The price of the first cryptocurrency falling below $60,000 will provoke panic selling. This was stated by FxPro trader Alex Kuptsikevich, writes CoinDesk.

According to the specialist, a break above $65,000 will signal a restoration of bullish sentiment. The implementation of the forecast will lead to the rate consolidating above 50DMA and the reversal area in May.

According to the expert, price dynamics are currently characterized by a sequence of lower lows and highs. This is a sign that investors are shedding strong positions as stock prices rise.

The trader cited a drop in mining difficulty after the halving in April.

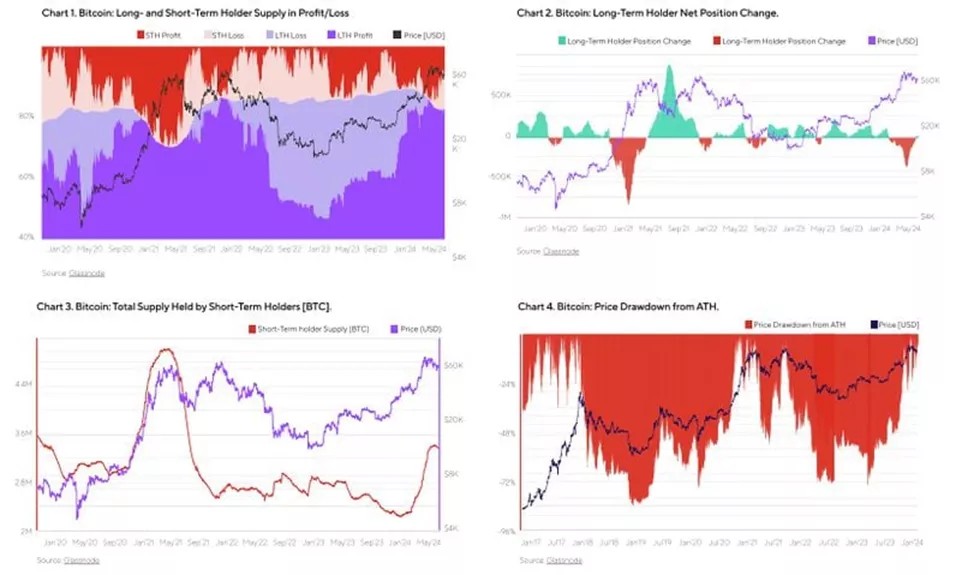

Analysts at Ryze Labs warned that the behavior of speculators—those who have held tokens for less than 155 days—could significantly impact markets in the coming months.

According to the observations of experts, there were three cases when a total of 94% of the coins held became “profitable”:

- from mid-November 2017 to mid-April 2017;

- from mid-February to mid-April 2021;

- from the end of February 2024 to the beginning of April.

The peak value of digital gold held by short-term investors was $117.8 billion in 2017 and $289.9 billion in 2021.

During these periods, long-term holders and miners got rid of the first cryptocurrency in favor of speculators.

According to experts, after reaching extremes, short-term investors' losses began to grow rapidly. This led to an inversion, when the latter switched to selling coins to hodlers.

Analysts emphasized that this shift has historically led to a significant drawdown in Bitcoin prices over the subsequent four to six months. So, in the last similar period it reached 6% of ATH a month later, they calculated.

Bitfinex predicted a sideways trend for Bitcoin in May and further growth of the asset.

Earlier, Standard Chartered said that the first cryptocurrency had already formed a minimum of $56,500, confirming the target of $150,000 at the end of the year and $200,000 by the end of 2025.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.

.jpg)