy/sells).

Longer term: still weeks away from a proper bullish environment. pic.twitter.com/NxVwSA4KtT

— Willy Woo (@woonomic) April 15, 2024

According to him, the sale accumulated volume delta (CVD), which measures market orders (instant buys/sells), has reached its peak, so the “boost” phase begins.

The expert noted that the market has not changed structurally since March, but April is “changeable in both directions.” Halving will be another catalyst for volatility.

The analyst also suggested that the next level at which large liquidations of short positions will occur will be $71,000-75,000.

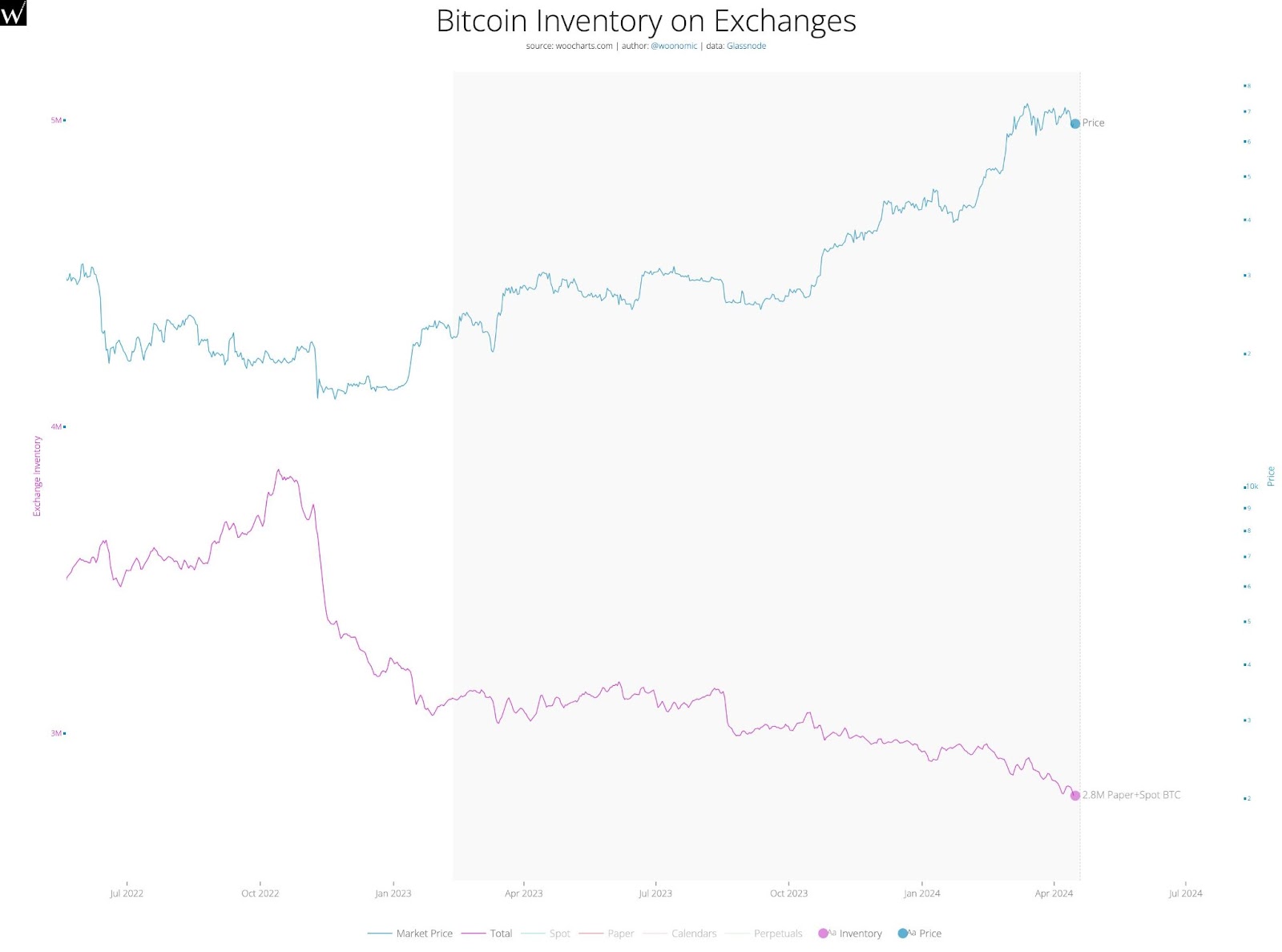

Given Bitcoin's supply and demand charts, it's only a matter of time before “the accumulation that's happening in this consolidation pushes us beyond the all-time high,” he said.

Bitcoin supply on exchanges. Data: Willy Woo.

Bitcoin supply on exchanges. Data: Willy Woo.

On the evening of Saturday, April 13, quotes of the first cryptocurrency fell below $61,000 amid the worsening situation in the Middle East. The next day, digital gold recovered to levels above $64,000. During the day, the volume of liquidations reached $955 million.

Wu clarified that in almost every cycle before the halving, there was a bearish phase due to the “overaccumulation” of the first cryptocurrency.

MN Trading founder Michael van de Poppe noted similar dynamics for Bitcoin. According to his observations, the asset has consolidated at the lows of the current range of $61,000-$71,000.

#Bitcoin consolidating at the range low and hit that level.

Still within the range and capitulation took place across the board.

Expecting to see higher level tests over the upcoming week. pic.twitter.com/oQOFhNONoG

— Michaël van de Poppe (@CryptoMichNL) April 15, 2024

At the time of writing, digital gold is trading at $65,492.

Earlier, Van de Poppe admitted that the quotes of the first cryptocurrency began to move to a maximum above $73,000.

Former BitMEX CEO Arthur Hayes predicted a possible fall in Bitcoin on the eve of halving. A reduction in the block reward is a price catalyst in the medium term, and during the designated period the coin will face an outflow of liquidity, the expert believes.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.