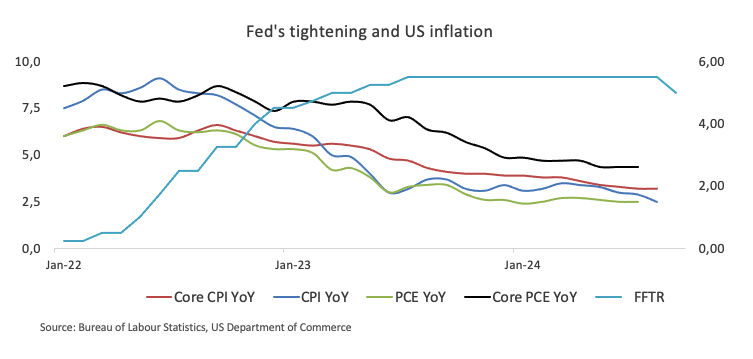

- The core personal consumption expenditure (PCE) price index is expected to rise 0.2% month-on-month and 2.7% year-on-year in August.

- Markets have already priced in about 50 basis points of easing into the next two Federal Reserve meetings.

- A firm PCE outcome is unlikely to change the Fed’s stance on monetary policy.

The US Bureau of Economic Analysis (BEA) will publish the significant Personal Consumption Expenditure (PCE) Price Index, which is the Federal Reserve’s preferred measure of inflation, on Friday at 12:30 GMT.

While this PCE inflation data may influence the very short-term path of the US Dollar (USD), it is highly unlikely to alter the Fed’s course on its interest rate path.

Ahead of PCE: Insights on the Fed’s key inflation metric

The core PCE price index is projected to rise 0.2% in August compared to the previous month, aligning with July numbers. Over the past twelve months, core PCE is expected to rise 2.7%, slightly above the 2.6% increase in July.

This underlying PCE price index, which excludes the most volatile food and energy categories, plays a crucial role in forming market expectations about the Federal Reserve’s interest rate outlook. This measure is closely monitored by both the central bank and market participants as it is not distorted by base effects and provides a clearer view of underlying inflation by excluding unstable components.

As for headline PCE, consensus forecasts suggest the downward trend will persist in August, with PCE expected to increase monthly by 0.1% (up from 0.2% previously) and year-on-year increase by 2.3%. % (compared to 2.5% previously).

Previewing the PCE inflation report, analysts at TD Securities argued: “Core PCE inflation was likely to remain under control in August, with prices advancing at a gentle 0.15% monthly pace. Given that strong rental prices acted as a key driver of core CPI inflation, core PCE will not rise as much Headline PCE inflation is also likely to have been recorded at a soft 0.10% m/m Separately. “We expect personal spending to moderate, increasing by 0.2% per month and 0.1% per month in real terms.”

How will the Personal Consumption Expenditure Price Index affect the EUR/USD?

The Dollar is cruising at the lower end of its multi-month range south of the 101.00 barrier, with initial contention around 100.20 so far.

Following the Fed’s big rate cut at its September 17-18 meeting, investors now see around 50 basis points of easing for the rest of the year, and between 100 and 125 basis points by the end of 2025.

A surprise in the publication of PCE should barely influence the Dollar price action as market participants have already shifted their attention to next week’s crucial Nonfarm Payrolls amid the Fed’s broader shift toward the labor market to the detriment of progress in around inflation.

According to Pablo Piovano, senior analyst at FX Street.com, “further upside momentum should motivate EUR/USD to confront its year-to-date high of 1.1214 (September 25). Once this region is cleared , the spot could head towards the 2023 high of 1.1275 recorded on July 18.”

“On the downside, the September low at 1.1001 (September 11) appears to be reinforced by the provisional 55-day SMA at 1.1009 ahead of the weekly low of 1.0949 (August 15),” adds Pablo.

Finally, Pablo suggests that “as long as it is above the 200-day SMA of 1.0873, the pair’s constructive outlook should remain unchanged.”

Economic indicator

Personal consumption expenditure – price index (MoM)

Personal expenses published by the office Bureau of Economic Analysis It is an indicator that measures the total expenditure of individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered a measure of economic growth since while personal spending stimulates inflationary pressures it can lead to an increase in interest rates. A result above expectations is bullish for the dollar, while a reading below consensus is bearish.

Last post:

Fri Aug 30, 2024 12:30

Frequency:

Monthly

Current:

0.2%

Dear:

0.2%

Previous:

0.1%

Fountain:

US Bureau of Economic Analysis

Inflation FAQs

Inflation measures the rise in prices of a representative basket of goods and services. General inflation is usually expressed as a month-on-month and year-on-year percentage change. Core inflation excludes more volatile items, such as food and fuel, which can fluctuate due to geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the target level of central banks, which are mandated to keep inflation at a manageable level, typically around 2%.

The Consumer Price Index (CPI) measures the variation in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage of inter-monthly and inter-annual variation. Core CPI is the target of central banks as it excludes food and fuel volatility. When the underlying CPI exceeds 2%, interest rates usually rise, and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually translates into a stronger currency. The opposite occurs when inflation falls.

Although it may seem counterintuitive, high inflation in a country drives up the value of its currency and vice versa in the case of lower inflation. This is because the central bank will typically raise interest rates to combat higher inflation, attracting more global capital inflows from investors looking for a lucrative place to park their money.

Gold was once the go-to asset for investors during times of high inflation because it preserved its value, and while investors often continue to purchase gold for its safe haven properties during times of extreme market turmoil, this is not the case. most of the time. This is because when inflation is high, central banks raise interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity cost of holding Gold versus an interest-bearing asset or placing money in a cash deposit account. On the contrary, lower inflation tends to be positive for Gold, as it reduces interest rates, making the shiny metal a more viable investment alternative.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.