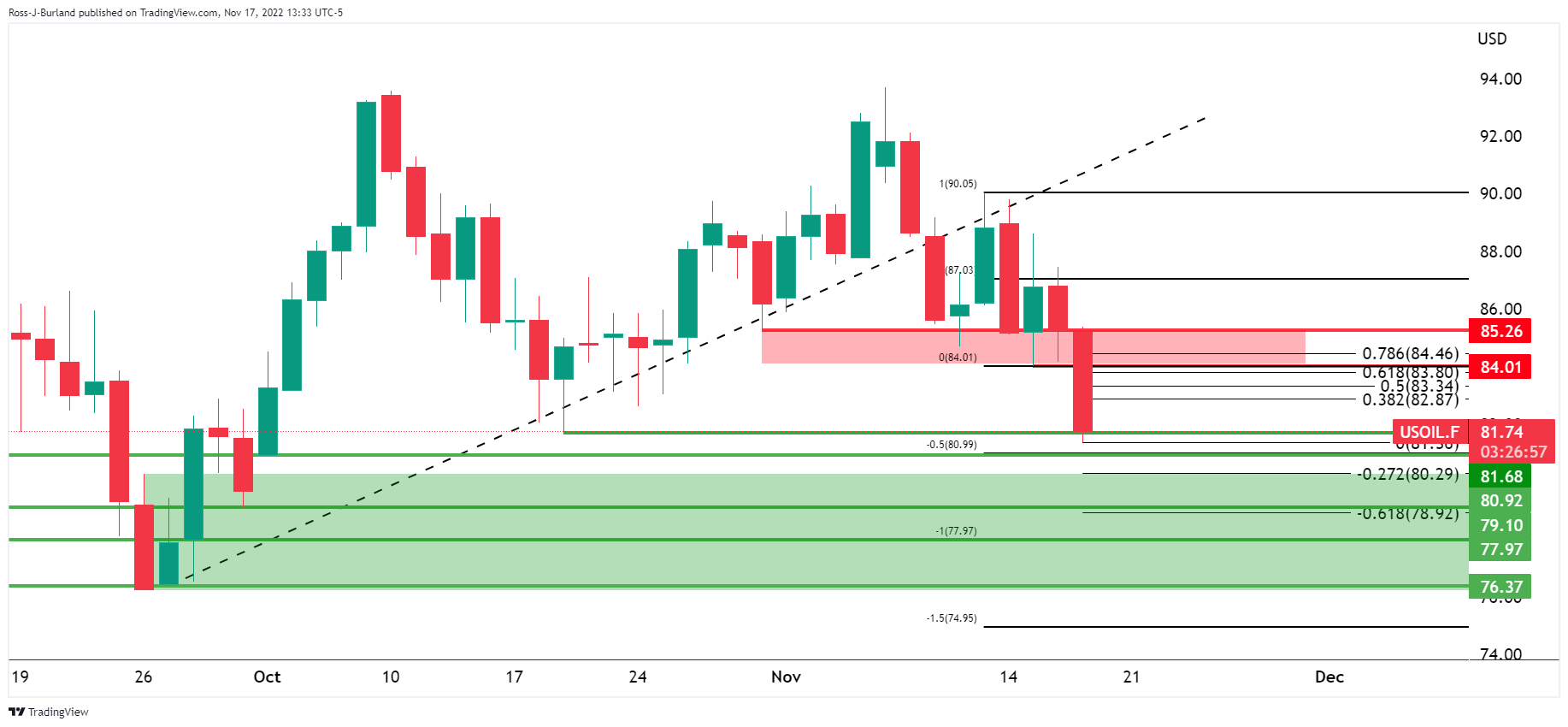

- WTI bulls move from the lows and take into account the ratio of 38.2%.

- Bears are looking for a discount to go deeper towards $78.00.

Based on previous analysis, WTI bears they are pressuring the bulls below critical strength with the break of $84.00 in sight, and the price of oil fell below $84.00 on Thursday after an accumulation of long positions.

Previous WTI analysis

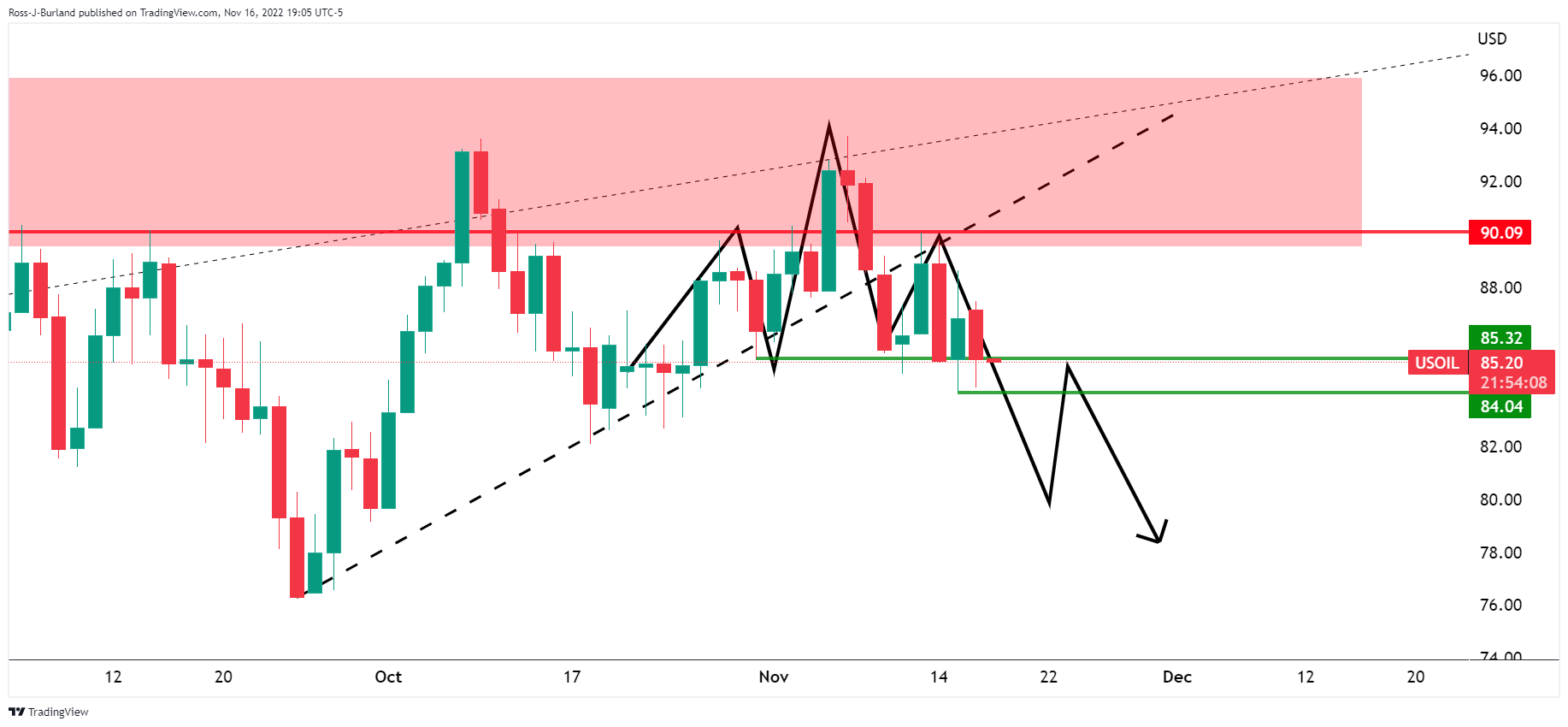

The price was showing on the trailing of the monthly trend line and was being rejected on a retest:

Price appeared to be about to complete an M formation below the highs locked below horizontal resistance:

A bearish Head-Shoulder pattern had emerged on the daily chart with the right shoulder on the reversal of the micro trend line:

Close up:

A move below $84 was needed to fully change the bias:

WTI Update

As illustrated, the price has indeed followed the path predicted on Thursday. Bears can now aim lower at the origin of the previous uptrend:

WTI H1 Chart

From an hourly perspective, drawing the expansion of the prior consolidating range, a 100% measured move points to a test of $78.00. However, a correction might be in order given Grab’s harmonic pattern. The 38.2% Fibonacci retracement level of bearish momentum sits near $82.90.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.