- WTI bears are in control and aim for a test of $72.00.

- However, the M formation could suffer a correction in the next few hours from important supports.

Oil prices They weakened in midday trading on Wall Street after the United States reported that inflation last month rose to an annualized rate of 6%, matching expectations and down from 6.4% in January.

However, inflation remains well above the Federal Reserve’s targets, implying prospects for a Recession, especially amid concerns from the banking sector that continue to challenge growth and demand-dependent commodities such as Petroleum.

At the time of writing, West Texas Intermediate crude oil is down more than 3% and set new session lows in the American session.

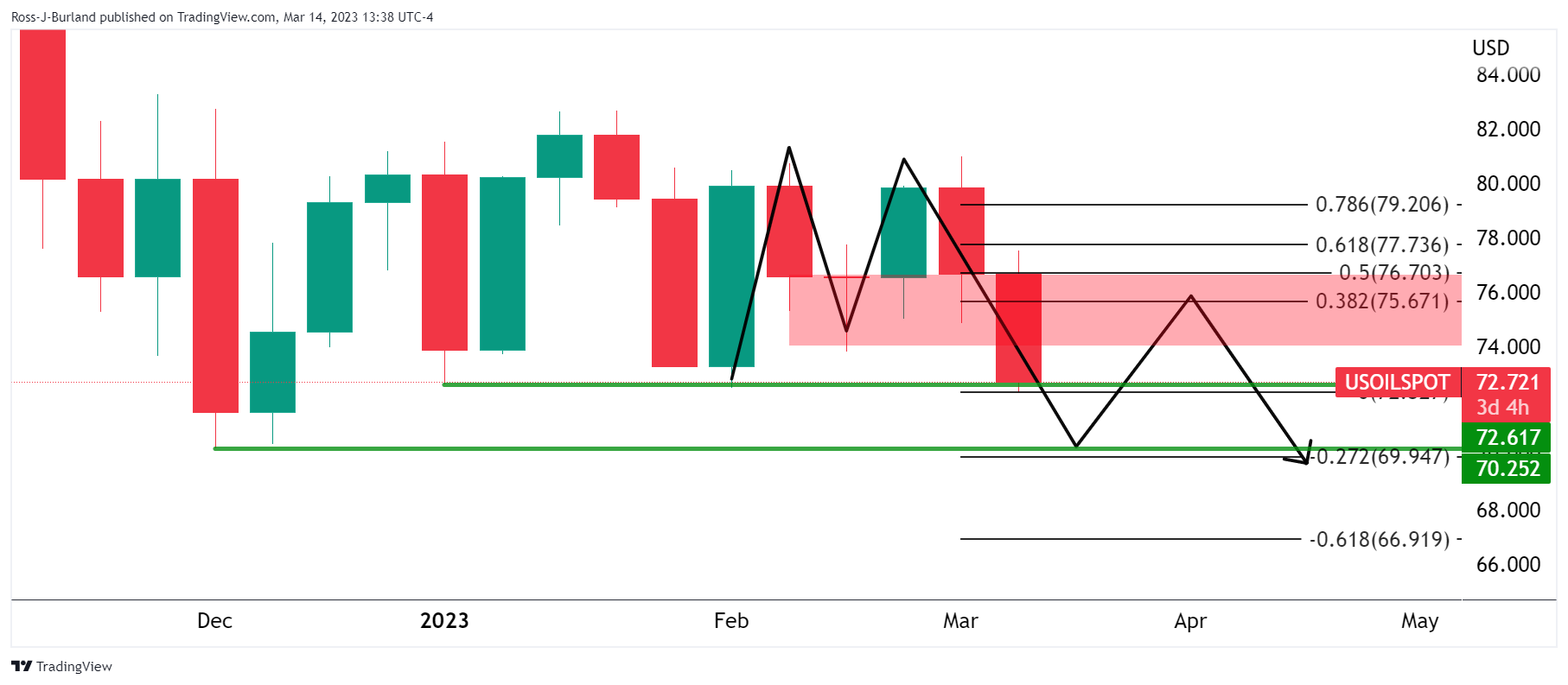

Looking at the charts, we can apply multi-timeframe analysis to determine the prospects for a correction in the meantime, but ultimately a bearish bias prevails such as the following:

WTI daily chart

.

In a series of lower highs, the daily charts show the price moving sideways within a wide range between $70.10 and $83.32. There is a price imbalance, gray area, above $77.50, but momentum is with bears while below $74.80, and liquidity below $70.10 is calling. However, even if we are at the back of the Downtrend, (break of the downtrend line), this could be an accumulation phase and a removal of stops below $70.10 could trigger a rise in the downtrend. demand later.

WTI weekly charts

The weekly charts show that the price broke out of the uptrend and is now pulling back and moving sideways, but still with a bearish bias as it sits in front of the downtrend micro line below $74.82 as illustrated above.

However, the M formation could stop bears between $70.25 and the neckline near a 50% mean reversion at $76.70.

WTI 1 hour chart

Moving down to the hourly chart, we see that the price is indeed in front of the downtrend line but finding support. The M formation, zoomed in, is a reversal pattern that could see a correction in the next few hours from support before a bearish continuation to test the $72 figure.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.