Airdrops are one of the most popular strategies for attracting audiences, which appeared back in 2017. However, lately, free token giveaways have become less and less effective.

Many airdropped tokens increasingly fail to hold long-term interest or maintain their value. This is stated in a recent KeyRock Trading research.

What happens to tokens after an airdrop?

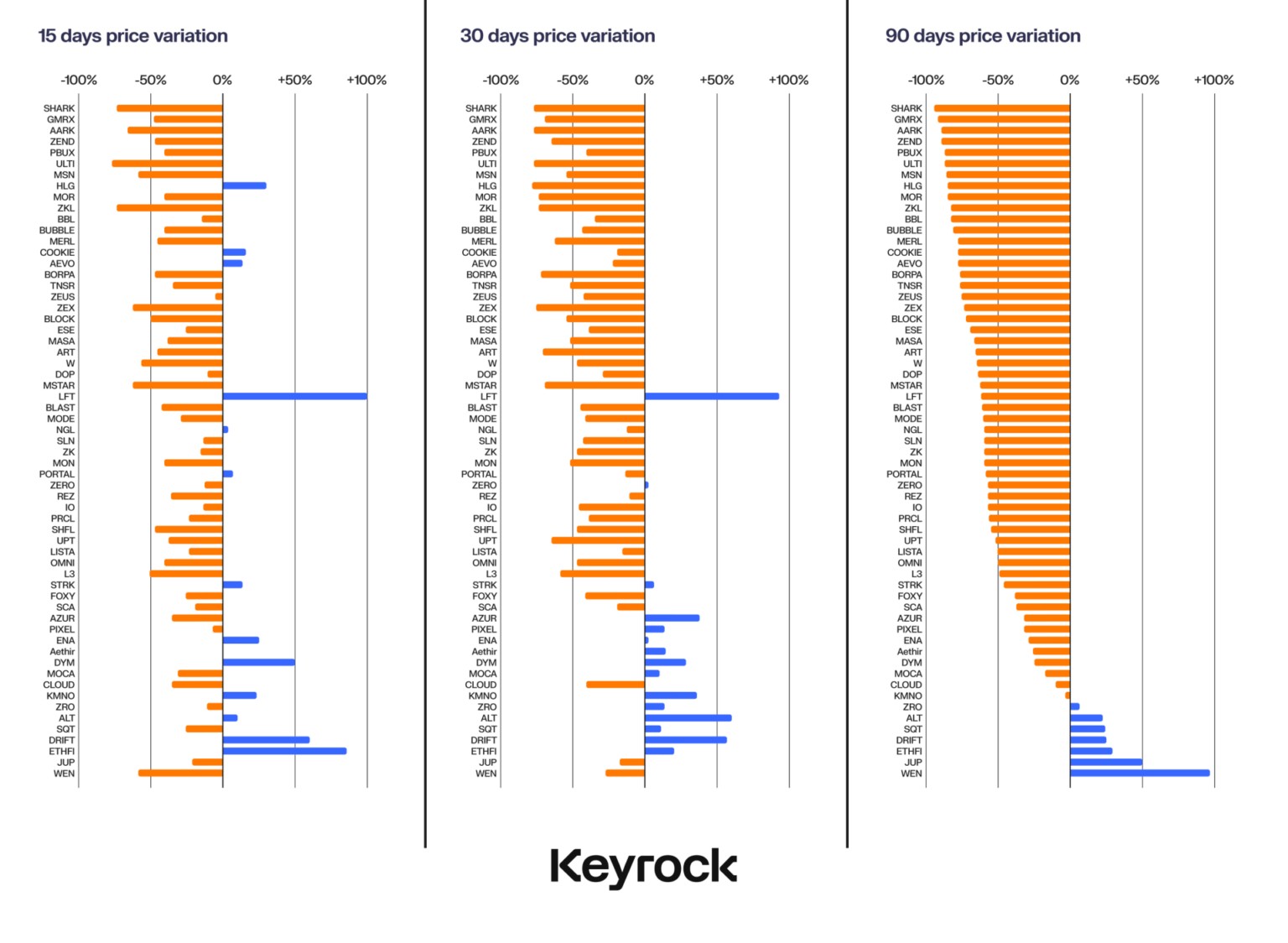

KeyRock specialists analyzed 62 airdrops conducted on six blockchains during 2024. According to the results, 88.7% of the tokens participating in the study showed a significant decrease in price already 90 days after the distribution. Only a few have shown resilience.

In the crypto ecosystem, airdrops are used to increase engagement in the project and wider distribution of tokens among users. However, an oversaturation of such strategies appears to have weakened their impact.

Price dynamics for airdrop tokens 15, 30 and 90 days after listing. Source: Keyrock

Price dynamics for airdrop tokens 15, 30 and 90 days after listing. Source: Keyrock

It is noteworthy that, despite the overall negative dynamics, not all results are equally disappointing. According to KeyRock, the success of tokens largely depends on the chosen blockchain.

Ethereum and Solana stand out among all – 14.8% and 25% of airdrops that took place on these blockchains maintained or increased their value three months after the distribution. Other networks, including BNB, Starknet, Arbitrum, Merlin, Blast, Mode and ZkSync, did not have a single successful distribution of free tokens in 2024.

Big hands usually bring success

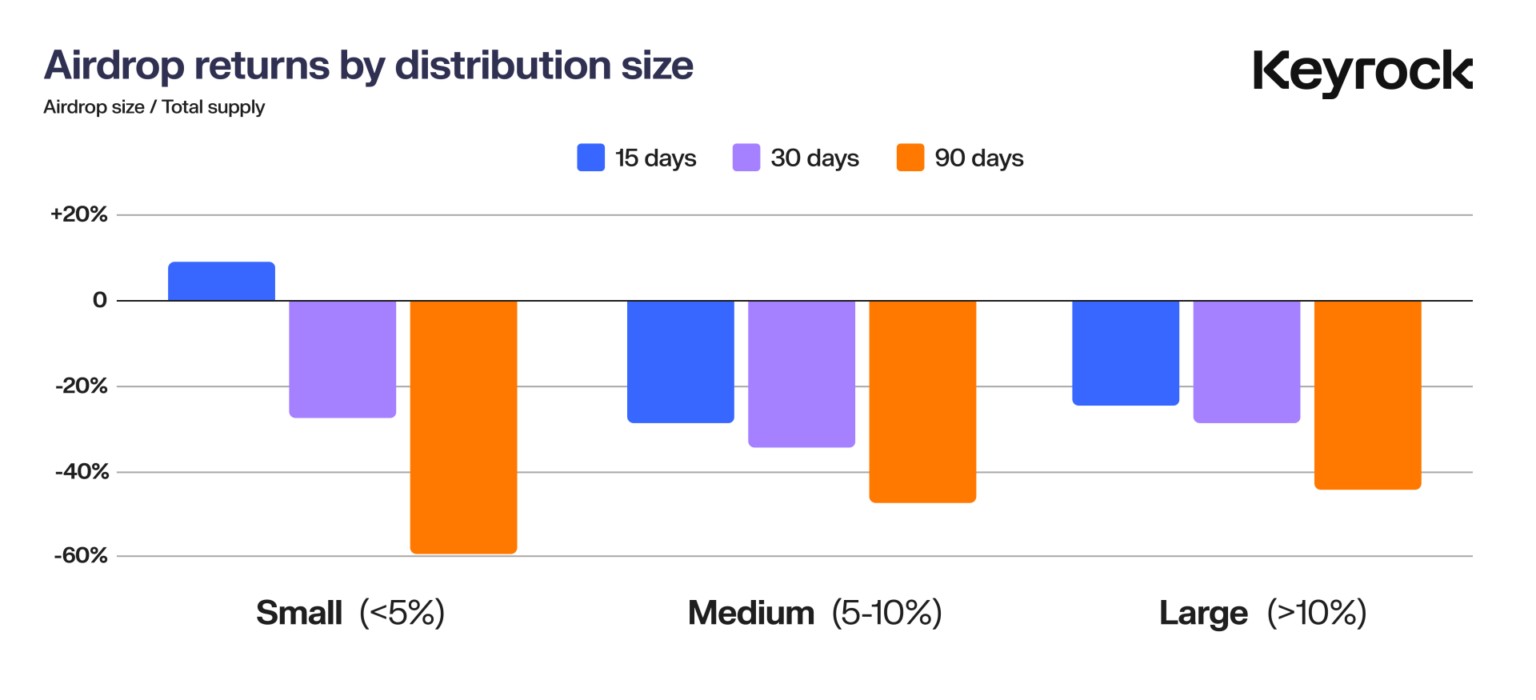

KeyRock specialists also analyzed token distribution strategies. They divided airdrops into small (when less than 5% of the total token emission is intended for the community), medium (from 5% to 10% of the token emission) and large (more than 10% of the token emission).

The results of the study showed that the size of the airdrop can significantly influence both the initial market reaction and the long-term prospects of the project.

Profitability of tokens depending on the size of the airdrop. Source: Keyrock

Profitability of tokens depending on the size of the airdrop. Source: Keyrock

In the short term, small airdrops often produce the best results. This is likely due to low selling pressure at launch. However, the successes of such projects are usually short-lived. Typically, their tokens drop within three months.

Initial shortages may deter flash sales. However, it also leads to delayed market corrections when conditions change or insiders become active and want to withdraw funds.

Medium airdrops find balance. They are the ones who demonstrate comparative stability and even show stable growth. However, it was the large distributions that showed the best results in the long term. They were found to contribute to the creation of a strong sense of collective ownership within the community. This could play a key role in stabilizing price fluctuations and maintaining user interest.

Previously, the Hamster Kombat team was criticized. At the end of the first season of the game, users did not receive the number of tokens they expected. A similar situation occurred with the Catizen “slipper”.

Stay informed! Subscribe to World Stock Market in Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.