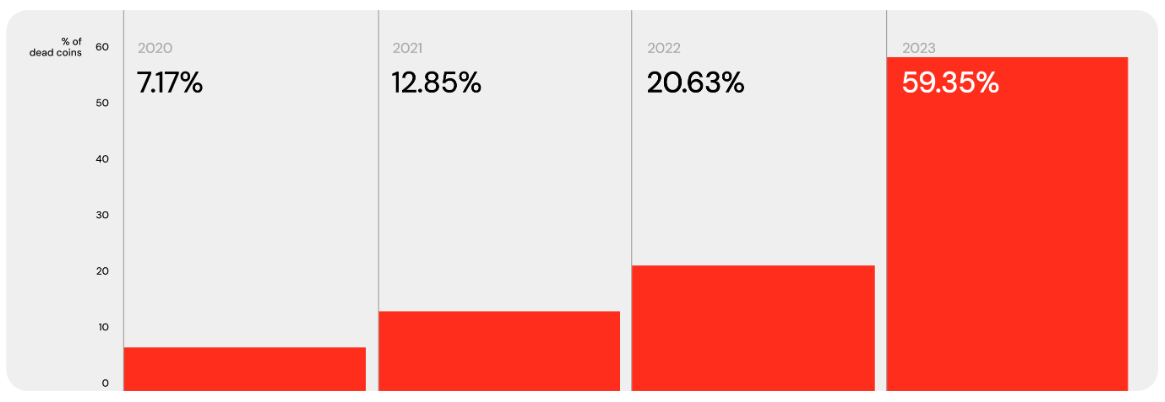

For crypto projects, 2023 was the hardest year in the last four-year cycle – during this period, developers abandoned 59.35% of the tokens tracked on CoinMarketCap. This is evidenced by research AlphaQuest.

Percentage of “dead” coins from 2020 to 2023. Data: AlphaQuest.

Percentage of “dead” coins from 2020 to 2023. Data: AlphaQuest.

High mortality rate

Analysts studied more than 12,000 projects, identifying “dead” ones according to four criteria:

- low liquidity/trading volume — 92.6%;

- broken website – 50.9%;

- excluded from the CoinMarketCap list – 47.6%;

- deleted X account – 35.6% (no updates in X for more than three months – 26.9%).

Experts also pointed to cases of fraud where attackers bought or gained access to abandoned project accounts to promote a scam.

Market filtering

72% of crypto projects (3,473 out of 4,834) that appeared during the 2020-2021 bull cycle also failed, analysts note.

Researchers have pointed to significant negative consequences of large bankruptcies. After the collapse of the Terra ecosystem, more than 35% of coins ceased to exist. The collapse of the FTX exchange took with it another 32% of tokens.

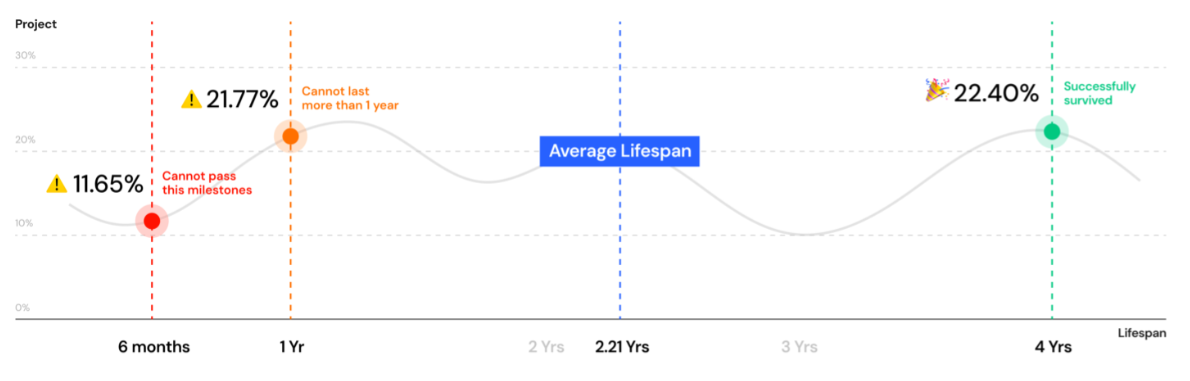

The average lifespan of startups in the digital asset industry is three years, AlphaQuest calculated. This means that a typical project is “unlikely to survive a four-year market cycle.”

Lifespan of crypto projects. Data: AlphaQuest.

Lifespan of crypto projects. Data: AlphaQuest.

According to analysts, only 22.4% of crypto projects exist longer than the designated period. Dead coins live on average only 2.21 years.

Victims

AlphaQuest has identified several categories of the crypto industry in which more than 50% of projects have ceased to exist:

- video and music – 75%;

- asset-backed stablecoins – 75%;

- metaverses – 51%.

The most affected ecosystems were Cardano and Terra – 74% of the project was “dead” for each. Celo, Harmony, Near, Zilliqa and Moonriver also suffered significant losses.

In addition, half of the startups backed by the failed hedge fund Three Arrows Capital failed. Other VC firms that have seen more than 50% of their crypto portfolio exit: Paradigm, DWF Labs, Polychain Capital, Andreessen Horowitz, Animoca Brands, Binance Labs, and Multicoin Capital.

Previously, CoinGecko specialists calculated that since the appearance of the segment GameFi about 2,127 out of 2,817 projects in this direction failed.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.