- They will supposedly launched missiles towards American bases in Qatar, climbing regional tensions.

- The crude WTI shot at $ 76.74, but reversed sharply as the operators took benefits and supply interruptions did not materialize.

- He Focus moves to the key support about $ 70.00 with the technical impulse turning down.

The crude oil WTI experienced a strong intradic volatility on Monday, jumping to its highest level since January before reversing all its profits. The prices initially recovered at $ 76.74 after Axios reported that Iran had launched six missiles to US military bases in Qatar, increasing the fears of a broader conflict in the Gulf.

The movement was driven by the immediate concern that the increasing hostilities could threaten oil traffic through the Ormuz Strait, a critical path for about 20% of global oil flows. The market reaction was fast, with the operators hurrying to take long positions during the early US session.

But as the session progressed, the narrative changed. Without confirmed or climbing damage beyond the initial missile launch, market participants began to reassess the situation. There was a benefit taking, and the WTI backed up sharply below the key support levels to settle about $ 70,80, a drop of almost 5% since its peak.

Iran’s last military movement occurs after a weekend of high tensions after air attacks to its nuclear facilities by US forces. The missile launch of Monday aimed at American bases represents a significant climb, but so far, the repercussions seem limited.

The operators remain cautious. Any new retaliation signal, especially if US assets are affected or navigation in the gulf is interrupted, could rekindle the price impulse. However, for now, the market seems to be valuing geopolitical noise without a significant impact on the supply.

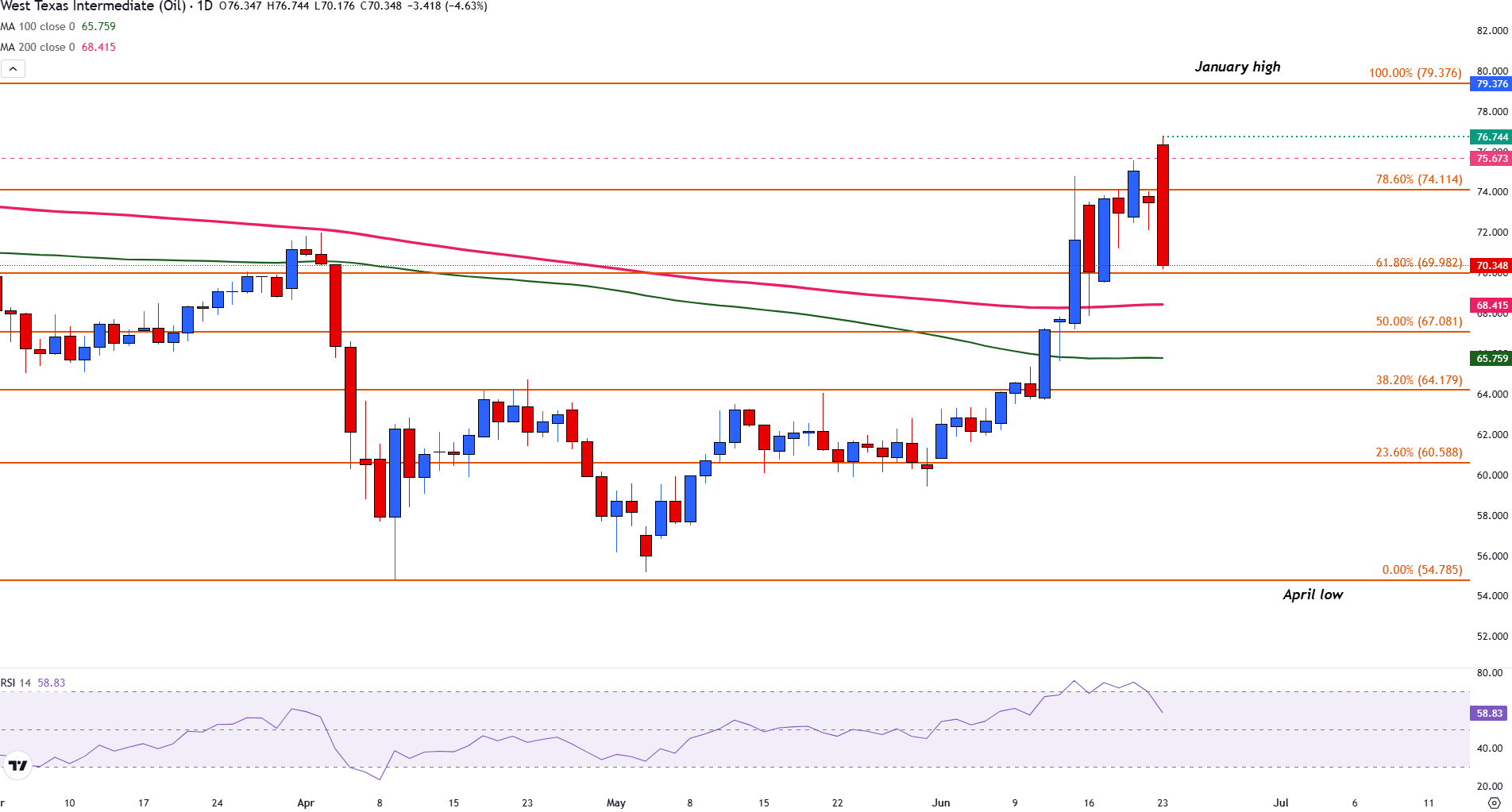

WTI crude oil price action

The rejection from the maximum of $ 76.74 marks a decisive turning point. The price failed to stay above the fibonacci setback of 78.6% of the fall from January to April in 74.11 $ and broke the psychological level of 72.00 $, changing the short -term impulse towards the decline.

The WTI is now floating just above the 61.8% setback at $ 69.98. A rupture below this area would expose the simple mobile average (SMA) at $ 68.42, followed by the 50% setback level of about $ 67.08.

WTI crude oil daily graphics

The relative force index (RSI) has fallen to 63, which suggests that overcompra conditions have relieved and bearish pressure could be intensified. Unless prices recover and close above $ 74.00 again, the trend for next week could remain cautiously negative.

WTI FAQS oil

WTI oil is a type of crude oil that is sold in international markets. WTI are the acronym of West Texas Intermediate, one of the three main types that include the Brent and Dubai’s crude. The WTI is also known as “light” and “sweet” by its relatively low gravity and sulfur content, respectively. It is considered high quality oil that is easily refined. It is obtained in the United States and is distributed through the Cushing Center, considered “the crossing of the world.” It is a reference for the oil market and the price of WTI is frequently traded in the media.

Like all assets, supply and demand are the main factors that determine the price of WTI oil. As such, global growth can be a driver of the increase in demand and vice versa in the case of weak global growth. Political instability, wars and sanctions can alter the offer and have an impact on prices. OPEC decisions, a group of large oil -producing countries, is another key price factor. The value of the US dollar influences the price of WTI crude oil, since oil is mainly traded in US dollars, so a weaker dollar can make oil more affordable and vice versa.

Weekly reports on oil inventories published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) influence the price of WTI oil. Changes in inventories reflect the fluctuation of supply and demand. If the data show a decrease in inventories, it can indicate an increase in demand, which would raise the price of oil. An increase in inventories may reflect an increase in supply, which makes prices lower. The API report is published every Tuesday and that of the EIA the next day. Their results are usually similar, with a 1% difference between them 75% of the time. EIA data is considered more reliable, since it is a government agency.

The OPEC (Organization of Petroleum Exporting Countries) is a group of 13 nations oil producing that collectively decide the production quotas of member countries in biannual meetings. Their decisions usually influence WTI oil prices. When OPEC decides to reduce fees, it can restrict the supply and raise oil prices. When OPEC increases production, the opposite effect occurs. The OPEC+ is an expanded group that includes another ten non -members of the OPEC, among which Russia stands out.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.