What is WLFI

WLFI is a decentralized finance platform (Defi) World Liberty Finance. Token provides management functions: its holders have the right to vote when making decisions regarding changes in the work of the site. The total supply of WLFI is 24.66 billion, of which most, 10 billion, belongs to the World Liberty Finance itself, that is, the Trump family. A little more than 4 billion tokens were allocated for public trading.

WLFI trading exchanges

WLFI is presented not only on Binance and Coinbase, but also on Bybit, Kraken, Upbit, OKX, Bitget, MexC, Kucoin, Bithumb. In addition to centralized platforms (CEX), WLFI is also available on decentralized (DEX). Among the latter, you can highlight Uniswap, Pancakeswap, Raydium and Orca.

How the price has changed

It is too early to talk about some grandiose analysis of the price change schedule, given that WLFI is trading on exchanges for the only third day. Although some conclusions can be drawn.

On September 1, the opening price on the Binance exchange was $ 0.2. In the first minutes of trading, she flew 2.39 times, up to $ 0.478. The fairy tale has not lasted a long time: after 15 minutes, WLFI lost a third of the cost, and a little more than seven hours a decrease from the maximum exceeded 56%.

What is this talking about? The fact that private investors in the first minutes were inspired by the advertising company around WLFI and raised the price to heaven. Further, large players began to massively sell their tokens, as a result of which the price quickly dived down.

Now the price of WLFI is about $ 0.23. This is 16% higher than the opening price on September 1, which is an excellent result. But at the same time, it is more than two times lower than the maximum value reached in the first minutes of trading.

Source: TradingView.com/Chart

Futures market

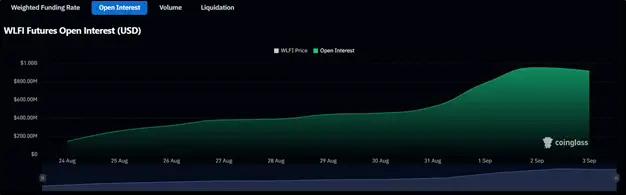

If the price schedule shows that the interest in fixing the profit is higher than the WLFI tokens themselves, then the data on derivatives are not so unambiguous. The open interest in futures on this cryptocurrency grew for ten days in a row on August 24, and on September 2 reached its peak – $ 954.15 million. Now the value of this WLFI indicator is comparable to the old -timer of the crypto industry, cryptocurrency silver – Litecoin, and higher than that of Avalanche. In other words, the speculative interest in trading in Trump’s cryptocurrency by September 3 remains at a fairly high level.

Source: Coinglass.com

WLFI and USD1

In addition to WLFI token, World Liberty Finance produces USD1 stablecoin. USD1 is a stablecoin tied in value in a ratio of 1: 1 to the US dollar. The World Liberty Finance claims that Stablecoin is provided with a cash equivalent and Treasury bonds of the United States (Trozheros). More information about the provision can

find On the Bitgo website in the World Liberty Finance section.

In other words, the declared model for ensuring such stablecoin is similar to Tether’s USDT. That is, the USD1 is not tied to the dollar rate due to algorithms or other methods that are different from physical support by other assets from the issuer.

Why does the crypto community still treat WLFI with distrust?

Causes of doubts in the prospects of WLFI

The first reason why the start of the World Liberty Finance token caused distrust: this is a fairly blurry formulation of the tasks of the site itself. The statement that it acts as a bridge between traditional and decentralized finances is just marketing. And people want more specifics.

The second reason: the big earnings of the Trump family. Already now, the current president of the United States, the ex-Reyltor, earned more on the launch of WLFI than on real estate.

The third reason: in January, the market was already conquered by the cryptocurrency associated with Trump, – the memcoid Official Trump (Trump). After the outbreak of bidding, the coin collapsed by 80% and since then has not given any signs of recovery.

The fourth reason: scammers are already actively applying phishing attacks to WLFI holders. The main vector of attacks fell on the functionality of the Ethereum blockchain, where the token was launched. Namely, the EIP-7702 is a proposal implemented in May, which made it possible to function ordinary wallets as smart contracts.

The fifth reason: a quick sale of WLFI with large investors – to make a profit while it is still possible to do.

A few words in defense wlfi

As for phishing attacks, the question should not be asked to WLFI, not to World Liberty Finance, but to Ethereum. It was in the blockchain that vulnerability was discovered. The owners of WLFI were attacked, because now the TOKEN is in trend, and the attackers well understood: in the moment you can make good money.

It must be remembered that memcoirs like Official Trump are basically not required to grow in price. The course of any memorial is purely speculative. In addition, a nine -month fall is not a critical time to tear your hair.

Not all major investors rushed to sell WLFI with their hands. Founder Tron Justin Sun, Trump’s business partner,

saidthat he has no such plans. Fixation of profit at the beginning of trading is far from an ordinary phenomenon. There are a lot of companies that enter the IPO first begin to fall in price. For example, shares of the same American Uber eight months after the start of trading fell three times. Nevertheless, the company did not go broke, and in 2025 its securities are more than doubled above the opening, and more than six times higher than the minimum value.

Conclusion

WLFI is the company of the company World Liberty Finance, owned by the Trump family. The coin attracted great attention to itself, which caused a price increase in the first minutes of trading by more than doubled. Then a correction followed, caused by the mainly uncertainty of investors in the long -term prospects of the project. Nevertheless, to say that WLFI is just a scam – for now, prematurely.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.