- Gold maintains its fall for the second day in a row.

- Higher yields on US Treasuries underpin demand for the US dollar.

- Investors await US inflation data before opening aggressive positions.

The gold extends decline for the second day in a row during the European session on Tuesday. Price sets new daily lows near $ 1,722 region and maintains a downward bias against the US dollar.

At the time of writing, the XAU / USD it is trading at $ 1,726, losing 0.36% on the day.

The US Dollar DXY Index is rapidly recovering from intraday lows around the 92.10 level and is pushing XAU / USD lower. The optimistic US economic outlook continues to support demand for the US dollar.

The sudden US 10-year yield revival has driven better dollar performance versus major currencies and commodities. The prospects for a scenario of higher inflation, in the context of increased public spending in a move to boost the economy coupled with a faster vaccination rollout, are drawing investors’ attention to the US dollar as an attractive investment instrument.

Investors now focus on the growth aspects of the market and ignore the fear of inflation, which weighs negatively on gold prices.

At the beginning of the American session, the publication of the US CPI data could indicate a new direction for the price of gold.

Gold technical levels

.

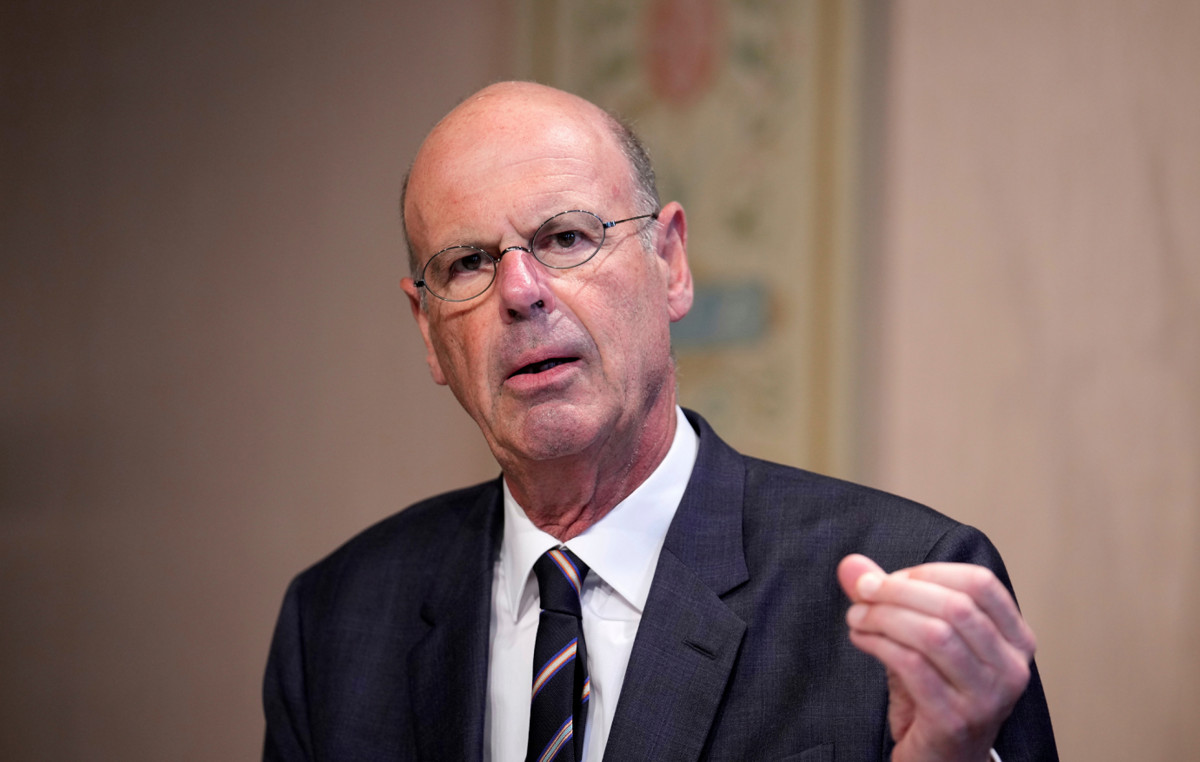

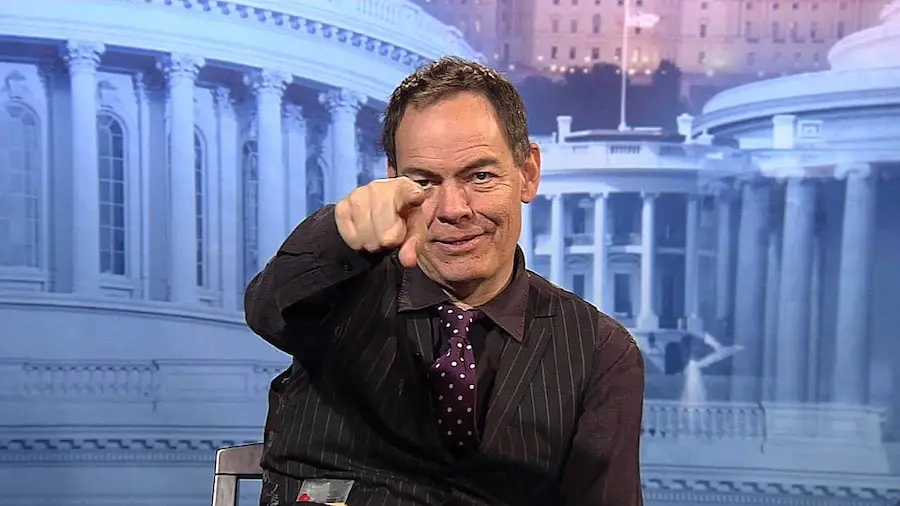

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.