- The AUD/USD pair recovers 0.6460, up 0.26%, as investors await the upcoming Reserve Bank of Australia monetary policy decision.

- Mixed US jobs data and Wall Street shutdown for Labor Day contribute to dollar weakness, with Fed rate hike probability for September remaining at 92% .

- Positive news from the Chinese housing market and comments from Cleveland Fed President Loretta Mester add to the complexity of the currency picture.

He Australian dollar (AUD) pared some of its losses from last Friday against the US dollar (USD) ahead of the upcoming Reserve Bank of Australia (RBA) monetary policy decision amid a boost in risk appetite. The pair reversed course after hitting a daily low of 0.6440 and is trading around 0.6460, up 0.26% on the day.

Risk appetite and mixed US jobs data fuel Australian dollar rally; all eyes on the upcoming RBA monetary policy

Wall Street remains closed for Labor Day. Last week’s US jobs data was mixed, with non-farm payrolls of 187,000, up from estimates of 177,000 in August, failing to prop up the dollar as the unemployment rate rose according to estimates. Later, the Institute for Supply Management (ISM) revealed that business activity in the US, as shown by the manufacturing PMI, stood at 47.6 figures vs. analysts’ estimate of 47.0 vs. 46.4. previous readings.

Consequently, investors cut their bets on the continuation of monetary policy tightening by the US Federal Reserve. The odds of interest rates being applied at the September meeting remain at 92%, with the first rate cut scheduled for May 1. On that date, operators forecast rates around 5.14%, 19 basis points below the effective rate of the Federal Funds (FFR), of 5.33%.

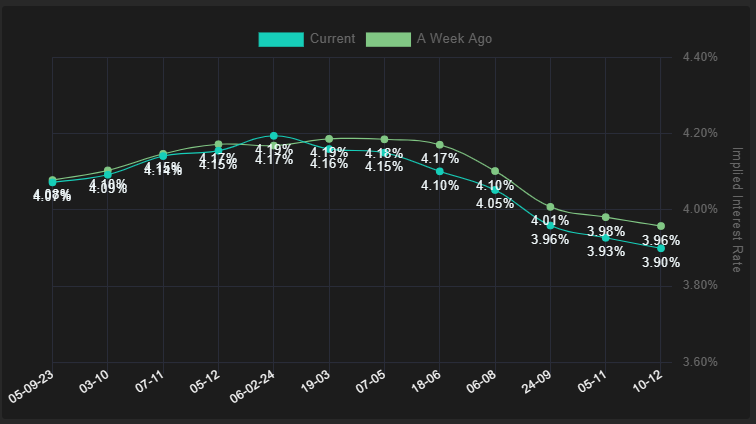

For its part, the Australian dollar has been favored by the RBA’s decision, which plans to keep the cash rate at 4.10%. However, traders do not foresee any further hikes until early February 2024, albeit with a slim chance of a nine basis point rate hike, as shown in the image below.

RBA Interest Rate Expectations

Source: Financial Source

In addition, the news from China improved investor sentiment, as the country put in place measures to boost its real estate market, which is in the throes of crisis. As the government eased measures, home sales rose, Bloomberg reported.

As for the performance of central banks, Cleveland Fed President Loretta Mester says the unemployment rate remains low and she still sees the labor market as fairly strong. However, the policy maker remains hawkish and sees rates higher for longer.

AUD/USD Price Analysis: Technical Perspective

AUD/USD remains biased lower but has so far been unable to extend losses below the August 17 daily low of 0.6364, the current year low, which would justify further losses. Intermediate support levels lie at the Nov 22 and Oct 21 lows at 0.6272 and 0.6210 respectively, before the pair challenges a much more important support level at the Oct 13 low at 0.6169. Conversely, the pair runs upside risks if it breaks above 0.6500.

AUD/USD

| Overview | |

|---|---|

| Last price today | 0.646 |

| daily change today | 0.0007 |

| today’s daily variation | 0.11 |

| today’s daily opening | 0.6453 |

| Trends | |

|---|---|

| daily SMA20 | 0.6465 |

| daily SMA50 | 0.6606 |

| daily SMA100 | 0.6643 |

| daily SMA200 | 0.6721 |

| levels | |

|---|---|

| previous daily high | 0.6522 |

| previous daily low | 0.6438 |

| Previous Weekly High | 0.6522 |

| previous weekly low | 0.6401 |

| Previous Monthly High | 0.6724 |

| Previous monthly minimum | 0.6364 |

| Fibonacci daily 38.2 | 0.647 |

| Fibonacci 61.8% daily | 0.649 |

| Daily Pivot Point S1 | 0.642 |

| Daily Pivot Point S2 | 0.6388 |

| Daily Pivot Point S3 | 0.6337 |

| Daily Pivot Point R1 | 0.6504 |

| Daily Pivot Point R2 | 0.6555 |

| Daily Pivot Point R3 | 0.6587 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.