XRP growth stalled, and this raises questions. In an annual comparison, the price increased by almost 400%. However, now Ripple is traded in a narrow range just below $ 3. We figure out why the rally does not continue.

Oachin-data shed light on the current problems of Ripple. Large holders (whales) actively bring funds to exchanges, and retail investors continue to buy. As in January, the direction of the XRP breakthrough will depend on which side will exert greater pressure on the price of XRP.

Whales returned to exchanges, and this usually promises problems

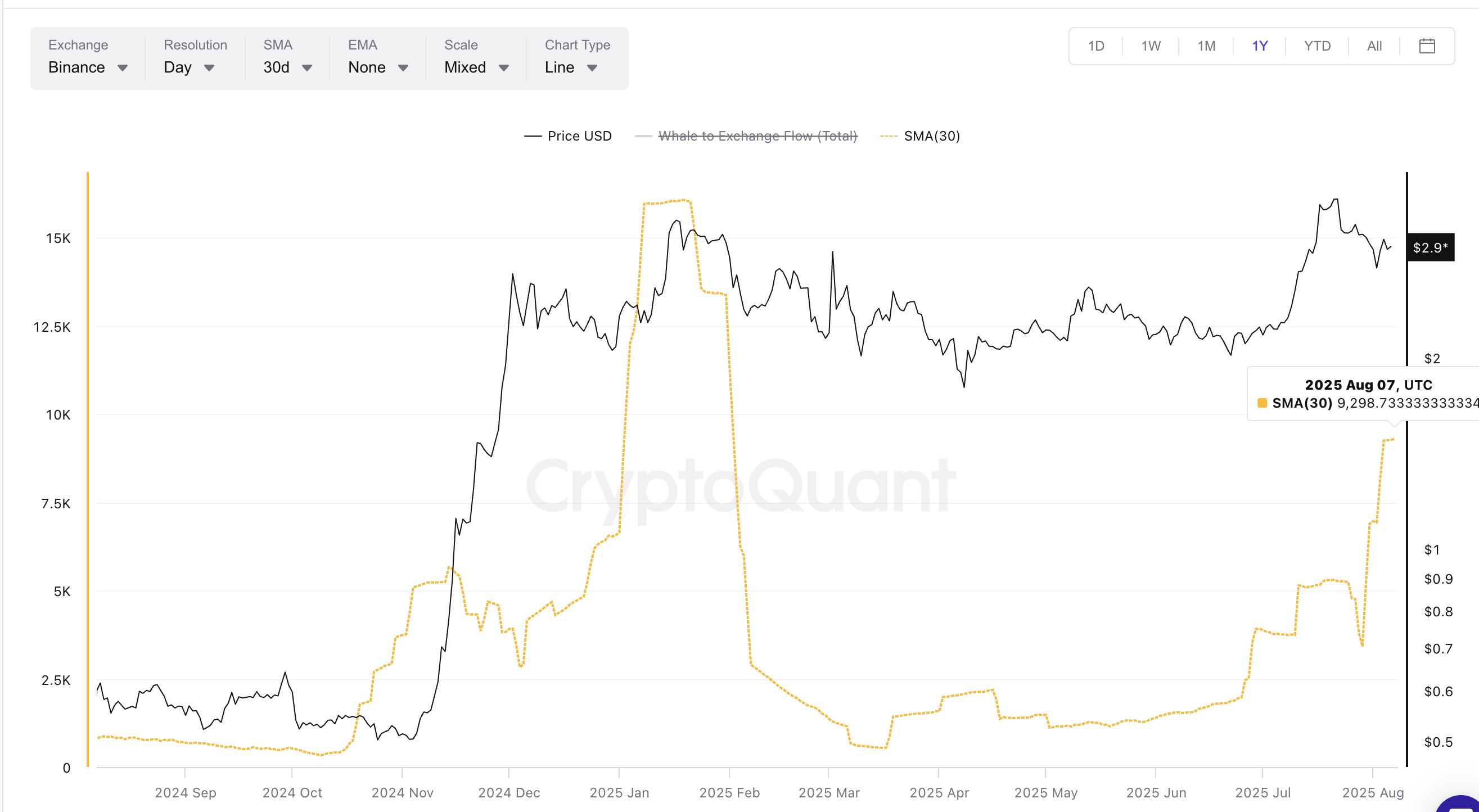

One of the obvious signs of whale activity is the volume of tokens sent to centralized exchanges. An increase in this indicator usually signals the possible pressure of sales. Take a 30-day sliding average to smooth out intra-day vibrations and identify clear trends.

On August 7, a 30-day simple sliding medium (SMA) flows of whales on the exchange jumped up to 9,298, according to Cryptoquant. This is the second largest surge this year, inferior only to January 18. Then the indicator reached the peak, and the price of XRP fell from $ 3.27 to $ 1.70 over the next four months.

Now the situation is repeated: whales are activated, and the price either freezes or unfolds. XRP again cannot take the barrier for $ 3. History shows that such pressure often restrains prices in prices, especially when small buyers do not have time for large players.

Retail buyers continue to accumulate, but whether whales are on their teeth

Not everyone is pessimistic. While whales send XRP to exchanges, short -term holders steadily increasing their positions. These are wallets that usually hold tokens from 1 week to 3 months. Now they are consistently buying on falls.

Hodl waves show how long coins remain in wallets, which allows you to determine who drives the market – short -term or long -term holders. We focused on the ranges of 1 week – 1 month and 1 – 3 months to track a recent accumulation.

July 10, when XRP was traded at $ 2.54:

- Holders in the category from 1 week to 1 month owned 4.117% of the supply

- Holders in the category of 1 to 3 months owned 4.81%

By August 6, these indicators grew to:

- 7.657% for 1 week – 1 month

- 5.912% for 1 – 3 months

This is a significant increase in accumulation, especially considering that it repeats the behavior before the July XRP rally up to $ 3.65. If retail investors continue to buy at such a pace, this can create support and ultimately lead to a breakthrough if large holders stop sales.

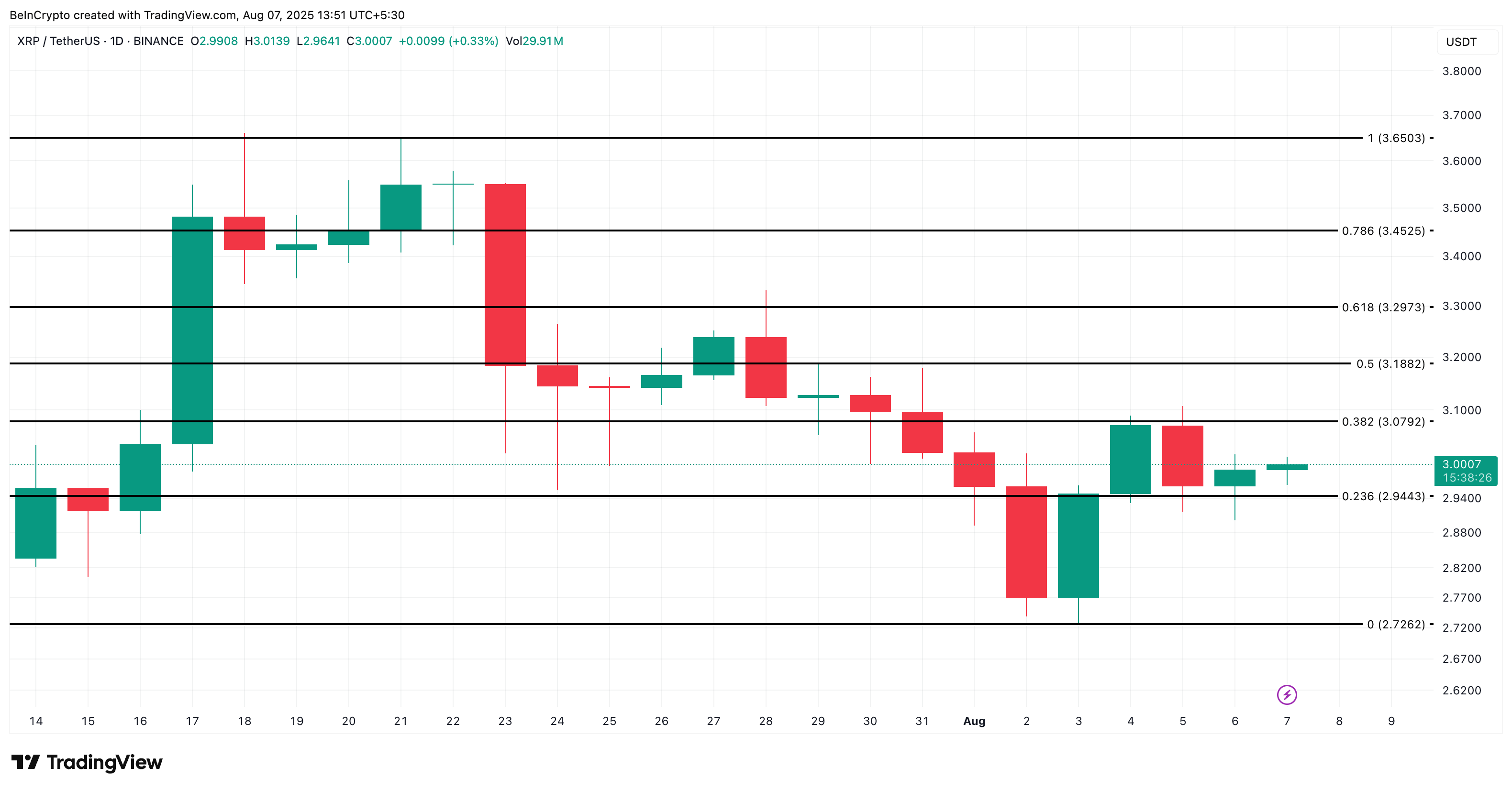

The price of XRP was stuck in the range, but not for long

The price tests support at the level of $ 2.94, with several daily closures just above this level. This is a key zone in the short term. If the XRP holds above this level and the purchasing pressure is increasing, we can see the movement to $ 3.08 and, possibly, $ 3.29, where the next resistance zone is located.

If the activity of the whales continues to grow and the pressure on the sale intensifies, the price may fall to $ 2.72. This is the lower boundary of the recent trading range and a possible breakdown area.

Now the XRP remains in the range, but the sales of whales and holding positions with short -term buyers cannot last forever. The next movement will show who controls the market.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.