- AUD/USD maintains a positive tone on the weakness of the US dollar.

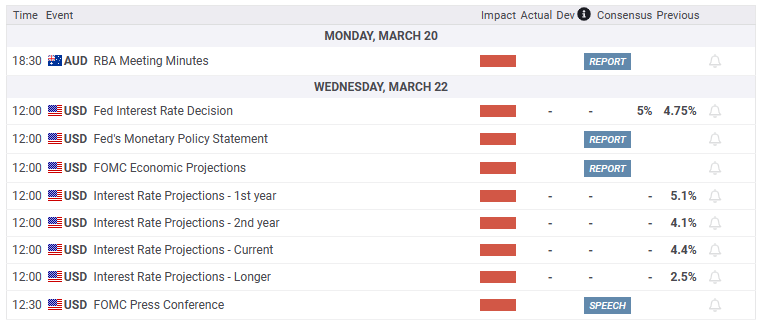

- Markets expect a 25 basis point rate hike by the Fed on Wednesday.

- AUD/USD Price Analysis: A daily close above 0.6714 would add bullish pressure; otherwise, it could drop to 0.6600.

He AUD/USD had bullish momentum above 0.6700, helped by improving market sentiment. Investors forgot about contagion fears from the banking crisis after UBS’s decision to buy Credit Suisse was seen by traders as an excuse to buy riskier assets. This, coupled with speculation about less aggressive monetary policy by central banks, weighed on the US dollar. At the time of writing these lines, the AUD/USD pair is trading at 0.6715.

AUD/USD will hover around 0.6700 before the FOMC meeting

The mood in financial markets remains optimistic after the saga of the banking crisis and appears to be calm. In the United States (US), however, First Republic Bank’s stock plunged after a further downgrade of its credit rating. The US Federal Reserve (Fed) is due to start its two-day policy meeting on Tuesday, and money markets estimate that there is a 70% chance that the Fed will raise rates by 25 basis points. This would raise the Federal Funds Rate (FFR) up to the threshold of 4.75% – 5.00%. Following the Fed’s decision, Chairman Powell will take the podium.

The latest round of US economic data saw contracting Industrial Production and deteriorating University of Michigan (UM) Consumer Sentiment. However, Americans expected inflation to drop, with 1-year expectations falling from 4.1% to 3.8%, while 5-year expectations fell to 2.8% from 2.9%.

The Dollar Index, a gauge of the dollar’s value against a basket of currencies, continues to extend its losses, down 0.51%, to 103.343, signaling a tailwind for AUD/USD.

On the Australian front, a lack of data left traders adrift on risk appetite. Although China’s reopening should support the Australian dollar (AUD), the latest rate hike by the Reserve Bank of Australia (RBA) was perceived as dovish, which would put downward pressure on AUD/USD.

AUD/USD Technical Analysis

After falling below the 0.6600 zone, the AUD/USD reclaimed the 0.6700 zone. However, the 20 day EMA at 0.6713 is difficult to break above as the AUD/USD is forming a dragonfly doji. If the AUD/USD records a daily close above the 20-day EMA, the pair will test the intersection of the 50/100-day EMAs, each at 0.6779-85, respectively. Once broken, the 0.6800 area could be tested. Otherwise, the AUD/USD could extend its losses below 0.6700 towards the 0.6600 zone.

What is there to watch out for?

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.